US dollar has been one of the best performing G10 currencies for the major part of the day. Strengthening of USD has been triggered by rather hawkish FOMC minutes release yesterday and supported further by a streak of better-than-expected US data today. ADP data showed a massive beat, lay-offs in Challenger report dropped to a 7-month low and services ISM jumped, driven by strong readings of employment and new orders subindices. However, USD started to give back some gains after the European stock market session closed.

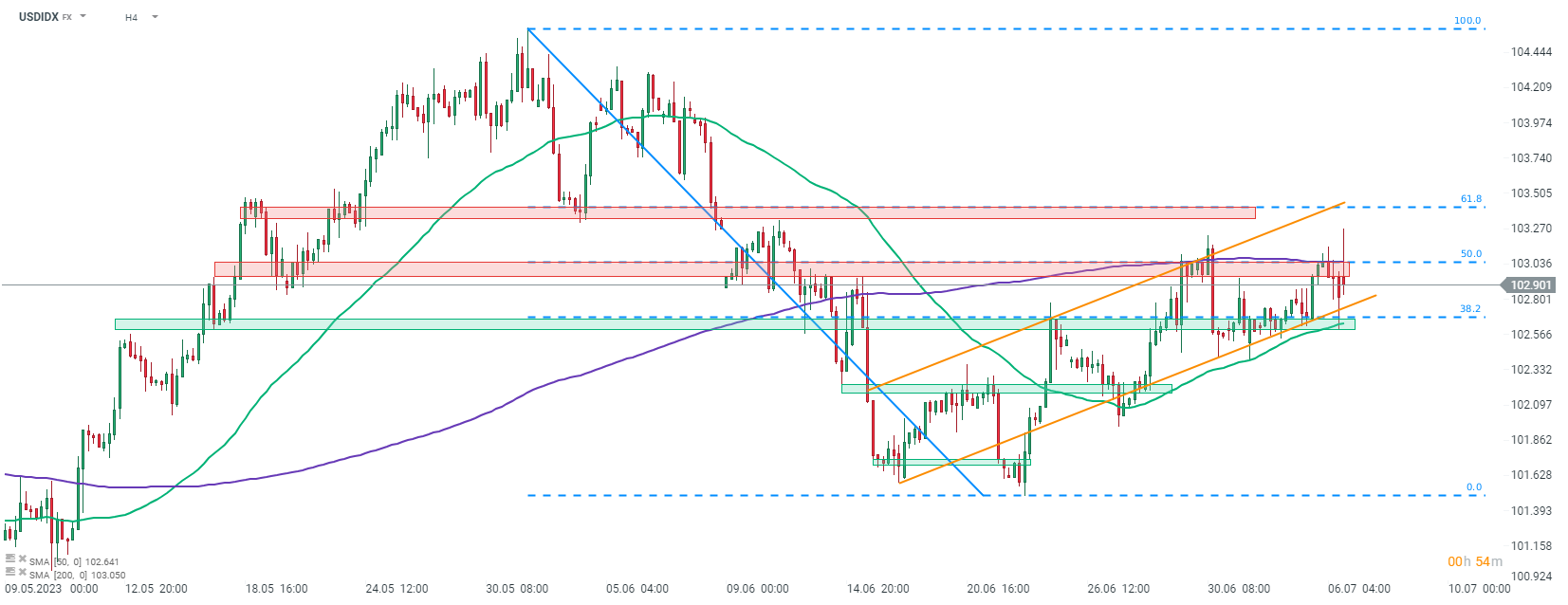

Taking a look at US dollar index chart at the H4 interval, we can see that the index has been trading in a short-term upward channel recently. After a period of trading near the lower limit of the channel, the index managed to bounce higher yesterday. However, advance was halted near midpoint of the channel, at the resistance zone marked with 200-period moving average (purple line) ad 50% retracement of the downward move launched at the end of May. Another attempt to break above this zone was made today and it also failed, leading to a pullback. NFP release tomorrow at 1:30 pm BST could be another driver of USD moves and should we see a strong jobs data, like in today's ADP release, greenback may be set to resume gains.

Source: xStation5

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.