Market sentiments are again weak today, despite quite strong rebound of risky assets and main sentiments benchmarks (such as EURUSD or Bitcoin) as Iran didn't respond directly to Israeli attack. As for now, Nasdaq100 (US100) loses more than 1% and EURUSD erases previous gains, but remains higher as US dollar index lost sam momentum. Austan Goolsbee, from Chicago Fed, commented that soft landing may be more difficult as persistently high inflation in housing pressures on higher Fed rates and progress on lowering inflation 'has stalled'.

Fed's Goolsbee

- The golden path is more difficult for 2024.

- If you hold at this level of restrictiveness for too long, you will have to start thinking about the impact on jobs.

- The Fed's current restrictive monetary policy is appropriate.

- Proper Fed policy going forward will depend on the data.

- Persistently high housing inflation is the main short-run problem.

- I see more space for progress on services inflation from labor supply increases.

- Not all data suggests the labor-market overheating.

- Progress on US inflation has stalled.

- It makes sense to wait to get more clarity before moving

- I don't know if recent inflation a sign of overheating.

- We will get inflation to 2% over a reasonable period of time.

- It is harder to get to 2% inflation absent housing progress.

- The policy tradeoffs are harder this year.

- We have done great on the employment mandate, but we have not succeeded on the inflation mandate.

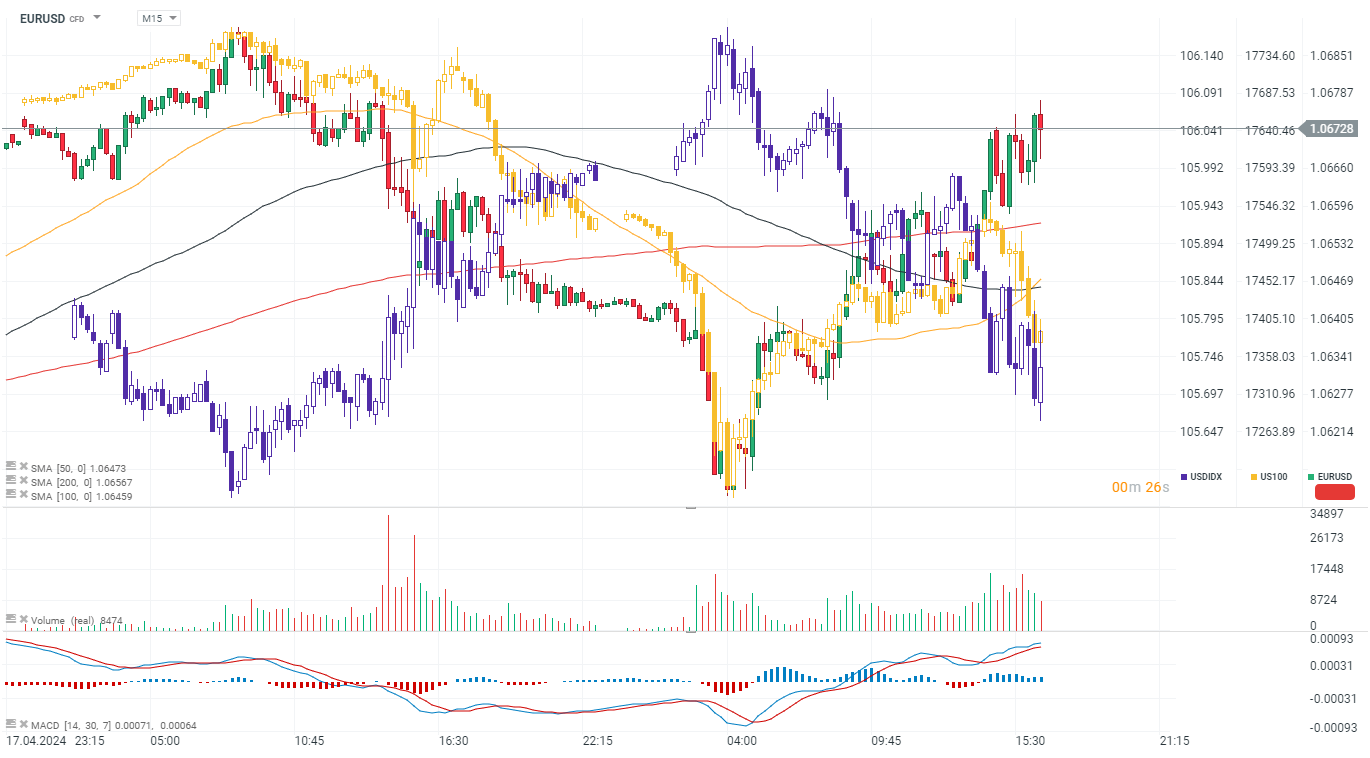

EURUSD (M15 interval)

Despite short-term rebound on Eurodollar (supported by the weakening US dollar, the purple chart) we can see that sellers activity is still high as real trading volume shows. What's important, is that also US dollar loses today with USDIDX dropping more than 0.2%. Reason for that may be in profit taking and recession concerns, as higher for longer Fed policy may indicate higher medium-term downside risks to US economy. GOLD rises 0.4% today.

Source: xStation5

Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.