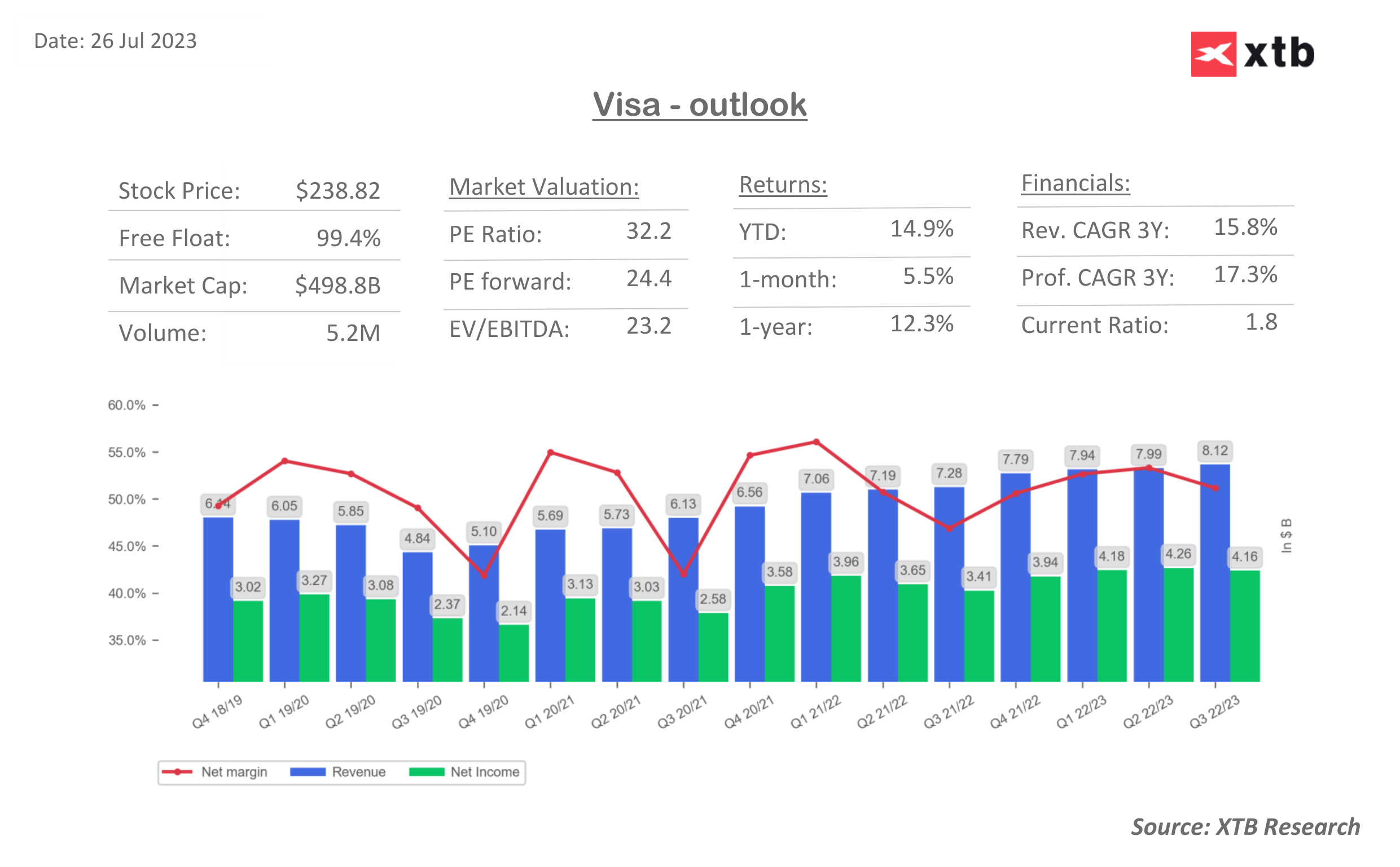

Visa Inc., the global payment processor, reported a modest increase in its fiscal Q3 2023 net income of $4.16 billion, with adjusted earnings surpassing estimates at $2.16 per share. This marks the smallest quarterly profit growth in over two years due to the ongoing impact of high inflation and rising borrowing costs. Nevertheless, the company's international transaction revenue grew by 14%, albeit short of the anticipated 18%. Visa's CFO, Vasant Prabhu, attributed the slowdown in U.S. payment volume growth since March to moderating inflation, as a decline in inflation typically impacts credit card companies, which charge a percentage on transaction values. However, despite concerns over a slowdown, the company forecasts low double-digit net revenue growth and mid-teens EPS growth for fiscal year '23.

Key financial metrics:

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app- Q3 2023 revenue: $8.12 billion

- Q3 2023 net income: $4.16 billion

- Adjusted EPS: $2.16

- International transaction revenue growth: 14%

- Forecasted net revenue growth for fiscal year '23: low double digits

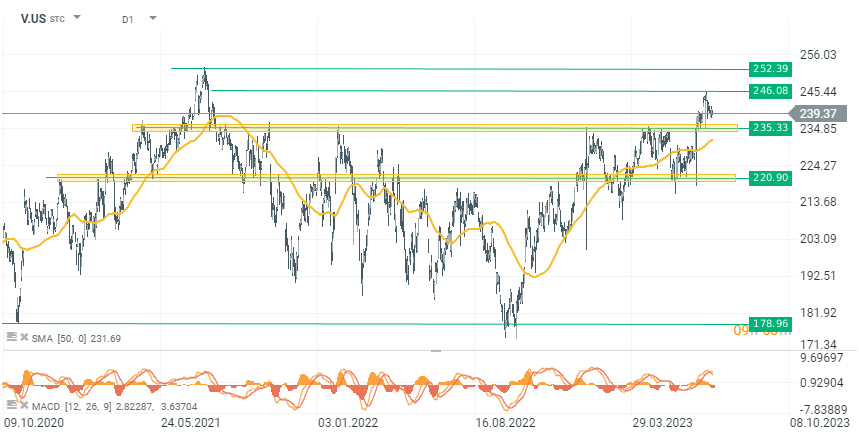

From a technical point of view, Visa shares are not far from the All-Time High (ATH) in mid-2021 at 252 dollars. However, after yesterday's quarterly release, the shares are down by 2.2%. A continuation of the declines could indicate a return to the nearest resistance zone around 230-235 dollars.

Visa (V.US), D1, source x Station 5

Visa (V.US), D1, source x Station 5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.