Swiss National Bank is scheduled to announce its next monetary policy decision tomorrow at 8:30 am BST. Markets are positioning for another rate cut, after SNB has surprised markets with an unexpected rate cut at its Q1 2024 policy meeting. However, is there a chance that another cut will be delivered tomorrow?

What markets expect from SNB?

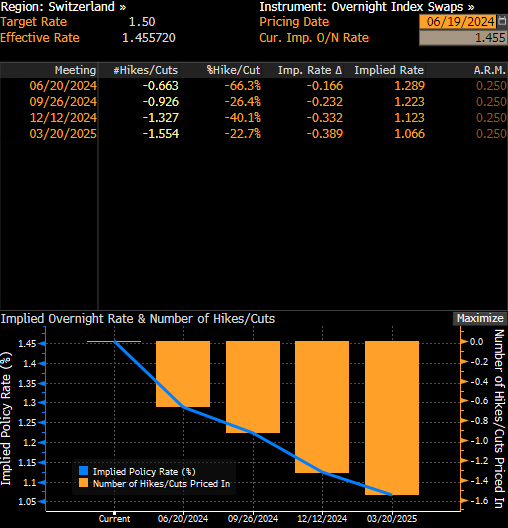

Expectations for tomorrow's SNB rate decision are not unanimous. Economists surveyed by Bloomberg are split, but majority expects no change in rates. 16 out of 28 economists surveyed see SNB policy rate staying unchanged at 1.50% tomorrow, while the remaining 12 expect it to be lowered to 1.25%. Situation looks different when it comes to money markets - overnight index swaps price in an over-60% chance of SNB pulling the trigger and delivering a 25 basis point rate cut at tomorrow's meeting. However, it should be said that odds of a June rate cut stood over 90% back in April, so markets have become less sure of SNBs intent to continue to ease policy.

Apart from the decision at 8:30 am BST, additional CHF volatility may also be present during post-meeting press conference at 9:00 am BST.

Money markets price in an over-60% chance of SNB cutting rates tomorrow. Source: Bloomberg Finance LP

The case for a rate cut is here

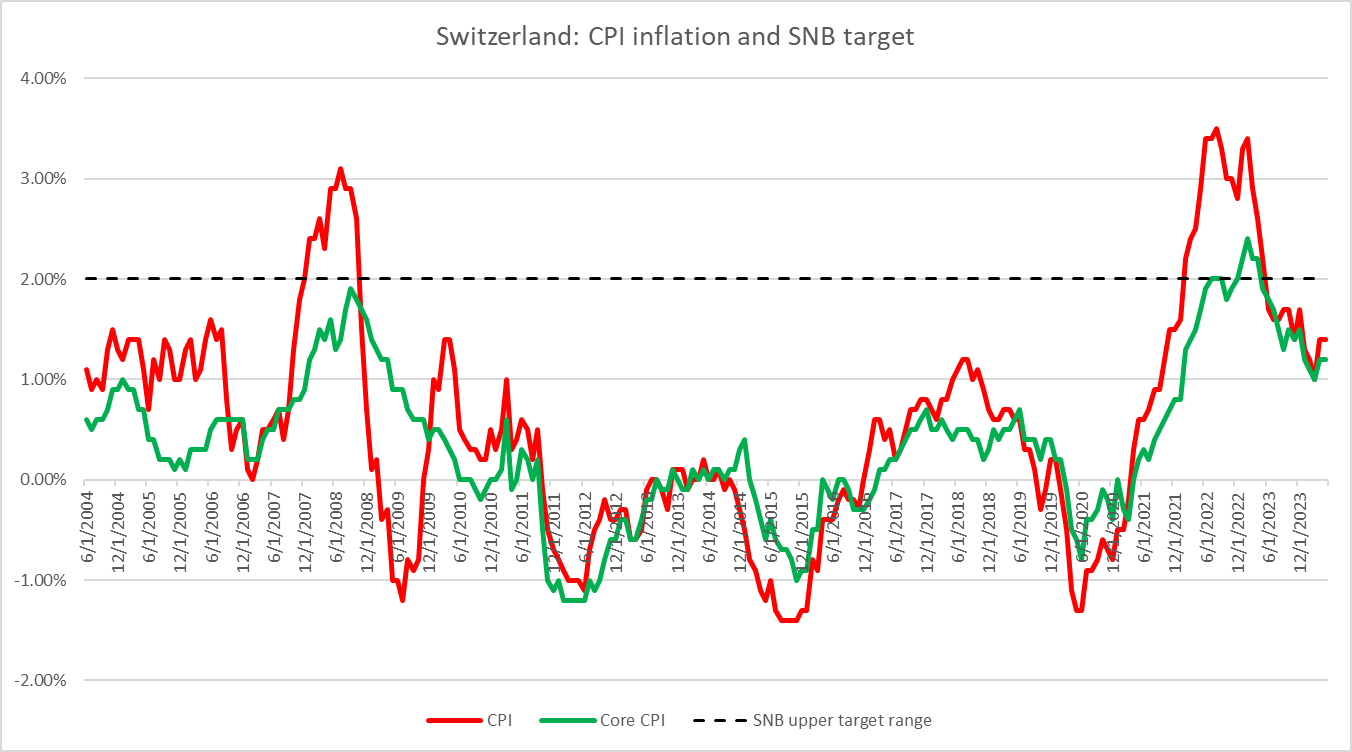

Swiss National Bank surprised markets at its Q1 policy meeting in March by unexpectedly cutting rates by 25 basis points. While economists and money markets are split on what will happen tomorrow, it should be said that the case for another rate cut is here. Inflation has returned to SNB's 0-2% inflation target over a year ago and has continued to move lower since, with small bumps along the way.

Apart from inflation, situation on the FX market is also supporting outlook that another cut may be delivered. Swiss franc has been very strong in spite of SNB easing policy and currencies strength is weighing on country's exports, which in turn is weighing on Swiss economic growth.

Also, SNB chief Jordan said at the end of May that current interest rate levels in Switzerland remain restrictive therefore there is certainly a room to cut rates.

Source: Bloomberg Finance LP, XTB Research

A look at USDCHF chart

Swiss franc has been strengthening against other major currencies recently. Taking a look at USDCHF chart at D1 interval, we can see that the pair dropped over 4% since local high reached at the beginning of May. Pair plunged below the 200-session moving average (purple line) and 38.2% retracement of the upward move launched at the turn of 2023 and 2024 this week.

As a rate cut is not fully priced in and economists are split over whether there will be one or not, SNB cutting rates could triggered CHF weakening. In such a scenario, an attempt may be made to push USDCHF back above the 200-session moving average. On the other hand, pause in cutting would be a hawkish surprise and would likely trigger a drop on the pair. In such a scenario, the 0.8780 area, marked with the 50% retracement, will be the support zone to watch.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.