The big day of the week is here. While investors were already offered US CPI report for May earlier today, there is one more big event scheduled - FOMC monetary policy announcement at 7:00 pm BST. US central bank is expected to leave rates unchanged, but traders are eager to know what Fed expects for the rest of the year. Let's take a quick look at what to expect from today's meeting.

No change to rates expected

When it comes to level of interest rates, situation looks clear - Fed will keep rates unchanged at today's meeting. Every out of almost 100 economists in the Bloomberg survey expects Fed Funds rate to be left unchanged in the 5.25-5.50% range. Such an outcome is also suggested by the markets, with Fed Funds futures pricing in an over-98% chance of Fed keeping rates unchanged, while swap prices in an over-97% chance of such an outcome.

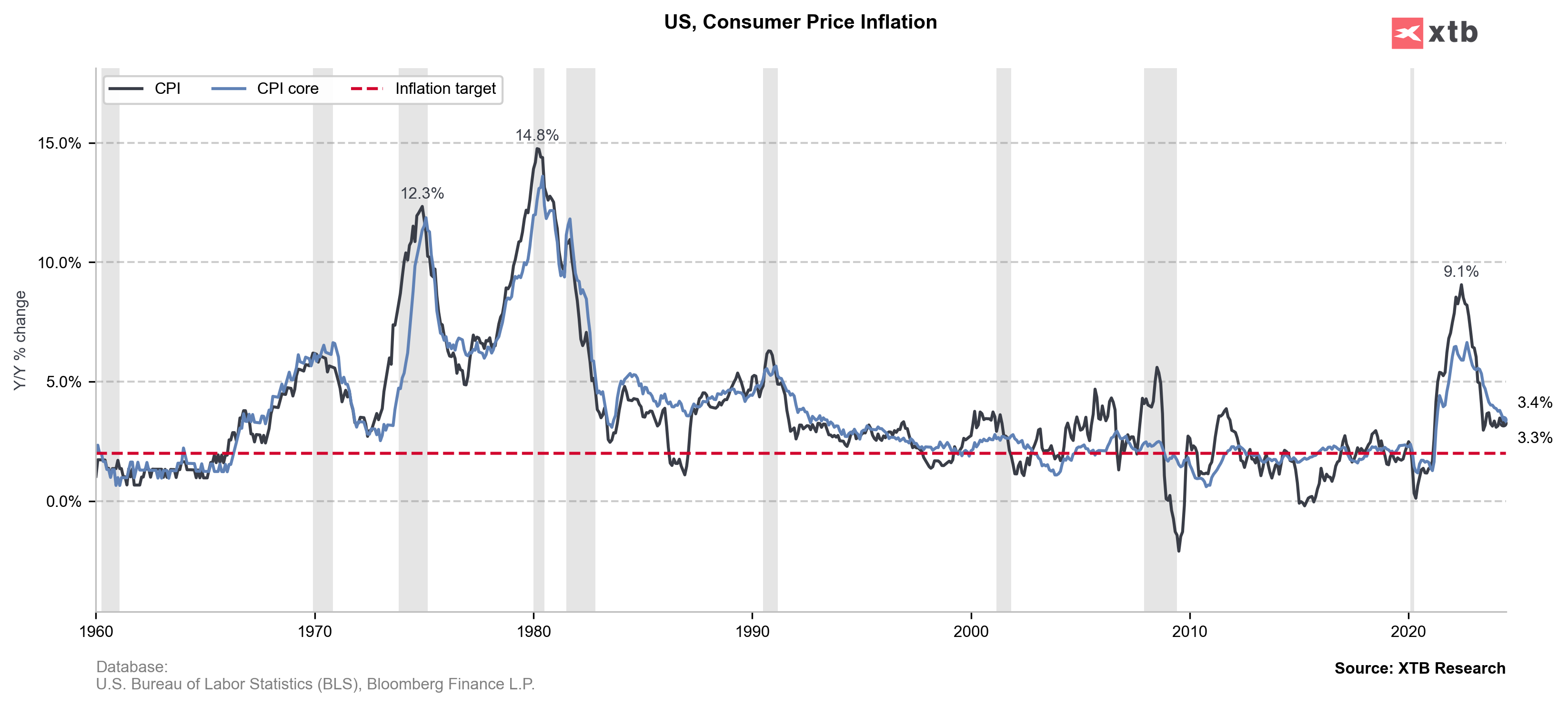

This should not come as a surprise as the macroeconomic picture simply does not justify rate cuts yet. Fed has a dual-mandate of maximizing employment and keeping prices stable. Given that jobs data remains strong and CPI inflation remains above Fed's target even after today's lower reading, cutting rates now would be premature and would risk refuelling inflation later on.

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

Attention on dot plot

Fed keeping rates unchanged at today's meeting is almost certain, so markets attention will focus on something else than rate level - new set of economic projections. Focus will be primarily on the so called 'dot-plot', or interest rate projections.

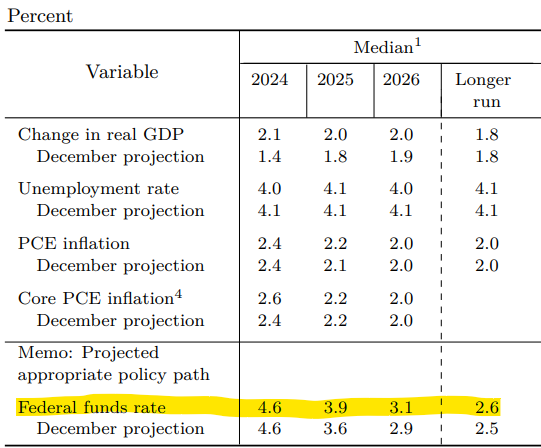

Let us recall that March FOMC projections saw a boost in real GDP and core PCE forecasts for 2024, compared to December 2023 projections. Unemployment rate was projection was lowered slightly. Forecasts for 2025-2026 were little changed. Most importantly, March 2024 forecasts saw no change to rate projections for 2024, which remained at 4.6%, signalling 3 rate cuts this year. However, this will likely change this time.

