Bank of England is scheduled to announce its next monetary policy decision at 12:00 pm BST today. Bank is not expected to cut rates, but the importance of the meeting increase yesterday, when UK CPI data for May showed headline inflation to the 2% target for the first time since 2021. Let's take a look at what is expected from and priced in for today's BoE meeting.

What markets expect from BoE?

Economists and money markets are in agreement that we will not see a chance in the level of UK interest rates today.

None out of over 40 economists surveyed by Bloomberg expects Bank of England to chage rates today. A decision to hold rates unchanged is expected to be made with 7-2 split (7 votes for holding and 2 for cutting) - just as it was the case back in May. BoE members Dhingra and Ramsden are expected to retain their dovish bias and continue to vote for cuts.

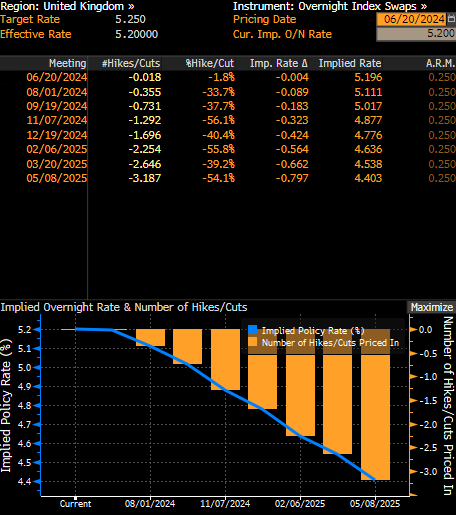

Money markets are currently pricing in a less than 2% chance of Bank of England and an around-35% chance of BoE rate cut at August meeting. However, pricing for September suggests an over-70% chance of Bank of England delivering a 25 basis point rate cut then.

Money markets do not price in a rate cut at today's or August meetings, but see an over 70% chance of a 25 basis point cut in September. Source: Bloomberg Finance LP

Too early for a cut, but traders will look for guidance

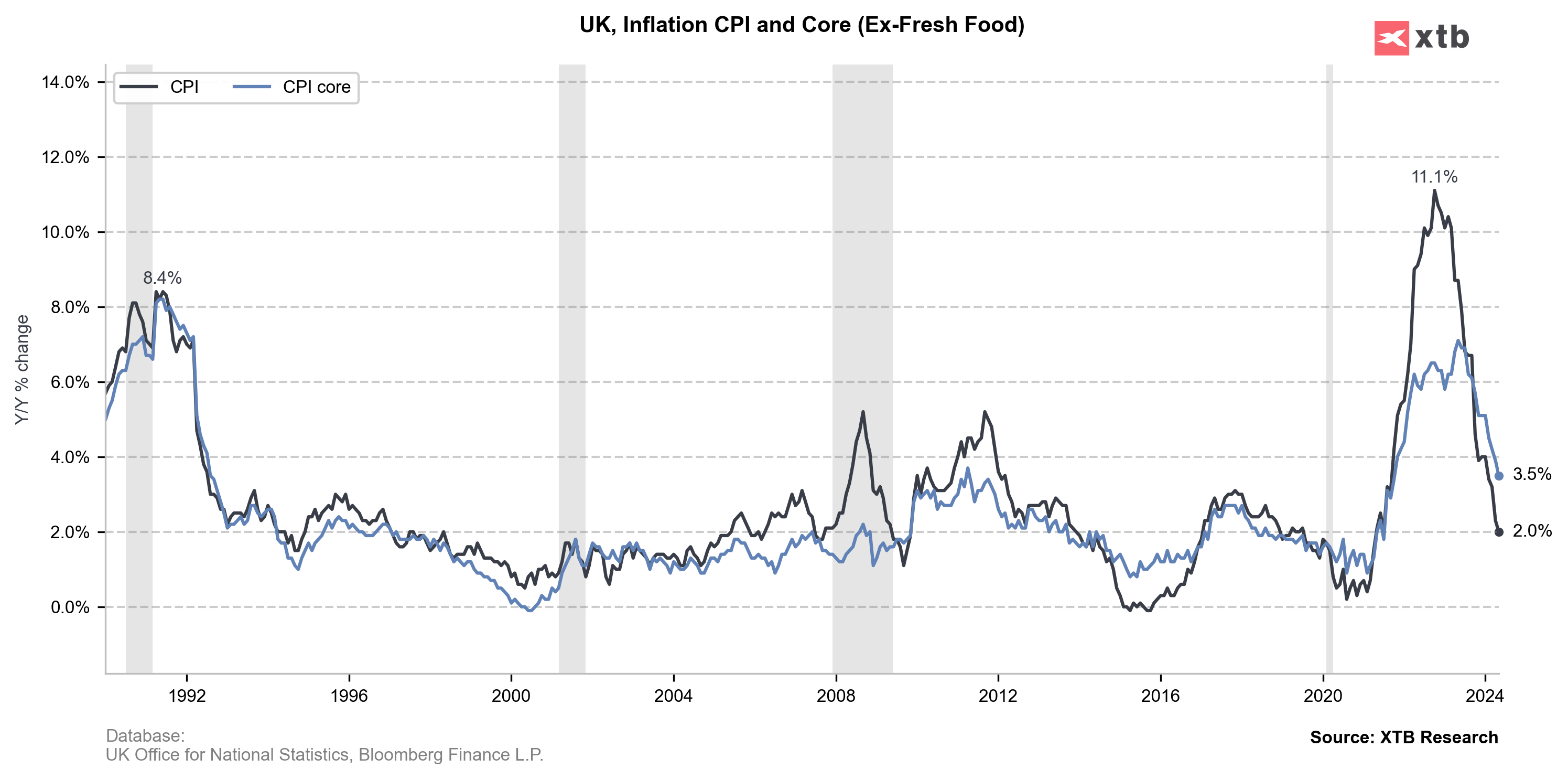

Just because today's meeting is not expected to result in the change in the level of rates does not mean that it will be a non-event. UK CPI data for May was released yesterday in the morning, and it showed headline inflation returning to 2% target for the first time since 2021! This is an important development, even though a less-volatile core measure still sits above the target (3.5%). While this is unlikely to encourage BoE to cut rates as soon as today, the Bank may offer some hints that rate cuts are coming soon. Still, any clear hint is not the base case scenario, with BoE being expected to retain its previous messaging of placing increasing emphasis on upcoming data releases.

