The widely watched US CPI inflation for December has just been released and showed inflationary pressures on the economy eased in line with expectations, which was perceived by markets as dissapointment.

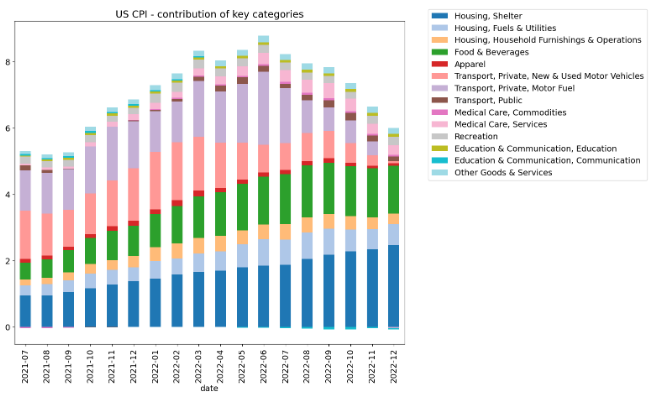

The annual inflation rate in the US slowed for a sixth straight month to 6.5% in December of 2022, the lowest since October of 2021, in line with market forecasts. It follows a 7.1% reading in November. Energy cost increased 7.3%, well below 13.1% in November, as gasoline cost dropped 1.5%, following a 10.1% surge in November. Also, fuel oil cost slowed (41.5% vs 65.7%) while electricity prices rose slightly faster (14.3% vs 13.7%). A slowdown was also seen in food prices (10.4% vs 10.6%) while cost of used cars and trucks continued to decline (-8.8% vs 3.3%). On the other hand, the cost of shelter increased faster (7.5% vs 7.1%). Compared to the previous month, the CPI edged 0.1% lower, the first decline since May of 2020, and beating forecasts of a flat reading.

It is likely that the market has focused on sharp declines of energy prices and its potential impact in the near future. On the other hand, housing-related inflation continues to rise. Nevertheless, this inflation is easing and the lower energy costs appeal to the Fed. Harker, who is known to be rather hawkish, says it is time for the Fed to raise rates only by 25 bps.

Today's data confirms that the price continues to weaken, however markets expected reading below market consensus. Today's CPI reading definitely increased uncertainty regarding FED next move, therefore volatility may remain elevated during today’s session.

Market reaction is rather mixed. US equities swing between gains and losses while the dollar erased early gains and resumed downward move.

