Reserve Bank of Australia is scheduled to announce its next monetary policy decision during the upcoming Asia-Pacific session. Announcement will be made on Tuesday, 5:30 am BST. RBA is expected to keep rates unchanged at 12-year highs for the fourth meeting in a row, but some hawkish tilt may be offer as inflation falls slower than expected. Let's take a quick look at what to expect from the meeting.

What happened since March 19, 2024 RBA meeting?

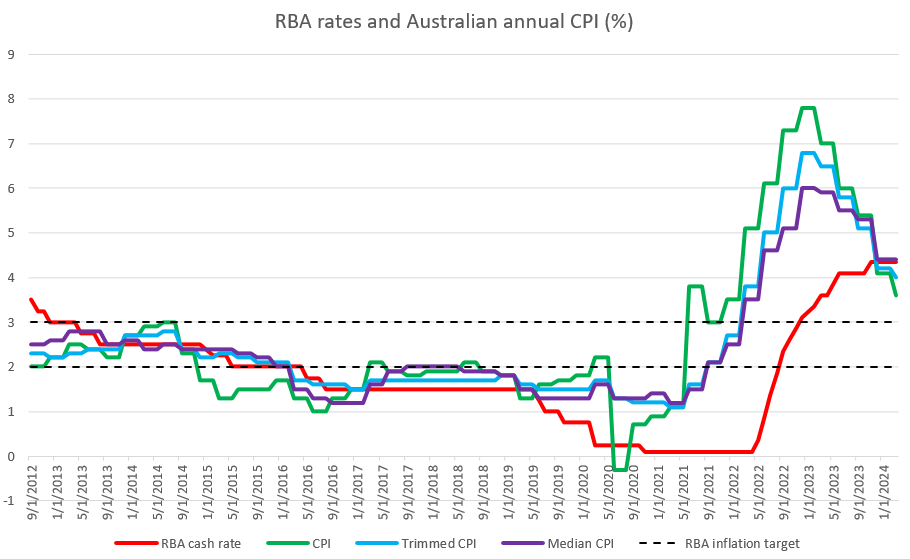

Previous RBA policy meeting was held on March 18-19, 2024. Bank left interest rates unchanged back than, with cash rate staying at a 12-year high of 4.35% for the third meeting in a row. Central bank changed statement and removed noted that 'further hike cannot be ruled out', and replaced it with note that 'it does not rule anything in or out'. However, data release since last meeting has been rather hawkish with labor market remaining tight and Q1 CPI data showing a smaller-than-expected slowdown. Inflation remains above RBA 2-3% target with economic continuing to fare well, so cutting rates does not look reasonable.

- Employment change for February +116.5k (exp. 39.7k), driven by 78.2k increase in full-time employment. Unemployment rate dropped from 4.1 to 3.7%

- Employment in March unexpectedly dropped 6.6k (exp. +7.2k), but the drop was entirely driven by part-time employment. Full-time employment increased 27.9k. Unemployment rate ticked higher to 3.8% (exp. 3.9%)

- CPI data for Q1 2024 showed a deceleration from 4.1% YoY to 3.6% YoY, more than 3.4% YoY expected and still above target. Core CPI measures remain close to or above 4%

- Retail sales for February increased 0.3% MoM, slower than 0.4% MoM expected and 1.1% MoM reported in January

- Retail sales later dropped 0.4% MoM in March in spite of an expected 0.2% MoM increase

- Housing market data for February and March disappointed, showing unexpected declines in building approvals

- Expansion in private sector credit slowed in March

- Manufacturing PMI climbed above 49 pts in April and remains just shy of 50 pts threshold. Services PMI weakened slightly to 53.6 but remains in expansion territory

CPI inflation in Australia slowed considerably from 2023 peak but remains above RBA 2-3% target. Source: Bloomberg Finance LP, XTB Research

What markets expect?

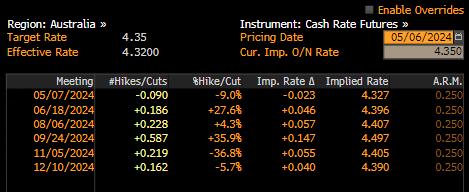

Economists surveyed by Bloomberg and Reuters expect interest rates to be left unchanged, with the cash rate staying at 4.35% for the fourth meeting in a row. Money market pricing also suggest that no cut will be made. Markets are pricing in just a 9% chance of RBA delivering a 25 basis point rate cut tomorrow. The latest hawkish data from Australian economy has greatly shifted pricing for the later parts of the year, with money markets now expecting rates to be left unchanged at current levels for the remainder of 2024.

