Today at 1:30 pm BST we will learn US retail sales data. After a strong rebound in July, a slowdown is expected for August, due to weakness on the auto sales side. However, as data from the last 30 years shows, retail sales rebounded 3-4 months after the first interest rate cut.

Will the data justify the need for a bigger cut?

August data will almost certainly show a decline in retail sales, given the sales figures in the auto sector. It's also worth remembering the fairly strong rebound in overall sales in July, resulting in a fairly high base. Today's data would have to show not only a stronger decline in overall sales, but also a decline in underlying sales to ensure that the Fed cuts interest rates by 50 basis points. What are our market expectations ahead of today's reading?

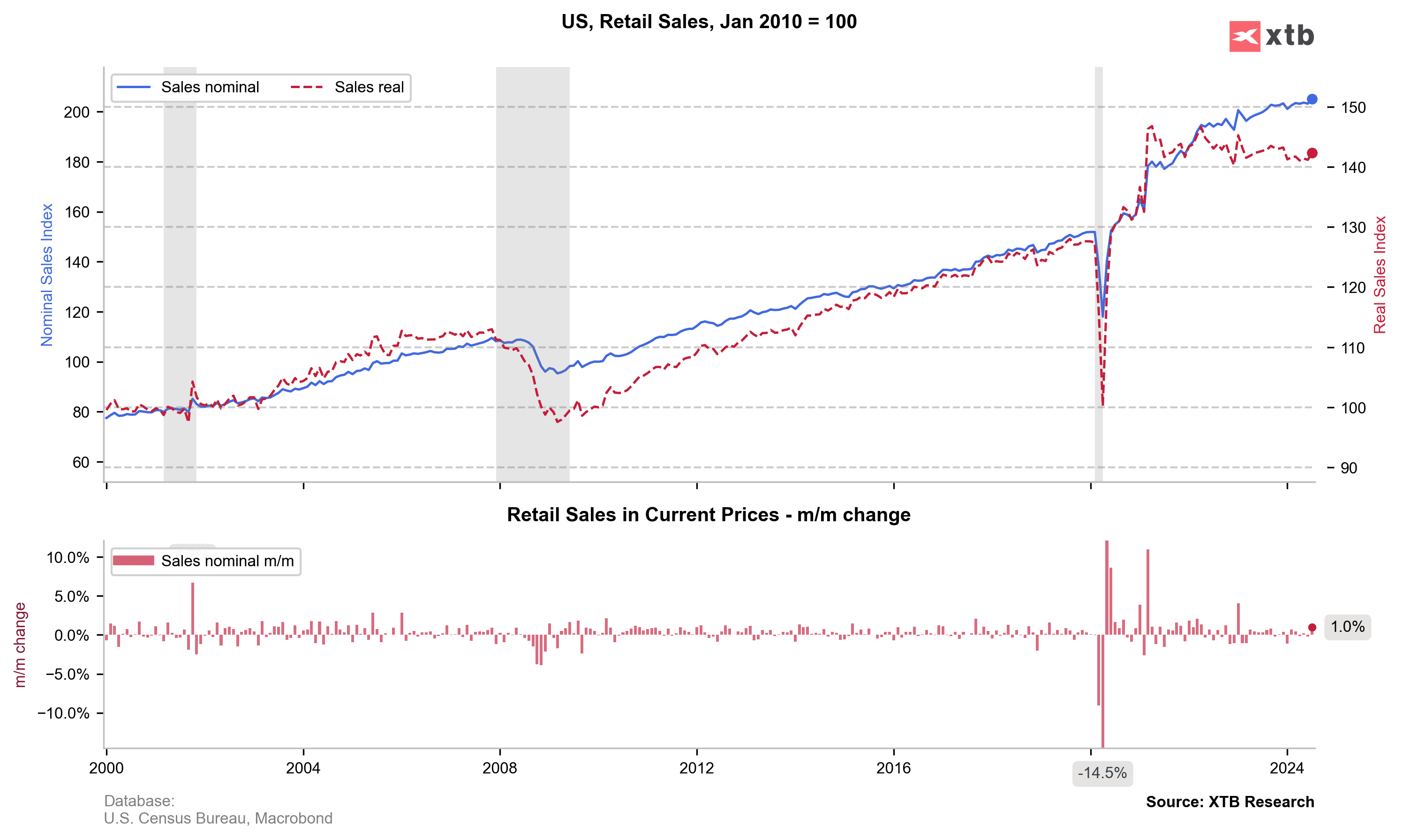

- Retail sales are expected to fall 0.2% m/m compared to July, when sales rose 1.0% m/m. Real sales are expected to fall 0.3% m/m.

- Core sales (excluding car sales) are expected to rise 0.2% m/m, with the previous increase of 0.4% m/m. In real terms, core sales are expected to rise 0.1% m/m.

- Core sales excluding automobiles and fuel are expected to rise 0.3% m/m, with a previous increase of 0.4% m/m.

- The control group (which excludes food, cars, fuels and building materials) is expected to rise 0.3% m/m and 0.1% m/m in real terms.

- Bloomberg Economics points out that retail sales typically rebounded for 3-4 months after the Fed made its first interest rate cut. Lower interest rates on credit cards and consumer loans should lead to a slight recovery in consumption.

Sales nominally rose 1.0% m/m recently. Realistically, however, we had a rebound after several months of stagnation. Due to the high base in July, sales are now expected to decline: nominally and real. Source: Bloomberg Finance LP, XTB

Sales nominally rose 1.0% m/m recently. Realistically, however, we had a rebound after several months of stagnation. Due to the high base in July, sales are now expected to decline: nominally and real. Source: Bloomberg Finance LP, XTB

Most sales categories (except food) are expected to show slower-than-normal sales. Source: Bloomberg Finance LP

Most sales categories (except food) are expected to show slower-than-normal sales. Source: Bloomberg Finance LP

How will the market react?

The market is now pricing in a greater than 70% probability of a 50 basis point interest rate cut by the Fed. The data would have to perform significantly worse than expectations today to push the probability above 80%. A decline in overall sales is rather strongly likely, but a surprise of no change from the previous month would be a sign of strong consumer sentiment, which could have a positive impact on the dollar. Note, however, that changes in the currency market today will be rather limited, looking ahead to tomorrow's very important event.

EURUSD is rising moderately today ahead of the data release. The pair retreated only minimally after the publication of extremely weak data from Germany on analyst and investor sentiment. Stronger data (no change from the previous month) could lead the pair to retreat to the vicinity of the 1.1100 level. On the other hand, if core sales did not rise contrary to expectations, it would be a sign of strong weakness in the US public, which would probably lead to a rise between 1.1160-1.1180.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.