Eneregy and food costs eased, however shelter jumped. Source: Macrobond, XTB

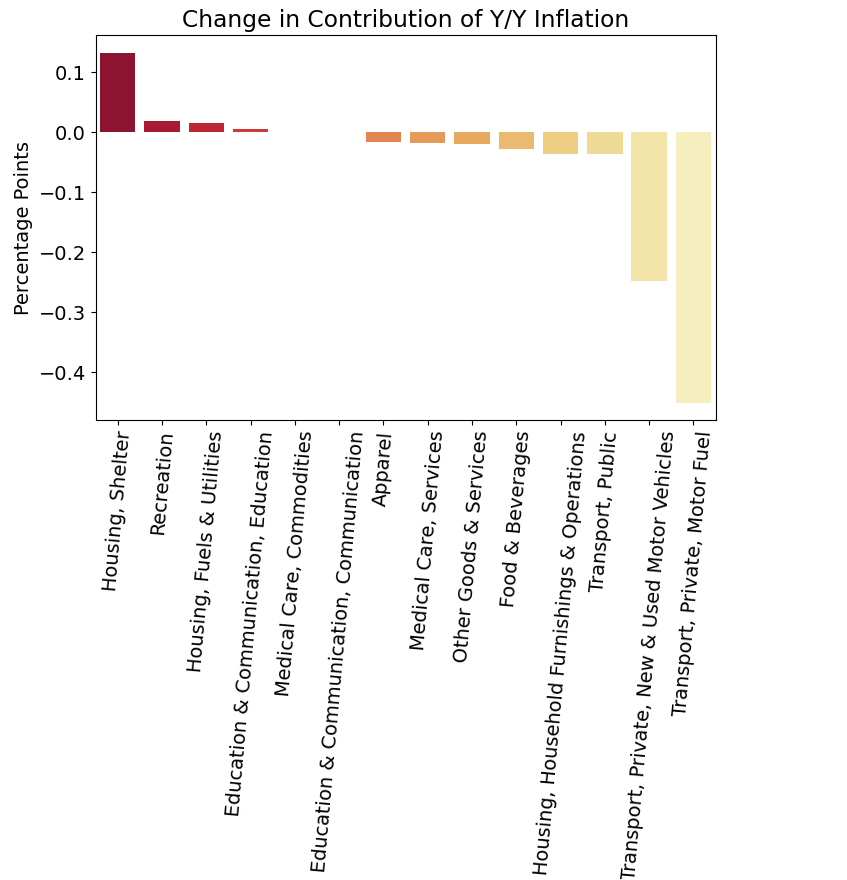

Fuel prices are falling by almost 10% m/m and have a negative contribution to inflation.Source: Macrobond, XTB

Fuel prices are falling by almost 10% m/m and have a negative contribution to inflation.Source: Macrobond, XTB

EURUSD pair bounced off local support at 1.0738 and resumed an upward move. Most popular currency pair is currently trading above major resistance at 1.0800. Source: Station5

EURUSD pair bounced off local support at 1.0738 and resumed an upward move. Most popular currency pair is currently trading above major resistance at 1.0800. Source: Station5

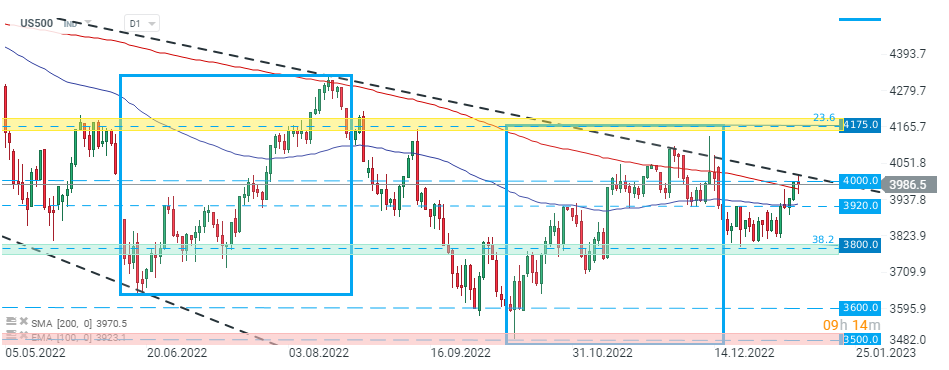

US500 bounced off key resistance at 4000 pts after CPI data release. Nearest support to watch lies at 3900 pts. Source: xStation5

US500 bounced off key resistance at 4000 pts after CPI data release. Nearest support to watch lies at 3900 pts. Source: xStation5

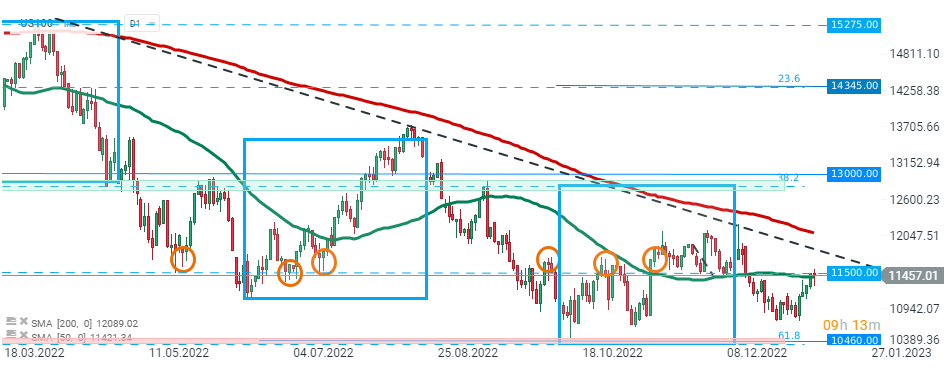

US100 also struggles to break above resistance at 11500pts. Source: xStation5

US100 also struggles to break above resistance at 11500pts. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market update: recovery takes hold, but investors remain on edge

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.