Summary:

-

US dollar edging higher on the day after data releases

-

Philly Fed beats forecasts while Initial jobless falls

-

USDJPY pulls back after gains on FOMC minutes

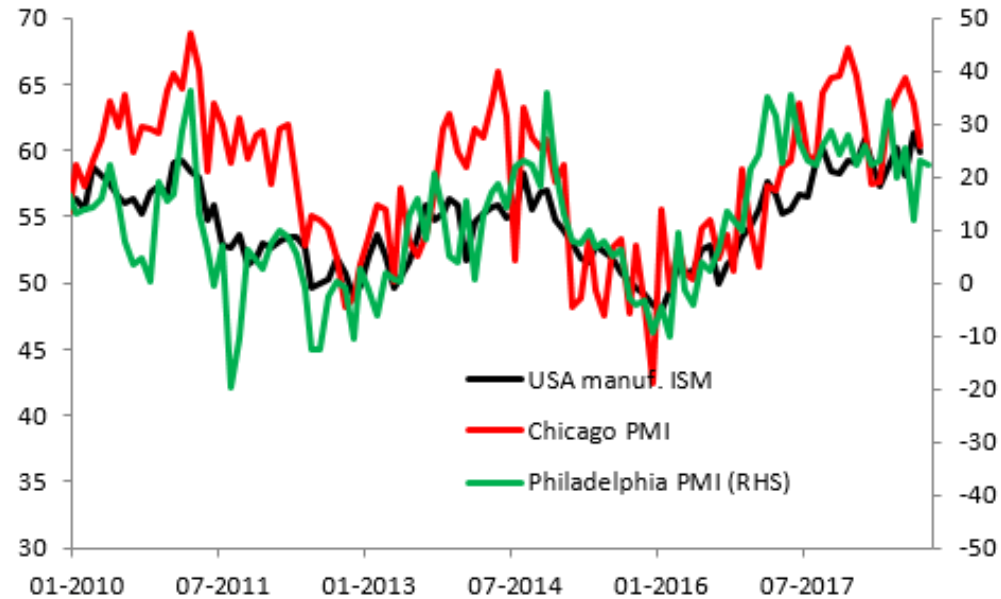

The greenback is currently moving a little higher on the day, albeit in a measured manner. The biggest move in any USD pair is just 0.4% and it appears that the buck is biding its time before making a larger move. Two data releases this lunchtime have failed to spark the dollar into life, with the Philly Fed manufacturing index the most positive and coming in at 22.2 for the current month. Even though this marks a slight decline on the prior reading of 22.9 it is above the 19.7 expected and marks the 2nd consecutive above forecast print for this indicator. This metric is notoriously volatile in the short term with month-on-month readings seemingly oscillating between beats and misses quite regularly. The recovery seen in the last couple of months is pleasing nonetheless considering the pull backs seen in the Chicago and US-wide equivalents and all three of these remain towards the upper reaches of the ranges seen this decade.

The latest Philly Fed reading has beaten forecasts and provided another welcome solid reading after the weakness seen a couple months back. The main US manufacturing indicators all remain high historically speaking. Source: XTB Macrobond

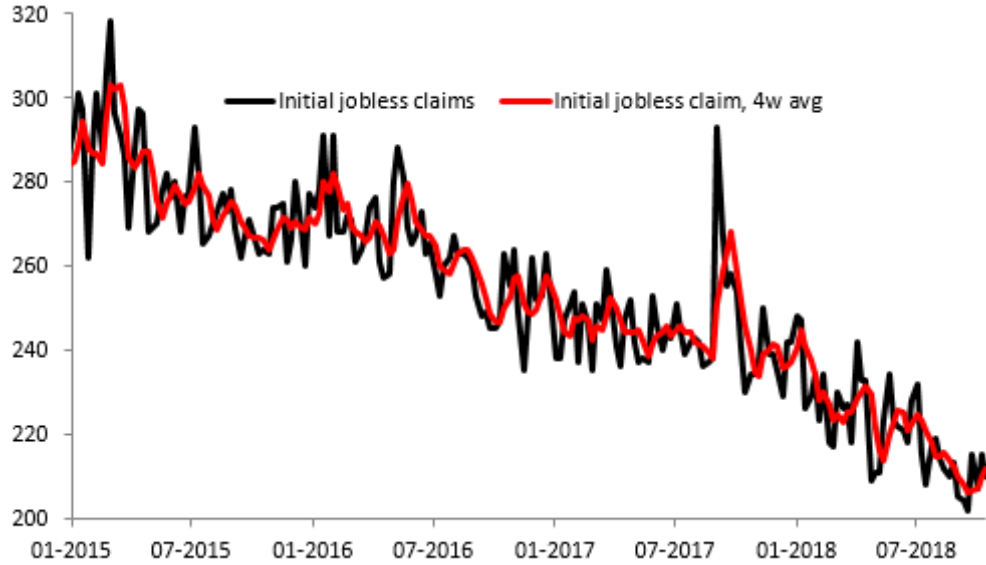

At the same time as the Philly Fed, the weekly initial jobless claims numbers were also released with a print of 210k. This is just below the expected 211k and down from the 215k previous, which was revised higher by 1k however. The big picture for employment remains little changed with nearly all indicators strong and suggesting there’s not much slack in the labour market. Wages are more important than unemployment metrics as they are seen to potentially translate into inflation more promptly with the Phillips curve seemingly losing some of its predictive powers in recent years.

Initial jobless claims fell last week and this unemployment measure remains close to its lowest levels in several decades. Source: XTB Macrobond

Looking across USD pairs, the USDJPY has been one of the most interesting of late with the cross representing a fairly good barometer of risk sentiment. The USDJPY often correlates closely with stock indices during times of heightened volatility and the past week has seen the market almost move in lockstep with the US500. Last Wednesday’s declines in both pairs have been recouped to some extent, but the question now is whether there’s a complete recovery ahead or a retest of the lows.

The past week has seen a close correlation between the USDJPY and US500 with both markets falling sharply before looking to recover the declines. Source: xStation

The past week has seen a close correlation between the USDJPY and US500 with both markets falling sharply before looking to recover the declines. Source: xStation

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.