Vodafone (VOD.UK) shares are down more than 3.5% in today's session, slipping to levels not seen since the start of the year following the announcement of a plan to lay off 11,000 staff and slow revenue momentum this year. The proposed mass redundancy program will be the largest in the company's history and is expected to be spread over the next three years. The company's new CEO, Ms Margherita Della Valle, said that the company's performance is not good enough and the company needs to change.

The company's CEO gives some hints in the area of planned changes. First and foremost, the company is to simplify the operations of the organization, which is expected to have a positive impact on the competitive position in the telecom industry. The company also intends to reallocate its resources and specifically support the Vodafone Business sector.

It is also worth remembering that the merger process with Vodafone's biggest competitor, Three UK, is progressing in the background. According to media reports, talks on this matter are already in the final straight. The merger is expected to be worth close to $19 billion.

The company today published its results for the 2023 fiscal year, with revenues of EUR 45.7 billion, roughly the same as last year. Source: Vodafone

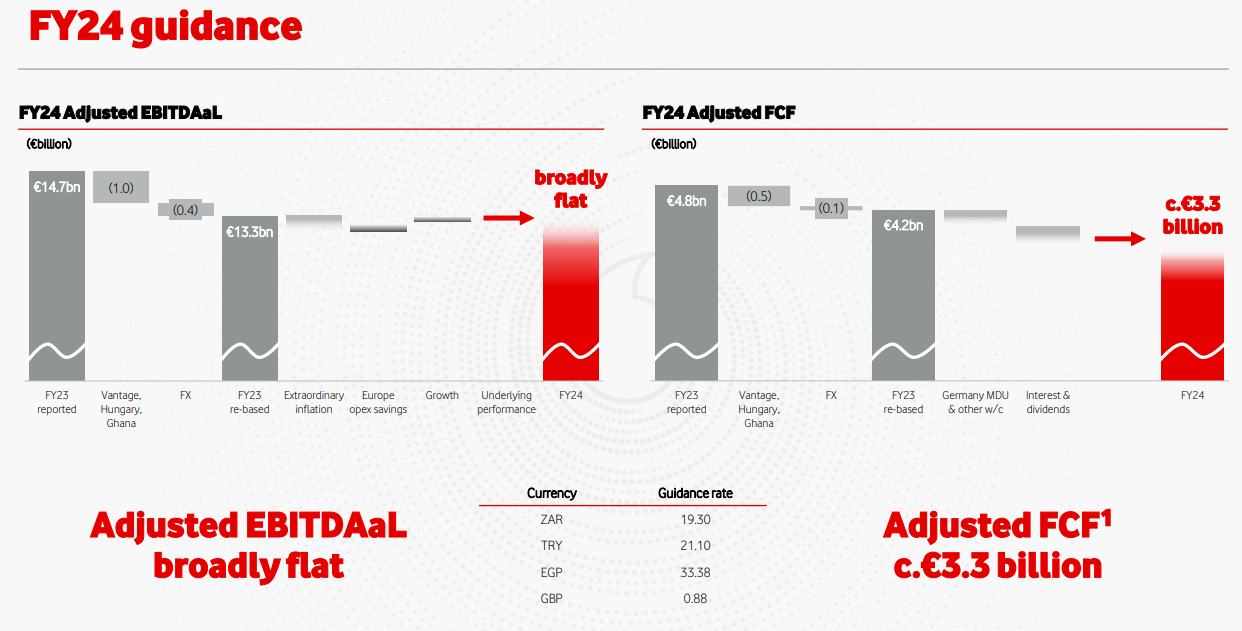

The company's forecasts for the next fiscal year are expected to come under pressure. Source: Vodafone

Vodafone (VOD.UK) share price chart, D1 interval. Source: xStation5

Vodafone (VOD.UK) share price chart, D1 interval. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.