The results of the largest retail chain in the US, WalMart (WMT.US), confirmed the overall strength of the US consumer and the good health of the company's business. The report showed that the company's focus on grocery products at the expense of 'discretionary' goods such as appliances, home appliances and others has yielded the intended results. E-commerce sales increased by 24% year-on-year, with nearly 6.3% growth in revenue from sales in the US - the company's main market. In comparison, rival Target (TGT.US) yesterday reported 5.4% lower y/y sales in the US and a weaker forecast for the full year.

Revenues: $161.6 billion vs. $160.22 billion forecast (5.7% increase y/y)

Earnings per share (EPS): $1.84 vs. $1.71 forecasts

Free cash flow (FCF): $9 billion vs. $0.2 billion in Q1 and $12 billion in Q4 2022

Inventories: down 7.1% y/y

- The company raised its full-year outlook for the fiscal year during which it expects earnings per share of $6.36 to $6.46 US (analysts had expected $6.3, previously WalMart had indicated a range of $6.1 to $6.2) with net sales growth of 4 to 4.5% y/y (3.5% in previous estimates);

- Revenue from the e-commerce segment now accounts for 15% of the company's net income, on $24 billion in revenue. Advertising revenue rebounded by 36%, and the average weekly number of users of WalMart's digital apps increased by more than 20% with a 14% increase in marketplace activity;

- Comparable sales excluding fuel rose 5.5% versus Wall Street's 4.1% forecast. Revenues from Sam's Club membership cards rose 7%, with the company highlighting growing popularity in China and expansion in the market there;

- International sales revenue showed an 11% year-on-year increase. Adjusted operating profit rose 8.1% y/y, and net margin improved 1.5%. The excellent performance on the free cash flow side gives considerable hope for even better readings in the next two quarters - seasonally much stronger.

- Most notably, WalMart's forecast shows that the company does not expect a recession or consumer slump in the US or globally. In the first reaction after the results, the company's shares gained 1.5% before the Wall Street open and, supported by higher guidance for the coming quarters, climbed to new highs above $161 per share.

![]()

WalMart's gross margin showed a positive growth rate, however, it declined slightly for the rest of the quarter. Source: WalMart

Revenues increased but a decline in momentum is evident - the result was still lower than Q4, a record quarter, but it is worth noting that this was the result for the holiday seasonally strongest quarter of 2022. Source: WalMart

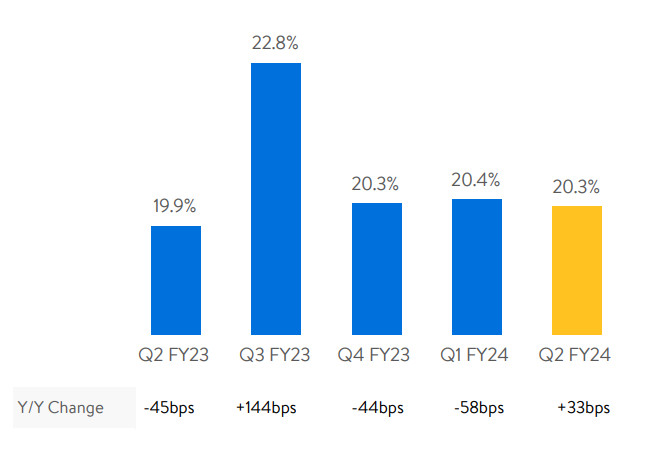

The company's costs remain relatively low and have not increased significantly despite inflation - they account for about 20.3% of net income. Source: WalMart WalMart shares, D1 interval. The price of the retail giant's stock has quickly staved off mid-2022 declines, supported by a strong U.S. consumer and competitive pricing against competitors. Source: xStation5

WalMart shares, D1 interval. The price of the retail giant's stock has quickly staved off mid-2022 declines, supported by a strong U.S. consumer and competitive pricing against competitors. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.