Fed Chair Powell will appear before the US House Financial Services Committee today at 3:00 pm GMT for the first day of his two-day semi-annual testimony to US Congress. Text of the speech is released some time before the testimony. While there is no set time for text release, it was released at 1:30 pm GMT previously. Powell will appear before the US Senate Banking Committee tomorrow at 3:00 pm GMT and while the text of the speech will remain unchanged on both days, questions from lawmakers may differ.

What will Powell say?

Semiannual testimony of the Fed Chair in Congress is an update from the central bank chief to lawmakers on the economy, monetary policy and inflation. Inflation is the most pressing issue as it remains well-above Fed's 2% goal, following massive monetary stimulus during the pandemic as well as recent crises that boosted commodity prices. Having said that, Powell is likely to repeat lines from the FOMC statement that further tightening is needed to get control over the inflation while also signaling that incoming data continues to show the US economy holding firm.

The speech itself is unlikely to include any surprises. Powell is unlikely to deviate much from the FOMC statement as would not want to trigger any major market moves. Moreover, two major pieces of US data will be released after the speech - US jobs data for February will be released this Friday while US CPI report for February will be released next Tuesday. Having said that, it makes it even more unlikely that Powell will send a message that can be seen as surprising as there is risk he may have to later retract, should jobs or inflation data surprise.

Is there a chance for a surprise?

As we have already explained in the previous paragraph, it looks unlikely that the text of Powell's testimony will include surprises. However, the speech will be followed by a Q&A session from lawmakers and this is a moment when surprises could be delivered. Democratic lawmakers have voiced concerns that the Fed may over-do tightening, what would have a negative impact on the US economy. Having said that, there is a chance that there will be questions about how high rates will go or whether tightening will cause a US recession. On the other hand, Powell answers this kind of questions on a regular basis at post-decision press conferences so he has experience in answering those kinds of questions without providing clear and direct answers.

