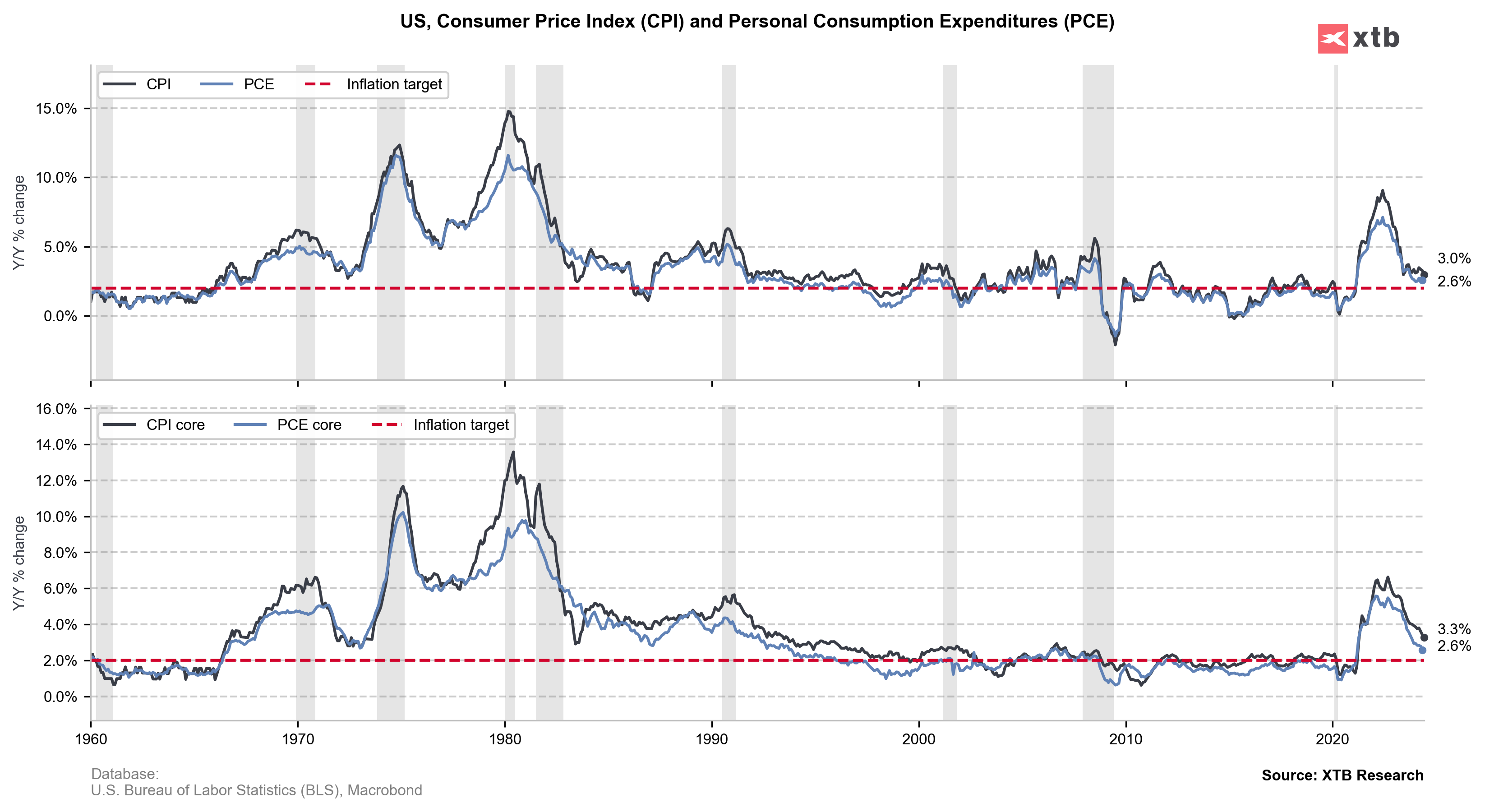

US CPI inflation for June fell to 3.0% year-on-year, a drop stronger than expected. However, CPI inflation remains above the PCE inflation indicator, which will be published today. Will PCE inflation continue to decline and give the Fed confidence to start lowering interest rates in September?

Market Expectations

The lower-than-expected CPI inflation rate has led to significant market turbulence. The US dollar has started to lose value, yields have begun to fall, and gold has reached its highest level in history, very close to $2,500 per ounce. Will today's PCE inflation reading justify the recent market moves, some of which have already been reversed? Market expectations:

- Headline PCE inflation is expected to fall to 2.5% year-on-year from the previous reading of 2.6% year-on-year. Monthly inflation is expected to increase by 0.1% month-on-month, compared to 0.0% month-on-month in the previous reading. Bloomberg Intelligence indicates that the monthly increase was likely only 0.04% month-on-month, suggesting an annual reading of 2.4% year-on-year.

- Core inflation is also expected to fall to 2.5% year-on-year from 2.6% year-on-year, although it's worth mentioning that a significant surprise drop from 2.8% year-on-year occurred the previous month. Monthly growth is also expected to be 0.1% month-on-month, similar to before.

- However, Bloomberg Intelligence indicates that monthly core inflation will increase by 0.16% month-on-month, and annually it will remain at 2.6% year-on-year. This is related to yesterday's core PCE reading in the GDP report, which showed a reading of 2.9% year-on-year, while market expected a decline from 3.7% in the first quarter to 2.7%

- One of the largest contributions is still expected to come from the real estate market. Costs of financial services and food consumed outside the home are also expected to rise.

- Expectations also indicate an increase in personal spending for June by 0.3% month-on-month, compared to the previous level of 0.2% month-on-month. Personal income is expected to increase by 0.4% month-on-month, compared to the previous level of 0.5% month-on-month.

As can be seen, market expectations point to a very optimistic report that should support dovish trends in the market. However, it is worth noting that after May's very good report, there may be revisions to some components and a rebound in June on a monthly basis. Therefore, there is a chance of a negative surprise. Nevertheless, today's reading should not change the Fed's direction if there is no major surprise. The Fed is expected to signal readiness for a rate cut next week, but will likely not indicate this explicitly. Powell is most likely to take the opportunity to clearly signal a rate cut during the economic symposium in Jackson Hole in August.

How Will the Markets React?

This morning we observed widespread weakness of the US dollar, but over time, less than 4 hours before the publication, we see a clear change. The US dollar is gaining against the yen and the franc, while EURUSD is close to yesterday's closing. Yesterday, the dollar weakened despite a very strong GDP reading. The dollar's weakness due to GDP may be related to reduced fears of a recession in the USA.

Looking at the EURUSD pair, we see that the pair may head towards the support area at the 38.2% retracement of the last upward wave and the level of 1.0835 at the lower boundary of the upward channel, which could also be a inverted flag pattern. If inflation exceeds expectations, an attempt to test the zone below the 1.0835 level cannot be ruled out, which could lead to the realization of the flag pattern and a decline to around 1.0800. However, if inflation turns out to be in line with expectations, it would signal readiness for interest rate cuts, opening the way to test the upper limit of the upward channel and a rise to around 1.0875, where strong resistance is located.

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.