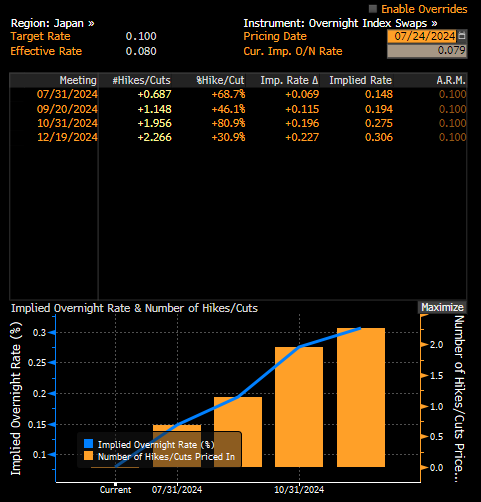

USDJPY pair is dropping below 155 today, with the yen gaining over 1% for the second consecutive day, driven by several factors. NBH television reported today that the Japanese government decided to raise the hourly minimum wage by 50 yen to 1054 yen for the current fiscal year. A higher minimum wage naturally hints at potential inflationary pressure, which could seal the deal for an interest rate hike in July or later in the year. Expectations indicate a 68% probability of a rate hike on July 31, and suggest over two full hikes of 10 basis points by the end of the year.

Interest rate expectations in Japan. Source: Bloomberg Finance LP, XTB

Another factor is investor positioning in anticipation of the end of favorable "carry trade" conditions in currency pairs involving the yen. BoJ rate hikes and rate cuts by other central banks, including the Fed, will reduce the interest rate differential. The return of capital to Japan additionally strengthens the yen. Therefore, we observe not only the dollar weakening against the yen but also the Mexican peso and Antipodean currencies. Interestingly, Donald Trump recently commented on the yen's excessive weakness, expressing his reluctance for other countries to have a significantly better position relative to the United States due to their currency.

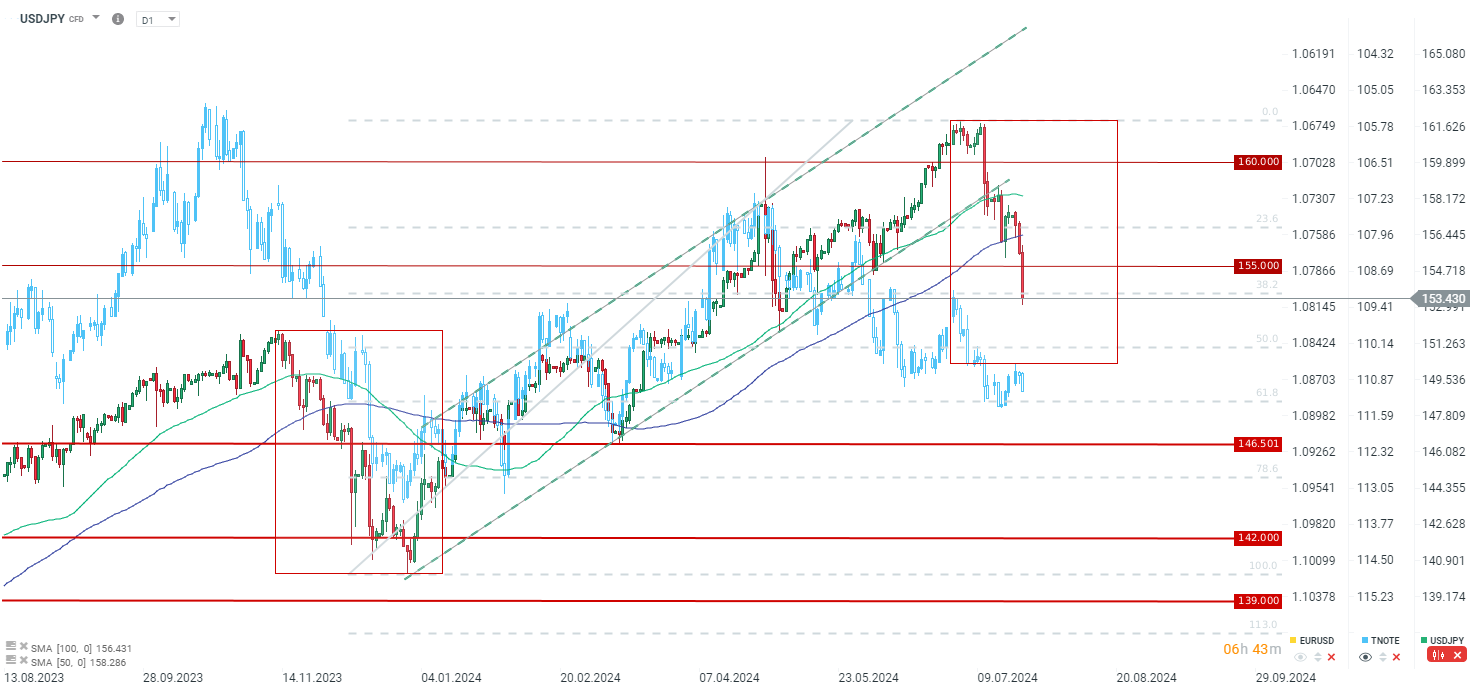

The USDJPY pair has reached its lowest level since mid-May today, falling not only below 155 but also below 154. During yesterday’s session, the pair crossed below the 100-day SMA. Previously, this average was breached in January and March, and the pair stayed below it for an extended period of time in November-December last year. If a similar situation occurs now, the pair could drop below 149 to the vicinity of the 61.8% retracement of the last upward wave, placing the pair at its lowest level since March. On the other hand, the pair has a long way to go, first needing to overcome the 38.2% retracement and then drop to the vicinity of the 50.0% retracement and the range of the previous significant correction, which occurred at the end of last year.

Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.