Summary:

-

Major US indices remain near all-time highs

-

US trade balance: -$52.5B vs -$52.4B exp

-

Uber to open sharply lower after earnings

There’s little sign of any let up in the recent move higher for US stocks with all three major benchmarks trading close to their all-time highs ahead of the cash open.

The S&P500 trades within just a couple points of its all-time high after breaking above a rising trendline going back almost 2 years at the start of the month. An RSI reading of 67.9 is still not in extremely overbought territory and there remains little by the way of reversal signs that suggest the market has peaked. Source: xStation

Trade continues to dominate the headlines with reports that the Trump administration are considering removing tariffs on $112B worth of Chinese imports providing a further boost overnight. There was a little dip lower when the influential Editor-in-chief of the Chinese and Global Times tweeted the following in response to the story but once again the market’s reaction function showed a greater willingness to rise on good news on this front than to fall on bad.

Despite these doubts raised as to the prospects of a de-escalation in trade tensions the markets remain unperturbed and clearly of the belief that a positive outcome will transpire. Source: Twitter

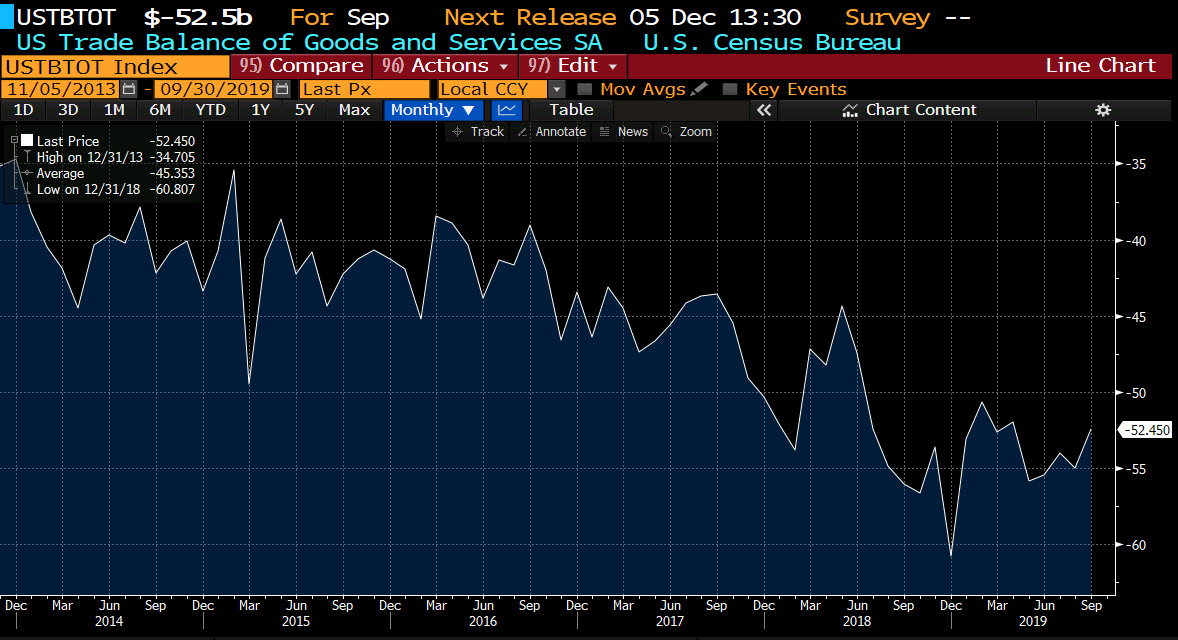

On the data front the main release will come at 3PM when we get the ISM non-manufacturing PMI (53.5 exp vs 52.6 prior) for October but before there then most recent trade figures are out. The trade balance for September came in at $52.5B v %52.4B expected and a prior reading of $55B (revised up from $54.9B). Exports came in at -0.9% vs +0.2% in August and imports also feel, with a reading of -1.7% vs +0.5% for the prior month. This number is rarely market moving but given the focus on trade is garnering greater attraction with the US-China deficit of $31.62B close to the $31.76B seen previously.

US trade balance was pretty much in line with forecasts as the deficit recovers from its highest level of more than -$60B just under a year ago. Source: Bloomberg

It’s expected to be a bumpy ride for Uber investors this afternoon after the firm announced its latest results after the closing bell last night. The results were as follows:

-

Loss per share: $0.68 vs $0.81 expected

-

Revenue; $3.81B vs $3.69B expected

Despite beating on both the top and bottom lines here with a smaller than forecast loss and higher turnover the stock is called to open lower by more than 6% this afternoon. The losses keep piling up for the firm with a net loss of $1.16B for the quarter topping the $986m seen for the same period last years as eye watering figures on this front become the norm. Speaking on CNBC, CEO Dara Khosrowshahi stated that the company is aiming for profitability on an adjusted EBITDA basis by 2021 but after an expected loss of $2.8-2.9B forecast for this year that does seem wishful. Another thing to watch for the stock this week is the expiration of a lock-up period tomorrow which will allow longer-term investors to cash out of their stock. Last night’s closing price represented a loss in excess of 30% from the IPO level.

Shares in Uber are called to start sharply lower this afternoon following the earnings update and not too far from their lowest ever level of 28.33. The stock has gone into reverse after beginning with an IPO price of 45.00 and with a lock-up period due to expire tomorrow there’s an indication that there could be additional selling to drive the stock even lower. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.