- The Fed will publish its decision at 7 PM GMT today, chair Powell's press conference will be held at 7:30 PM GMT p.m.

- No new macroeconomic forecasts will be presented, but it is probable that there has been a change in interest rate expectations

- The Fed may communicate that it will begin reducing the pace of balance sheet reduction (QT) starting this June

More inflation uncertainty amid latest data

Two weeks ago, Powell, during a speech, indicated that the latest data do not give confidence in a further decline in inflation to target. What's more, we are after another inflation reading and a GDP report that put us even further away from the first interest rate cut:

- The GDP deflator for Q1 rose to 3.1% at an annualized rate against an expectation of 3.0% and the previous level of 1.7%

- PCE Core rises to 3.7% for Q1 at an expected rate of 3.4% and at the previous rate of 2.0%

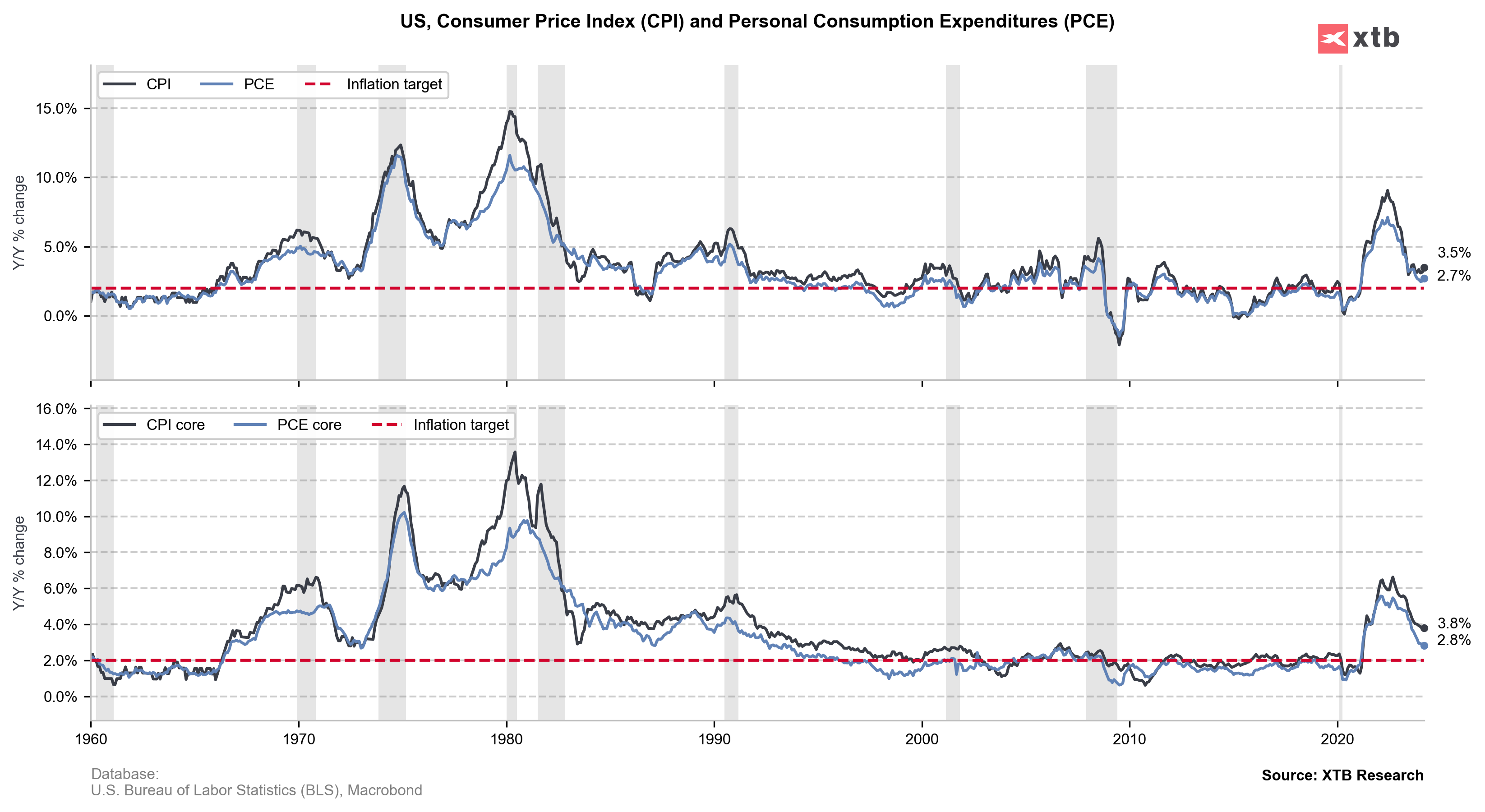

- PCE inflation for March rises to 2.7% y/y with expectations of 2.6% y/y and with the previous level of 2.5% y/y

