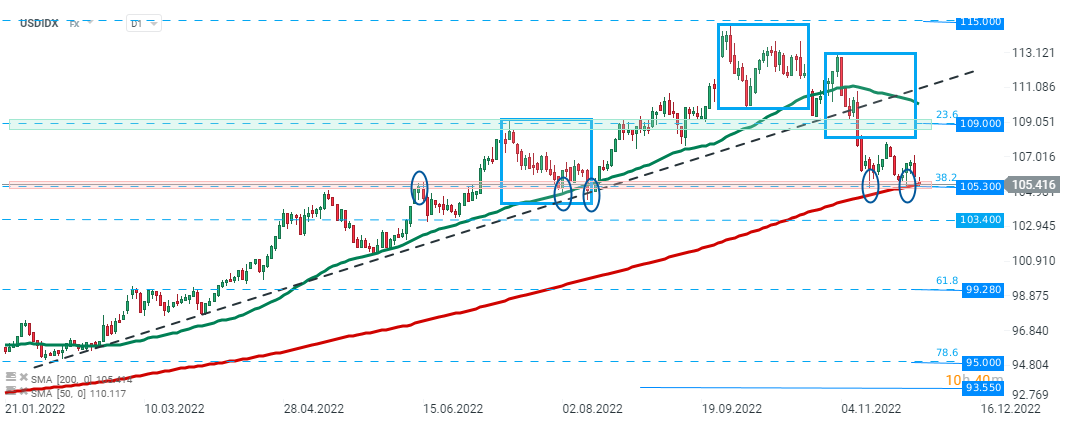

Dollar index plunged to a 15-week low of 105.30 following yesterday’s dovish comments from Powell. Fed Chair said that “slowing down at this point is a good way to balance risks,” and that the central bank could moderate the size of rate hikes as soon as December, which weakened the US dollar. Index is testing key support at 105.30 which is marked with previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the upward wave launched in May 2021. Should break lower occur, local support at 103.40 may be at risk. On the other hand, if bulls will manage to halt declines, then another upward impulse towards resistance at 109.00 may be launched

USDIDX, D1 interval. Source: xStation5

USDIDX, D1 interval. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market update: recovery takes hold, but investors remain on edge

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.