US CPI inflation for June data will be released today at 1:30 pm BST. The expectations point to a higher reading of 8.8% y / y compared to previous reading of 8.6% y / y. In turn, core inflation is to drop slightly to 5.7% y / y from 6.0% y / y. Today's inflation reading will give us more hints in what to expect from the Federal Reserve's July decision. There have been several indications of a slowdown in inflation recently, but it seems the Fed, in order to remain credible, will want to demonstrate that it will fight inflation until it sees clear signs that price pressure is retreating.

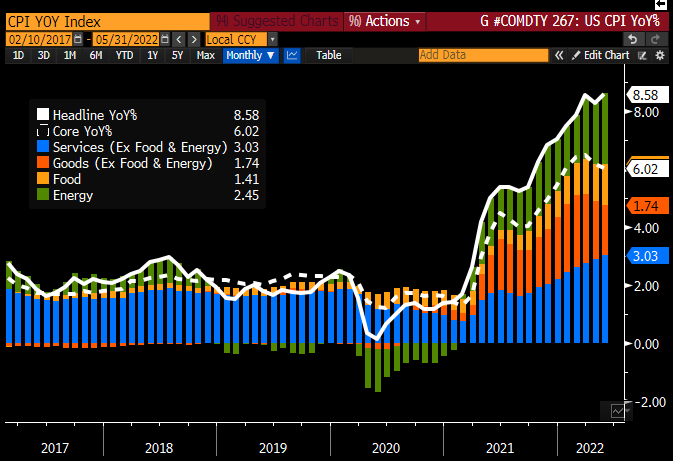

When it comes to the inflation reading, the most important thing is the costs of services. Along with rising raw material prices and tensions in the supply chain, the prices of almost all products rise sharply. As you can see, recently we have seen slight declines in contribution from goods, which results from the decline in commodity prices. On the other hand, energy continues to drive up inflation and the situation does not seem to change any time soon. Source: Bloomberg

When it comes to the inflation reading, the most important thing is the costs of services. Along with rising raw material prices and tensions in the supply chain, the prices of almost all products rise sharply. As you can see, recently we have seen slight declines in contribution from goods, which results from the decline in commodity prices. On the other hand, energy continues to drive up inflation and the situation does not seem to change any time soon. Source: Bloomberg

Inflation expectations are quite balanced. The vast majority of analysts see inflation at 8.8%, and the highest forecast is 8.9%. The lowest was 8.1%. Therefore, the dollar could strengthen if inflation broke the level of 9.0%, which could lead to an increase in interest rates by 100 bp. On the other hand, a smaller hike of around 50 bp could be possible if inflation fell to around 8%, which seems unlikely at the moment.

EURUSD is trading around 60 pips above parity. Range of the largest correction in the trend in the last two weeks indicates that a key resistance is located around 1.0110. However, to achieve this level, the CPI would have to fall sharply towards 8% level. In turn, breaking the parity could be possible with inflation reading above 9%. Source: xStation5

UK energy cap news, and easing fears about AI help to boost the market mood

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

Bank of England: A spring cut is likely, but will it come in March or April?

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.