New York Fed survey indicated a drop in inflation expectations. Stock indexes gain after dismal opening:

- Inflation expectations are an important measure from the Fed's point of view. They can be compared to a 'self-fulfilling prophecy'; when consumers expect ever-higher prices (high inflation expectations), the inflationary spiral tends to spiral upward. A drop in expectations also translates, in a piecemeal fashion, into a drop in wage pressures, which can be an additional important factor in holding back inflation;

- Markets have speculated recently regarding the risk of persistently high inflation expectations not falling enough despite the Fed's hawkish moves. This scenario could herald the significant damage the economy would suffer from tightening in a high-inflation environment. The NY Fed survey has calmed Wall Street somewhat;

- Thursday's reading of the U.S. inflation report for September is still in question. A decline in CPI and core inflation below expectations could give financial markets a breather and reduce the likelihood of a prolonged cycle of rate hikes. On the other hand, in an environment of continued declines in inflation expectations, the market may begin to slowly price in that 'regarding rising inflation, the worst is over'.

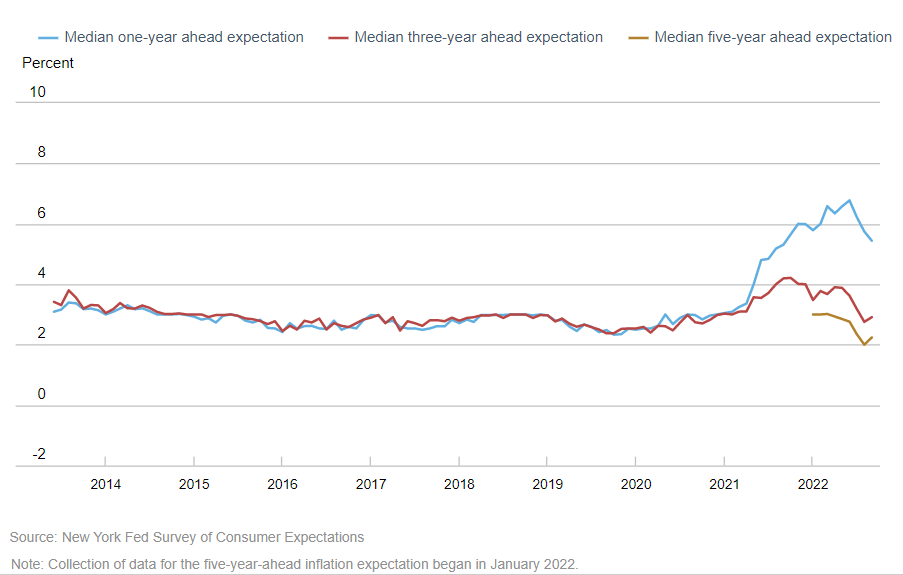

Inflation expectations have decisively declined on a year-over-year basis, which is positive and dampens the risk of damage the Fed could do with aggressive tightening in an environment of persistently high inflation expectations and inflation. At the same time, longer-term 3- and 5-year expectations have delicately increased, which could mean that the Federal Reserve may have trouble getting inflation to its 2% target. Source: New York Fed

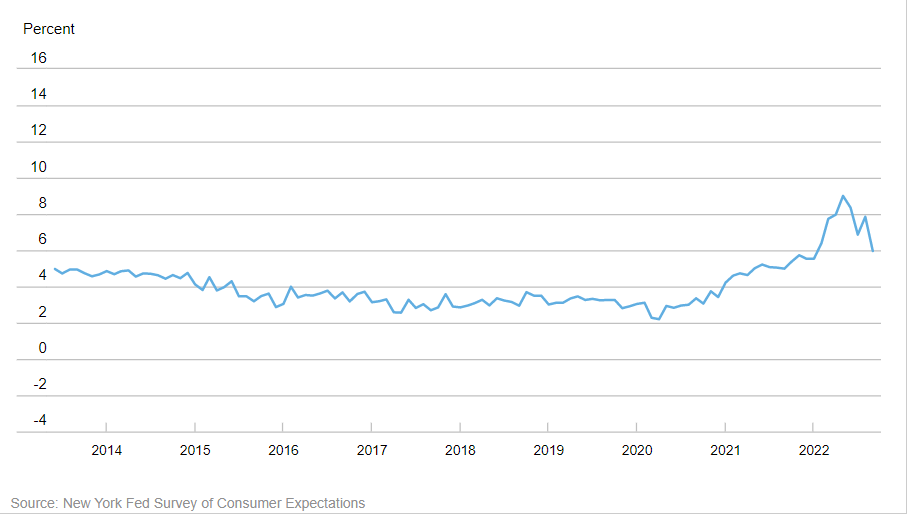

Inflation expectations have decisively declined on a year-over-year basis, which is positive and dampens the risk of damage the Fed could do with aggressive tightening in an environment of persistently high inflation expectations and inflation. At the same time, longer-term 3- and 5-year expectations have delicately increased, which could mean that the Federal Reserve may have trouble getting inflation to its 2% target. Source: New York Fed  Consumer price expectations fell sharply and broke an upward trend, returning to levels seen in early 2022. Source: New York Fed

Consumer price expectations fell sharply and broke an upward trend, returning to levels seen in early 2022. Source: New York Fed

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.