Release of US data pack for February, including PCE inflation, is a key macro event in the afternoon today. Even though it will be a report for February, somewhat outdated given that we are entering April next week, it is the Fed's preferred measure of inflation and will therefore be watched closely.

However, it may not have too much impact on the next FOMC rate decision. This is because traders will be offered data for March prior to the next FOMC meeting (both CPI and PCE). Nevertheless, today's reading is likely to impact market expectations regarding Fed's rate path and it may trigger some moves on the market.

1:30 pm BST - US, data pack for February.

- Headline PCE. Expected: 5.1% YoY. Previous: 5.4% YoY

- Core PCE. Expected: 4.7% YoY. Previous: 4.7% YoY

- Personal Income. Expected: 0.2% MoM. Previous: 0.6% MoM

- Personal Spending. Expected: 0.3% MoM. Previous: 1.8% MoM

CPI data for February, which was already released, pointed to another slowdown in the headline measure and a similar outcome is expected from headline PCE data today. However, the question is what comes next as some price growth proxies, like for example Manheim index for used vehicles, points to a possibility of CPI re-accelerating in Q2 2023.

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

Manheim used vehicles index (green line, 3-month lead) suggests that inflation slowdown may take a halt and reverse in the coming months. Source: XTB, Bloomberg

A look at the markets

EURUSD

EURUSD bulls failed to break above the resistance zone ranging above 1.0920 mark. As a result, a double top was painted in the area. This is a bearish pattern but a strong signal would be generated only once the pair drops below the neckline of the pattern, which can be found near 38.2% retracement in the 1.0710 area.

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

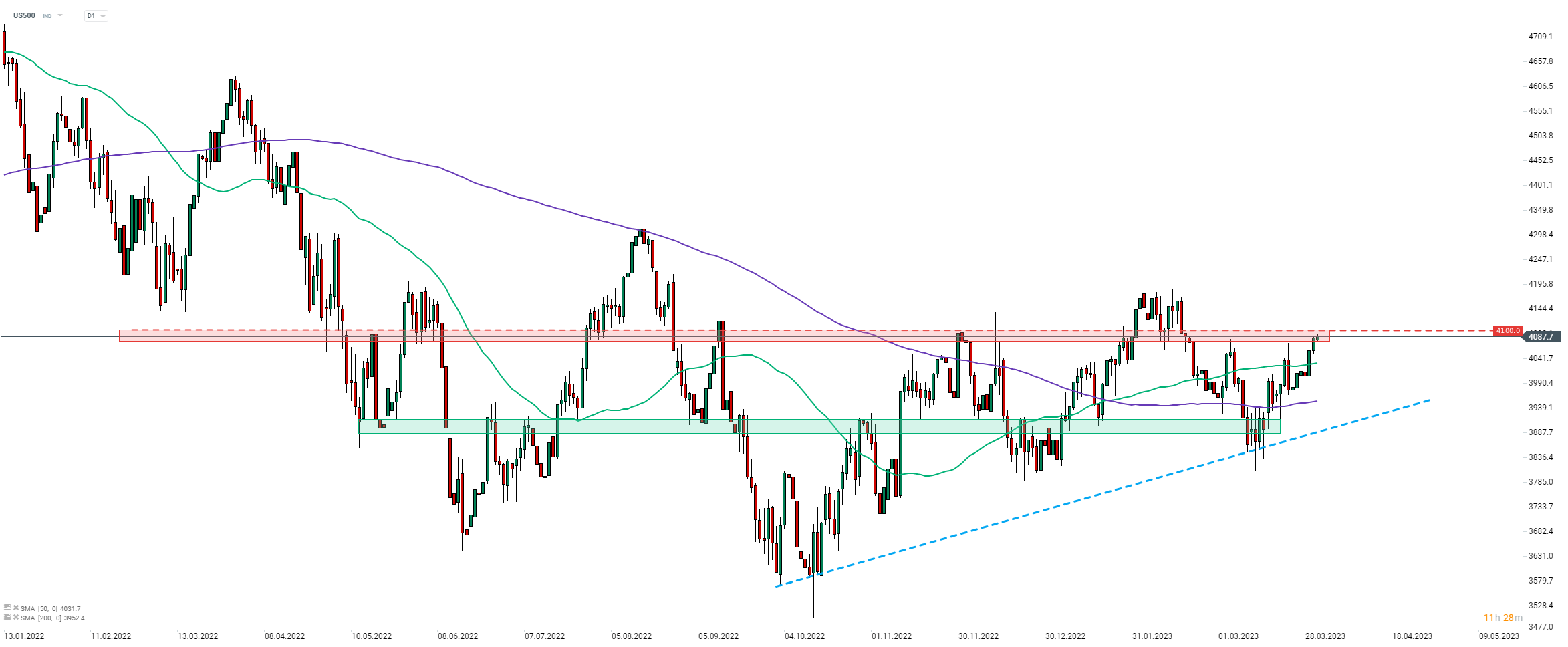

US500

S&P 500 futures (US500) traded higher in the early afternoon ahead of the US PCE report release and ahead of the Wall Street cash session open. The index reached 4,100 pts resistance zone and a softer PCE reading could provide fuel for another attempt at breaking above it.

US500 at D1 interval. Source: xStaiton5

US500 at D1 interval. Source: xStaiton5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.