- Core PCE inflation remains at 2.8% y/y with expectations of a 2.7% y/y decline

- Both measures increase at 0.3% m/m, in line with expectations and the previous reading

- Labor costs for Q1: 1.2% with an expectation of 1.0% and the previous level of 0.9%

Powell and other Fed members have repeatedly indicated that they need more certainty to decide on cuts. Rather, the data adds to the confidence that we are moving away from the inflation target, and some are even suggesting that the next move will be a possible return to interest rate hikes. While this seems an unlikely scenario at this point, of course, one should not forget to compare current inflation with the situation in the 1970s, when after the first descent in inflation we had an increase to even higher levels after several months. This is precisely the scenario the Fed will want to avoid. As the US central bank does not control the situation on oil markets, the Fed has to respond with a more hawkish stance to the risk of higher oil prices amid geopolitical tensions.

PCE inflation is rebounding, which does not give confidence that inflation will fall to target within the forecast period. Source: Bloomberg Finance LP, XTB

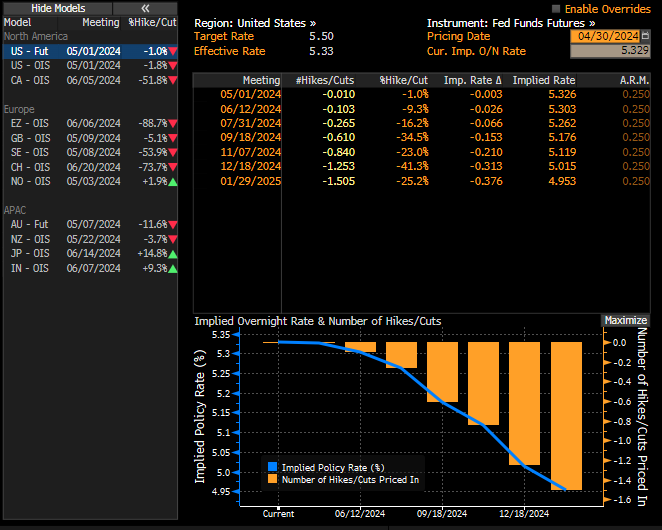

Just earlier this year, the market was forecasting 5-6 interest rate cuts in 2024. Now those expectations point to 1.2 cuts. It also appears that the Fed itself will shift its expectations in June and indicate that it sees 2 or only one cut this year.

Market expectations currently point to just over 1 cut this year! On the other hand, as many as 5-6 cuts were forecast earlier this year. Source: Bloomberg Finance LP

