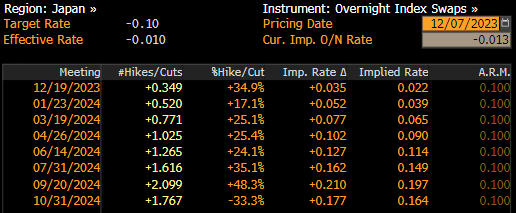

Japanese yen is a clear outperformer among G10 currencies today. JPY gains as traders are positioning for Bank of Japan exiting an ultra-loose monetary policy and hiking rates out of the negative territory. Comments from BoJ governor Ueda are seen as a driver behind the move. Ueda told Japanese lawmakers that handling of the monetary policy will become more challenging from the year-end, what fuelled speculation that the Bank is readying to exit negative rates. However, hints started arriving yesterday, with BoJ Deputy Governor Himino playing down adverse effects of rate hikes in his comments on Wednesday. As a result, market pricing for BoJ rate hikes increased and now money markets see a 35% chance of 10 basis point rate hike at December 19, 2023 meeting, up from around 26% yesterday. Increase in hawkish bets is also driving the biggest jump in Japanese yields in almost a year!

Money markets see around 35% chance of Bank of Japan delivering a 10 basis point rate hike at December meeting. Source: Bloomberg Finance LP

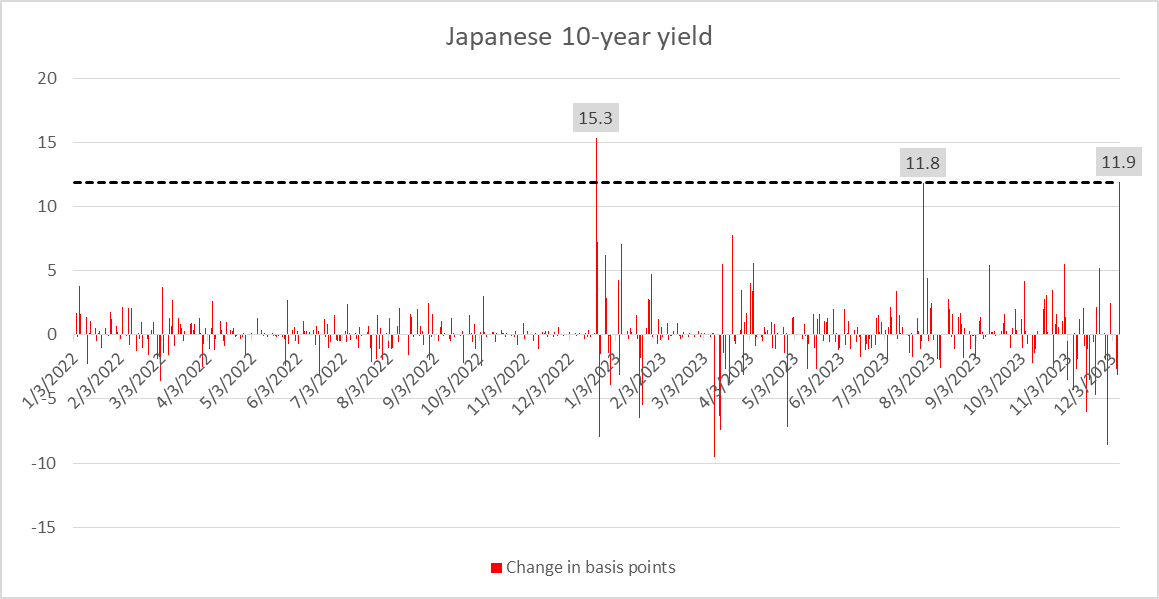

10-year Japanese yield experiences the biggest single-day jump since December 20, 2022. Source: Bloomberg Finance LP, XTB

10-year Japanese yield experiences the biggest single-day jump since December 20, 2022. Source: Bloomberg Finance LP, XTB