Another factor that makes it unlikely for a rate cut to be delivered today is political in nature - UK elections will be held at the beginning of July and central banks usually refrain from making unexpected policy moves ahead of such events in order not to be accused of political motivations. What further supports the view that Bank of England will remain cautious today is pre-election blackout period. Bank of England has cancelled all public statements after general elections were called, meaning that should markets misinterpret today's decision, the Bank will be unable to clarify it until after July 4, 2024 (election date).

Headline UK CPI inflation return to 2% target in June this year for the first time since 2021. Source: Bloomberg Finance LP, XTB Research

Headline UK CPI inflation return to 2% target in June this year for the first time since 2021. Source: Bloomberg Finance LP, XTB Research

A look at GBPUSD

As we have already said, it is highly unlikely that Bank of England will surprise today, with a decision any other than keeping rates unchanged. Clearer hint that the rate cut will come at the next meeting in August would be seen as a dovish surprise and would likely trigger GBP weakening. On the other hand, suggestion that rate cuts will not be delivered until Q4 2024 or that they won't be delivered this year at all would be a hawkish surprise and would see GBP strengthen. However, as we have said, Bank of England is likely to be cautious today due to the upcoming elections. Having said that, moves on GBP market may be limited.

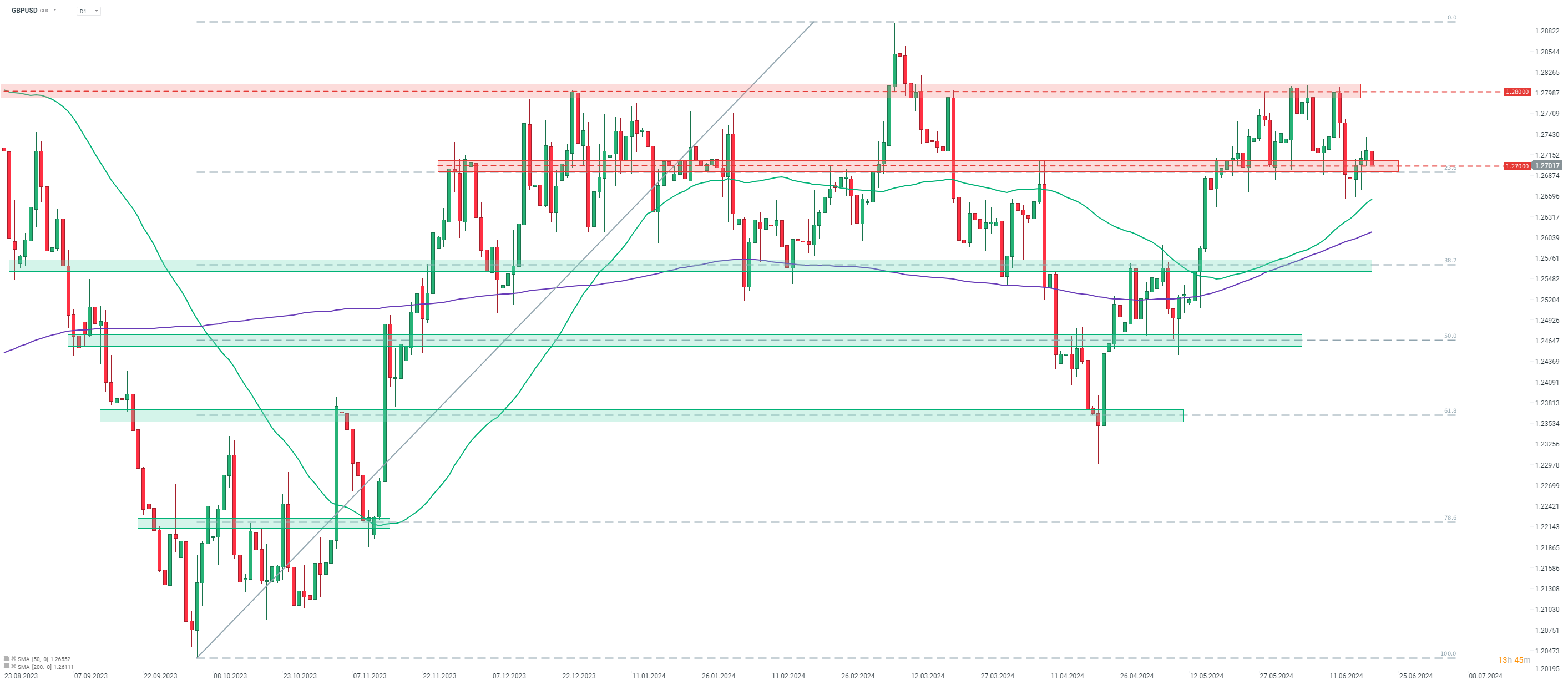

Taking a look at GBPUSD chart at D1 interval, we can see that the pair enjoyed strong gains in late-April and in May, but has begun to trade sideways in June. Price moves have been limited to the 1.2700-1.2800 range since. Bears attempted to push the pair below the lower limit of the range recently, but the downside breakout proved to be short-lived and the pair returned above 1.2700 mark.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.