Attention focused on the balance sheet

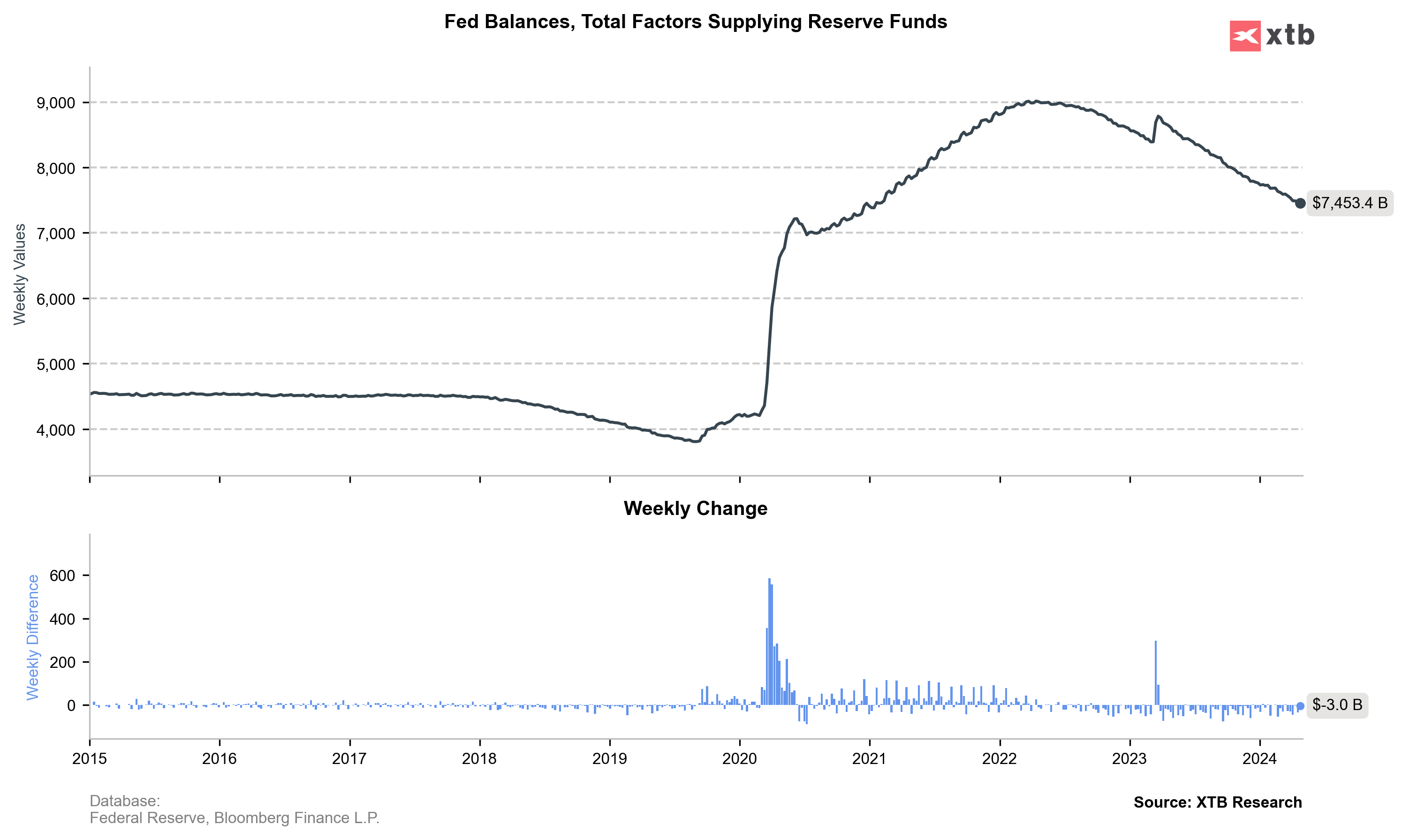

Minutes from the previous meeting showed that Fed members want to avoid the market liquidity squeeze scenario that occurred in 2019, when the balance sheet reduction program was still underway. That's why it's possible that the Fed will already admit that there will be a reduction in the pace of balance sheet reduction from the middle, which would be expected to reduce liquidity risks. On the other hand, it is worth noting that the Fed's balance sheet is still extremely high and has not yet reached the point where it was after the first phase of the pandemic (about $7 trillion). In theory, news that the Fed is preparing to reduce the pace of balance sheet reduction (QT reduction) would be positive for the stock market. On the other hand, financial conditions in the market remain quite loose, so theoretically there is also no rush to decide on such a step. The Fed's balance sheet has been reduced since 2022. The level of reduction has already reached $1.5 trillion. Source: Bloomberg Finance LP, XTB

The Fed's balance sheet has been reduced since 2022. The level of reduction has already reached $1.5 trillion. Source: Bloomberg Finance LP, XTB

What to watch out for?

There is a high probability that the Fed statement will only undergo cosmetic changes and no change to the balance sheet will be communicated. In view of this, all attention will focus on the post-decision press conference. In addition to Powell's words from 2 weeks ago, it is worth pointing to comments by Austan Goolsbee of the Chicago Fed, who is considered one of the more dovish members of the US central bank. Goolsbee indicated also that the progression in the decline of inflation has clearly deteriorated, and the Fed needs to recalibrate its approach. In contrast, John Williams of the New York Fed says that if inflation continues to rise, even a hike cannot be ruled out. During the press conference, the questions may be whether anything can now convince the Fed to cut, or whether the Fed is already leaning more toward hikes at this point. Nevertheless, the consensus at this point is that the Fed will present a hawkish pivot at the current meeting.

How will the market react?

The EURUSD pair remains around the 1.0700 level, as low expectations for cuts and high yields amid weak data from Europe may indicate a stronger dollar for longer. If the Fed's overtone justifies the high yields, the EURUSD pair could again test the vicinity of the 1.0600 level, or even lower if the ECB is heading for a cut in June. However, if the Fed does not show concern about inflation and makes changes in the pace of balance sheet reduction, then there will be a chance for an increase and a test even the 1.0800 level.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.