Money markets expects RBA to keep rates unchanged tomorrow and in the remainder of 2024. Source: Bloomberg Finance LP, XTB Research

What to focus on?

Markets and economists are expecting no move. If RBA was to surprise with rate move, it would more likely by a hike rather than a cut. However, even though recent data has been rather hawkish with inflation being above RBA projections, chance of a rate hike looks very slim.

Wording of the statement is more likely to include surprises and be a source of volatility. RBA may reverse latest change and once again state that 'rate hike cannot be ruled out', signaling that rate hike having a bigger chance than cut. This could support AUD. Also, new economic outlook will be released and they may surely influence market moves as well. If rates are indeed to stay higher for longer as recent shift in market pricing suggests, new forecasts may show downward revisions to growth outlook. Attention will also be on any revisions to CPI outlook.

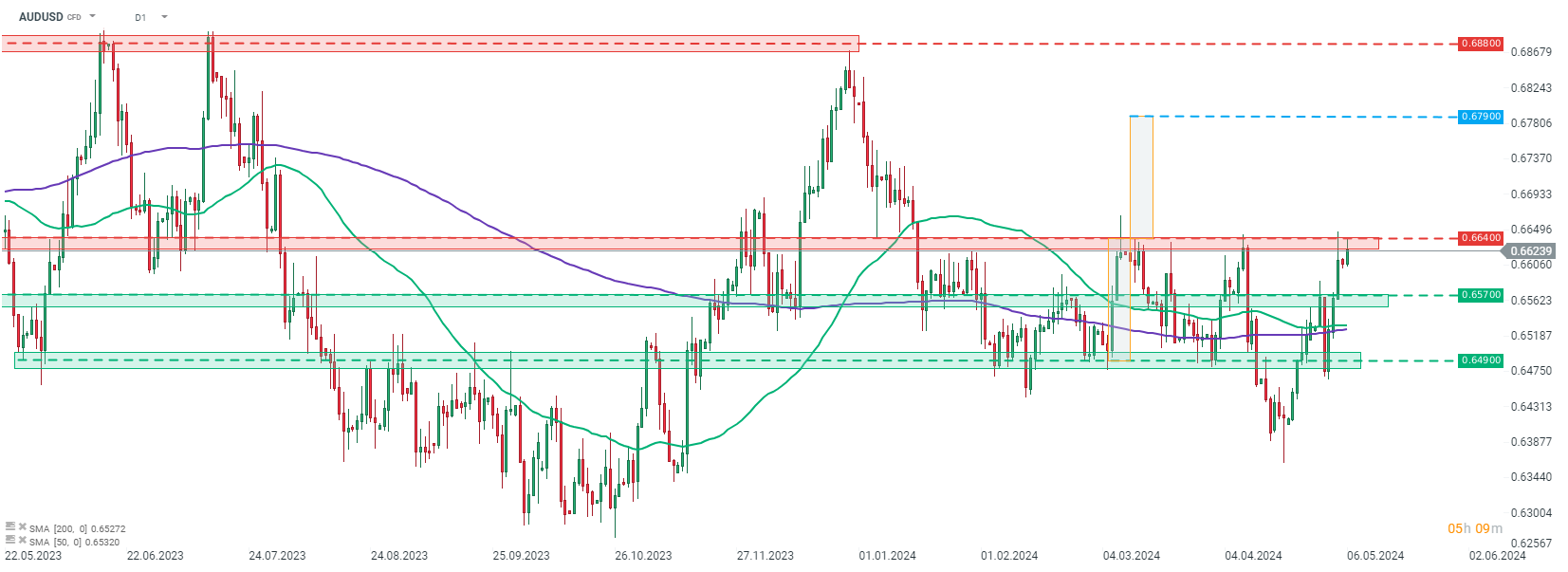

AUD has recovered strongly against USD recently. Pair jumped around 4% since mid-April lows and is now testing the 0.6625 resistance zone, which marks the upper limit of the ongoing trading range. A hawkish surprise from RBA could help push the pair above this hurdle and pave the way for a bigger upward move.

Source: xStation5

Source: xStation5

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

Morning wrap (09.02.2026)

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.