Bank of England is set to announce its next monetary policy decision tomorrow at 12:00 pm BST. Economists seem unanimous in their expectations and point to BoE delivering a 25 basis point rate hike tomorrow, bring the main UK rate to 4.50% - the highest level since October 2008. Moreover, it would be the 12th consecutive rate hike from the UK central bank. Money market almost fully price in a 25 bp rate hike and suggests a very slim chance of any other outcome. However, the real question is what comes next.

UK inflation remains elevated with headline CPI coming in at 10.1% YoY in March. While this was a slowdown from the 10.4% YoY report in February, a deceleration off the October 2022 peak of 11.1% YoY has been very slow. Core gauge remained unchanged in March at 6.2% YoY. Persisting inflation as well as rather solid macroeconomic data - economists expect the UK economy managed to avoid contraction and grew at a pace of 0.1% QoQ in Q1 2023 (release - Friday, 7:00 am BST) - give BoE some room to continue tightening. Money markets currently expect rates in the UK to peak at 5.00% in November 2023, requiring two additional 25 bp rate hikes after one we are likely to see tomorrow.

Investors should keep in mind that a clear and direct guidance on rate levels is unlikely to be offered. Instead, BoE would likely offer a vague statement that the current macroeconomic situation may warrant more tightening. Traders should therefore pay attention to how votes in the Monetary Policy Committee (MPC) split. If 7 MPC members vote in favor of a hike and 2 vote for rates to stay unchanged - no change in composition from previous meeting - market may take it as BoE continuing on its course. However, an increase in the number of MPC members voting for a cut could be seen as highly dovish and may exert pressure on GBP. GBP is also likely to react to new set of economic projections - a higher inflation forecast may boost rate hike odds and therefore support the British pound.

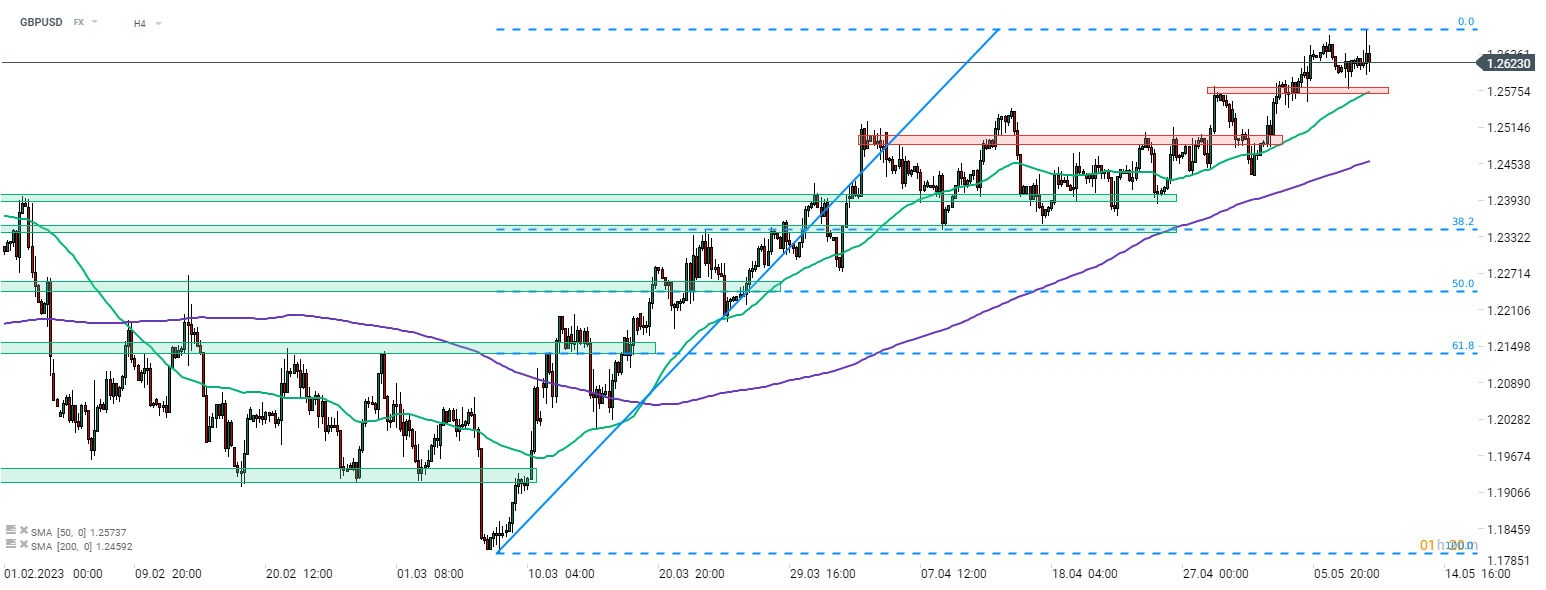

GBPUSD jumped to a fresh 1-year high after US CPI data release earlier today. However, USD regained ground later on and the whole post-CPI upward move was erased with the pair now trading more or less unchanged compared to preannouncement levels. Future of the GBPUSD rally will likely depend on what the Bank of England does tomorrow - growing number of MPC doves may put further gains under question while upward revision in CPI forecast could provide more fuel for the rally. Source: xStation5

GBPUSD jumped to a fresh 1-year high after US CPI data release earlier today. However, USD regained ground later on and the whole post-CPI upward move was erased with the pair now trading more or less unchanged compared to preannouncement levels. Future of the GBPUSD rally will likely depend on what the Bank of England does tomorrow - growing number of MPC doves may put further gains under question while upward revision in CPI forecast could provide more fuel for the rally. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.