A look at the markets

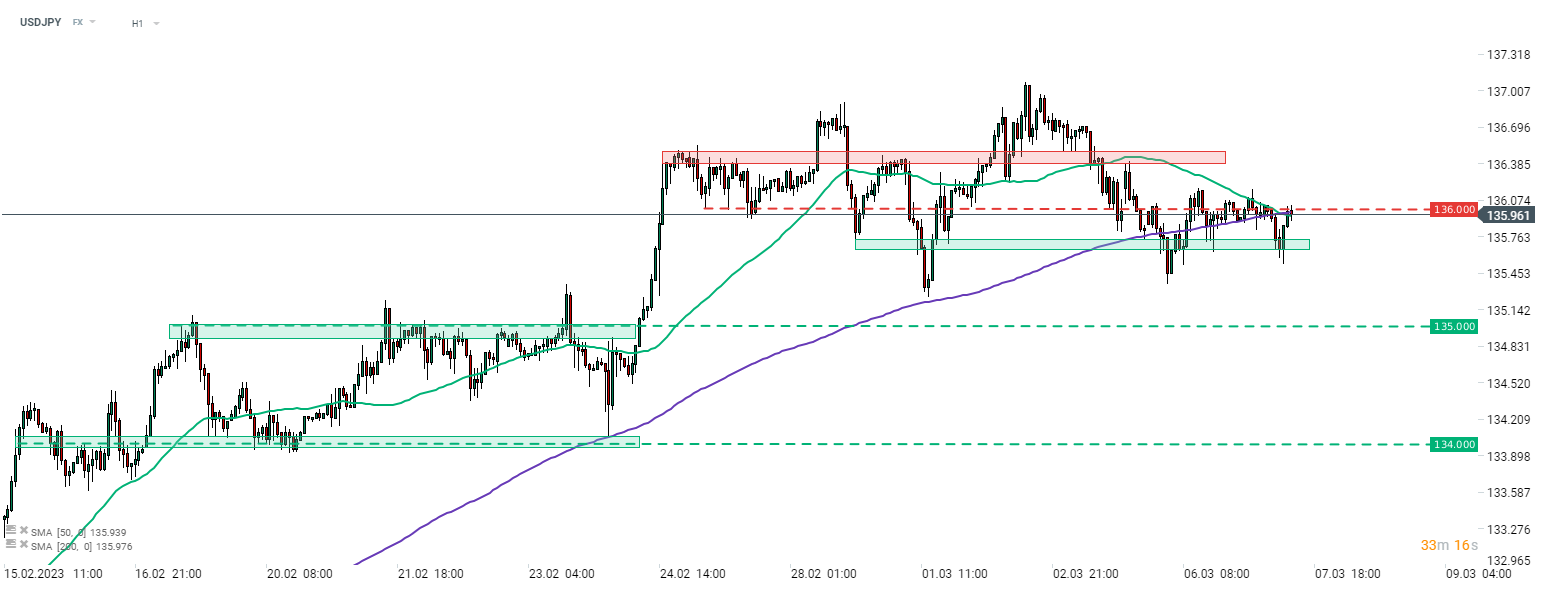

USDJPY

USDJPY pulls back from a mix of important resistances on H1 interval - 50-period moving average, 200-period moving average and a 136.00 swing area. The 200-period moving average on H1 interval acted as an important support earlier and a failure to break back above it may herald a period of weakness in USDJPY. Source: xStation5

USDJPY pulls back from a mix of important resistances on H1 interval - 50-period moving average, 200-period moving average and a 136.00 swing area. The 200-period moving average on H1 interval acted as an important support earlier and a failure to break back above it may herald a period of weakness in USDJPY. Source: xStation5

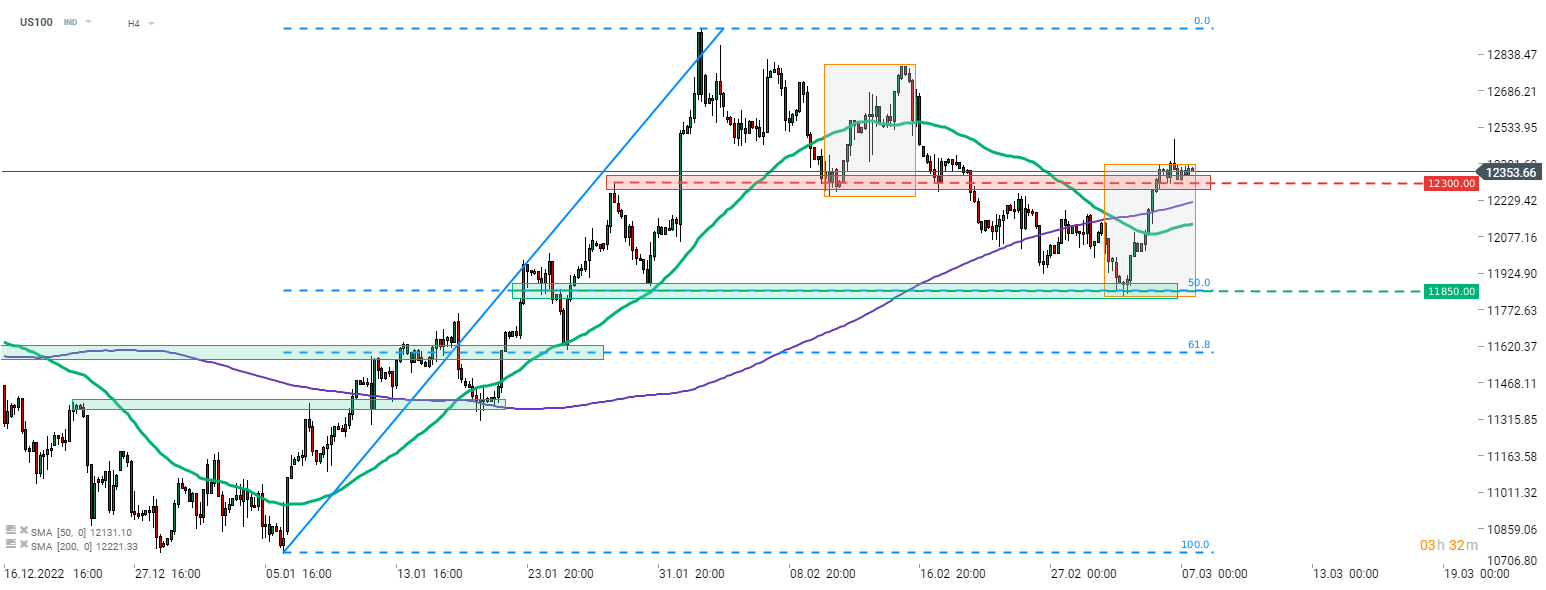

US100

Nasdaq-100 (US100) trades near the upper limit of the Overbalance structure and a break above would, at least in theory, hint at bullish trend reversal. Powell testimonies in Congress this week could be a make or break for the index. Source: xStation5

Nasdaq-100 (US100) trades near the upper limit of the Overbalance structure and a break above would, at least in theory, hint at bullish trend reversal. Powell testimonies in Congress this week could be a make or break for the index. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.