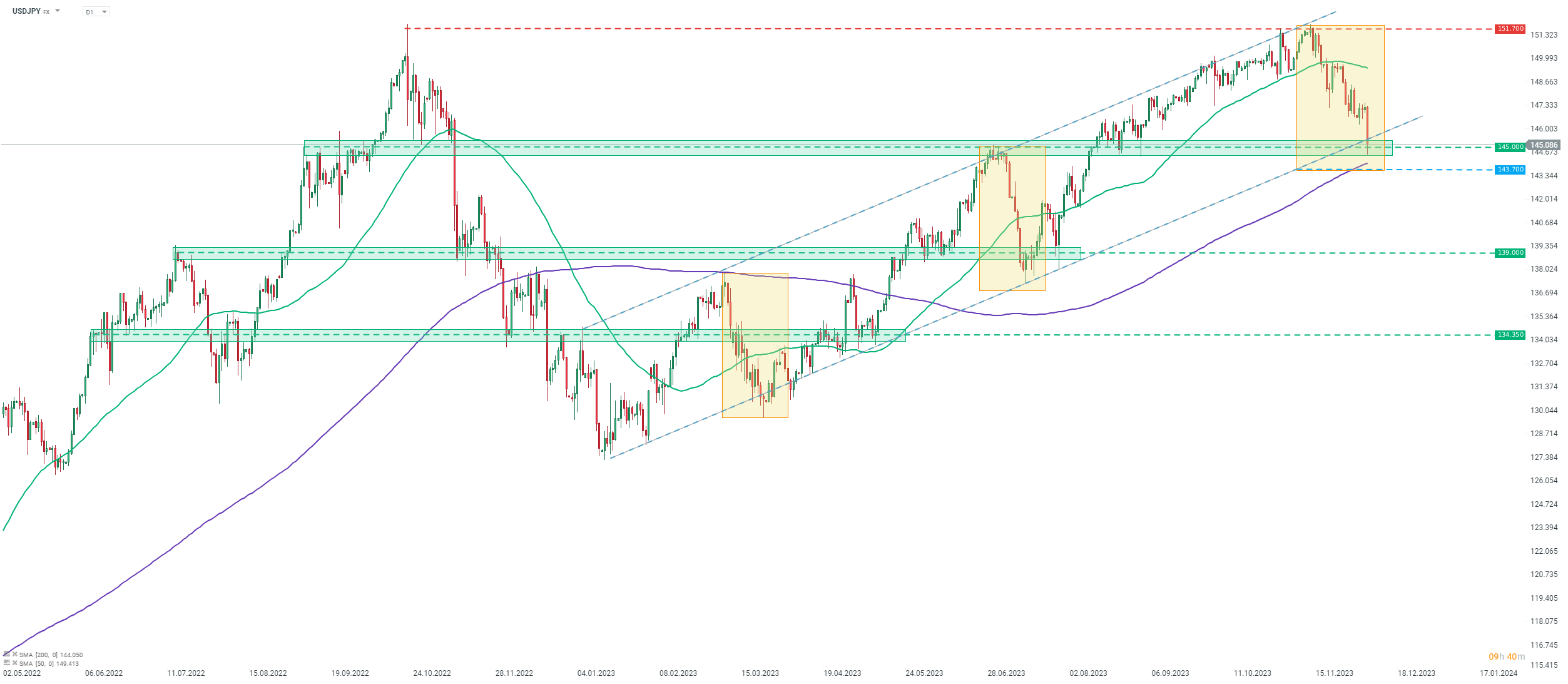

An expected hawkish turn by the Bank of Japan is pushing USDJPY 1.5% lower today. This is the biggest single-day drop for the pair since January 12, 2023 when the pair plunged 2.4%. Taking a look at USDJPY chart at D1 interval, we can see that the pair is making a drop below the lower limit of the bullish channel today and is testing the 145.00 support zone. A break below this area may be followed by a drop towards 143.70 zone, where a key support can be found. The 143.70 area is marked with the lower limit of the Overbalance structure as well as 200-session moving average and a move below this zone could hint at trend reversal.

Source: xStation5

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.