Money markets and economists are somewhat split on what the Fed will do this year. Namely, they are split between one and two rate cuts, although some financial institutions hint a possibility of Fed not making any changes to rates this year at all. It looks highly unlikely that the median will remain unchanged at 4.6%, and post-decision market reaction may hugely depend on whether median changes to indicate one or two cuts.

Source: Federal Reserve

How can markets react?

Whether the announcement will be considered dovish or hawkish will depend on new projections, especially median rate forecasts for this year.

- Unchanged at 3 rates cuts this year (dovish scenario): a strong dovish reaction - indices and gold up, while USD declines

- 1 or 2 rate cuts this year (base scenario): no strong reactions in the market, slightly hawkish reaction in case of 1 cut - indices slightly down, no major move on USD and gold

- No cuts this year (hawkish scenario): a strong hawkish reaction in the markets - USD up, while indices and gold decline

However, investors should keep in mind that apart from median, distribution of votes will also matter. Back in March, 9 out of 19 votes suggested 3 rate cuts this year. Overall, 15 out of 19 voters expected 2 or more rate cuts this year. Should majority of members opt for 2 or more cuts this time as well, it may trigger a dovish reaction in the markets. Otherwise, the split would be seen as hawkish. Of course, situation may change later and additional volatility should be expected during Fed Chair Powell's post-decision press conference at 7:30 pm BST. We will provide live coverage of the event in the News section.

USD is taking a hit today, following lower-than-expected CPI reading for May. US dollar index (USDIDX) sharply pulls back from the 105.50 resistance zone and is testing 200-session moving average (purple line) in the 104.30 area right now. The next major support zone in-line can be found ranging around 103.30.

Source: xStation5

Source: xStation5

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.