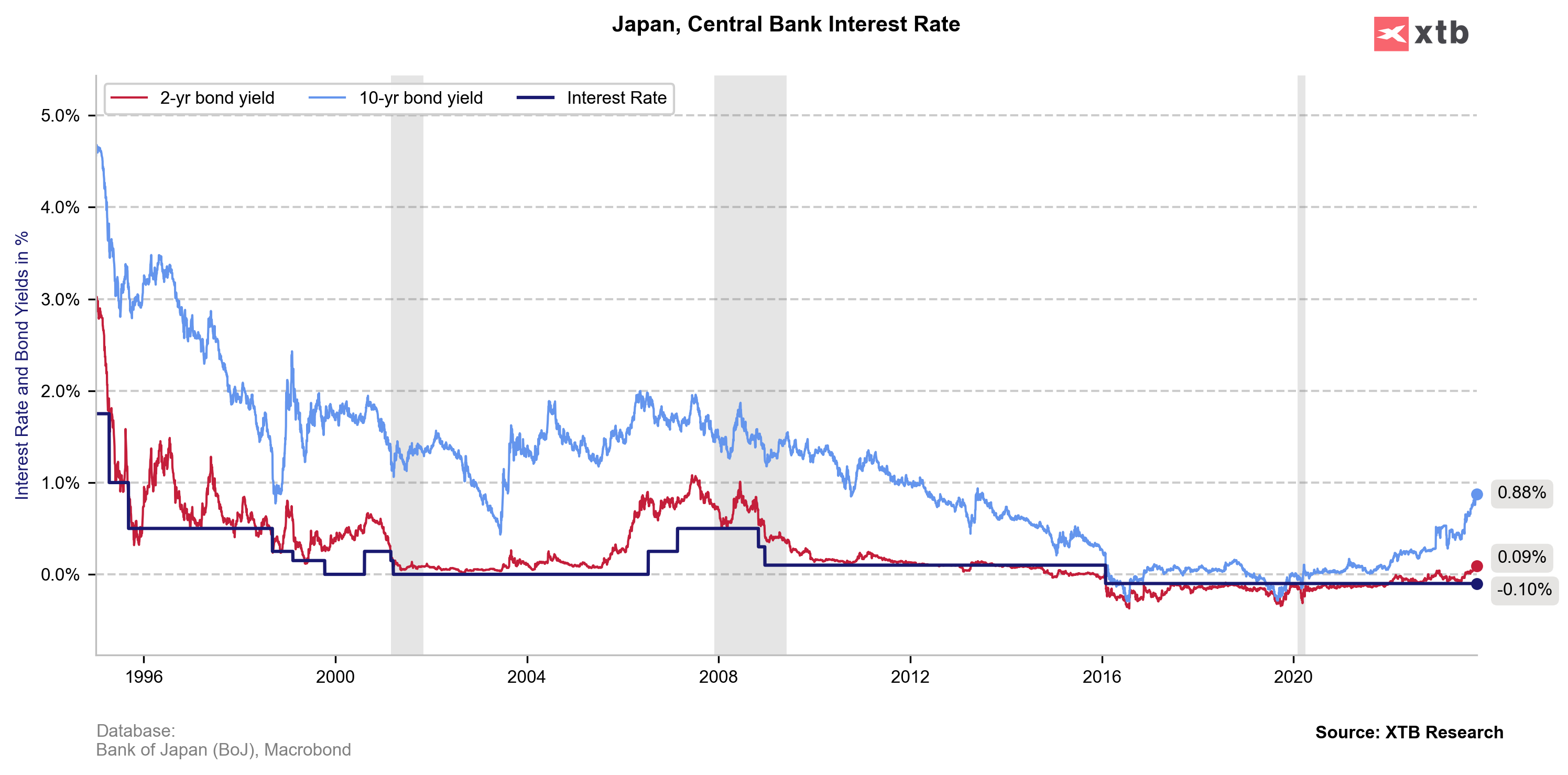

Today's session brings slightly increased volatility of the Japanese yen, due to the Bank of Japan's monetary policy decision scheduled for tomorrow. With the start of the session on Wall Street, the USDJPY pair fell below the psychological barrier of 150.00, which previously served as a checkpoint for the Bank of Japan's presumed currency interventions. The reason for this appreciation of the yen was a report by the Nikkei agency, stating that the Bank of Japan is considering allowing the yields of 10-year government bonds to exceed the level of 1%, while the current upper range of possible deviation is exactly 100 basis points.

Currently, yields are slightly below the 0.9% zone. Maintaining such a range (a 0% target with a possible deviation of 100 basis points) in an environment of rising yields is costly, and it cannot be ruled out that it will actually be raised. Source: XTB

The USDJPY pair dips after the announcement of a possible relaxation of the band around the target yield. Source: xStation 5

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.