The Wendy's Company, on August 9, 2023, announced its unaudited results for the second quarter ending July 2, 2023. The company showcased significant sales and profit growth, with a notable increase in the US company-operated restaurant margin. The breakfast and late-night segments experienced substantial growth, and the company's digital strength persisted. Wendy's also reported 80 global restaurant openings in the first half of the year. The company's president and CEO, Todd Penegor, expressed confidence in achieving their short and long-term growth outlooks. Todd Penegor also highlighted the company's progress against their strategic growth pillars, emphasizing the significant profit expansion supported by strong same-restaurant sales momentum.

Operational Highlights:

- Systemwide sales growth: US at 6.1%, International at 12.7%, and Global at 6.9%.

- Same-restaurant sales growth: US at 4.9%, International at 7.2%, and Global at 5.1%.

- Systemwide sales: US at $3,185 millions, International at $461 millions, and Global at $3,646M.

- Restaurant openings: Wendy opened 80 new global restaurants, but in net figures it was 14 restaurants in the US and 14 restaurants internationally

Financial Highlights:

- Total revenues increased to $5,616M, a 4.4% growth.

- US company-operated restaurant margin increased by 2.3%.

- Operating profit rose to $1,093M, a 13.5% growth.

- Net income surged to $596M, a 23.7% increase.

- Adjusted EBITDA stood at $1,445M, marking an 8.7% growth.

- Reported EPS was $0.28, a 27.3% growth.

- Free cash flow was reported at $1,335M, a 40.2% increase.

For the year 2023, The Wendy's Company has provided the following projections:

- Global systemwide sales growth is expected to be between 6 to 8%.

- Adjusted EPS are projected to be between $0.95 to $1.00.

- Cash flows from operations are anticipated to be between $340 to $360 million.

- Capital expenditures are expected to range from $75 to $85 million.

- Free cash flow is projected to be between $265 to $275 million.

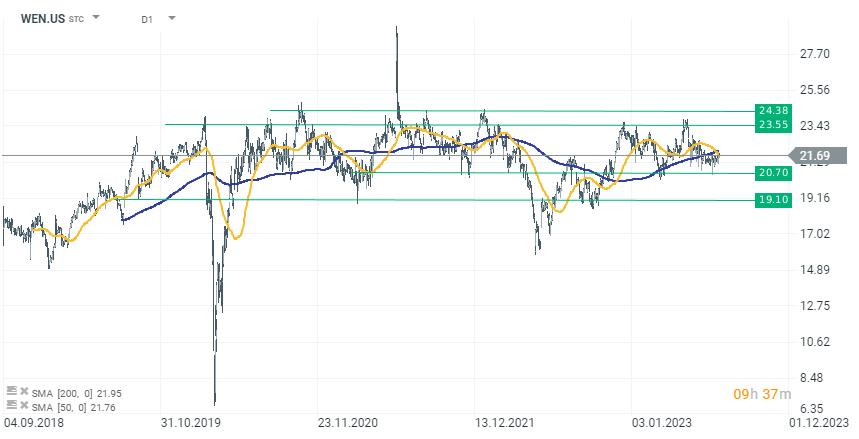

WEN.US - Wendy's shares have essentially been moving in a sideways trend since 2019, limited within the range of 19.10 and 24.38 dollars per share. After announcing the results, the stock price is down 0.41% in pre-market trading, source xStation 5

WEN.US - Wendy's shares have essentially been moving in a sideways trend since 2019, limited within the range of 19.10 and 24.38 dollars per share. After announcing the results, the stock price is down 0.41% in pre-market trading, source xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.