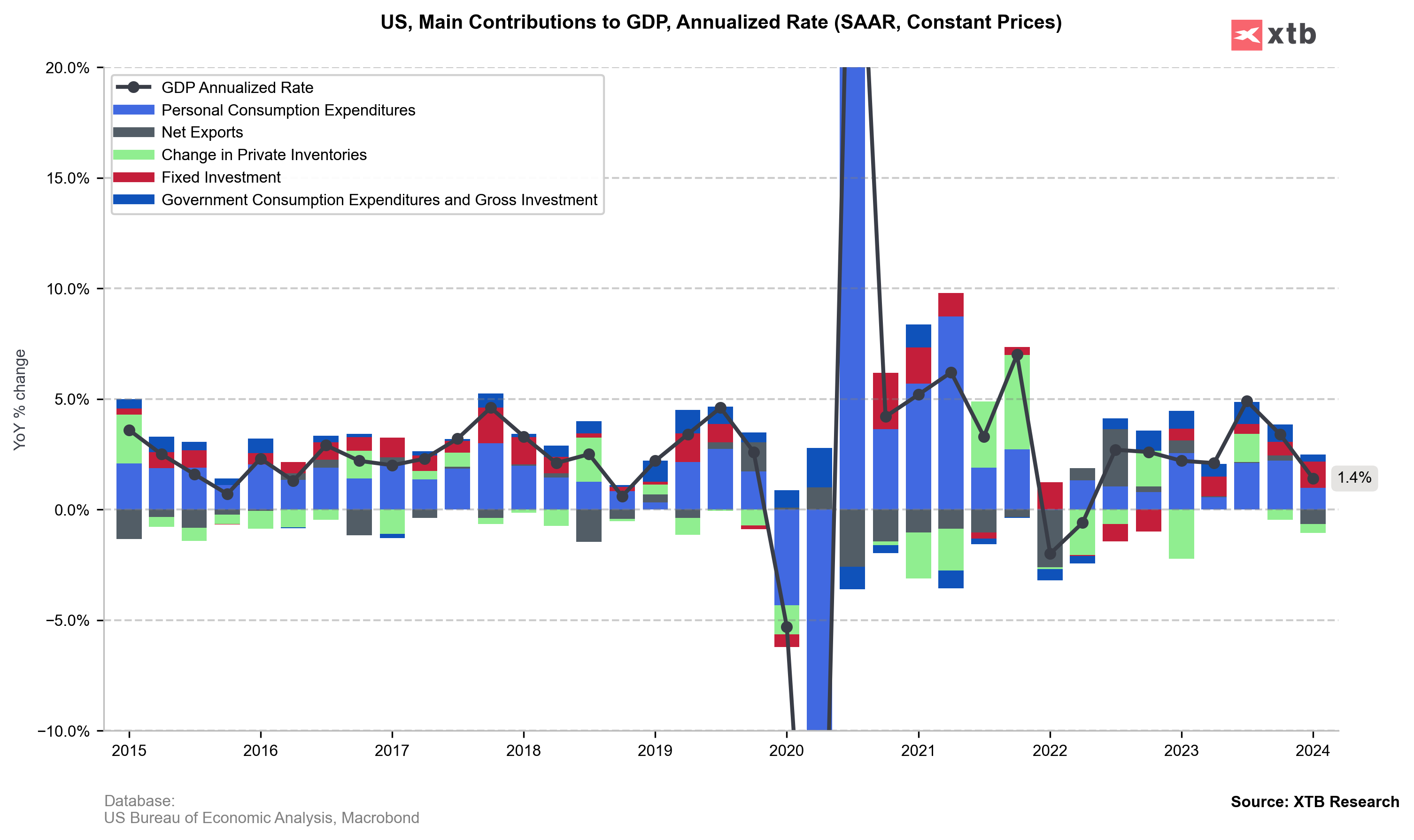

The US GDP report is probably the most important macro reading this week. It is expected that the second quarter was better than the previous one, although the change in Q2 is still expected to be significantly lower than in the last quarter of last year.

According to the Atlanta Fed, economic growth in Q2 is still largely driven by consumer spending and private investments. However, it is worth noting that retail sales have been slightly worse recently, although market expectations indicated even worse data.

It is worth recalling Powell's words from one of the Fed meetings when he mentioned that growth is still largely driven by private consumption. Consumer spending in Q1, on an annualized basis, was only 1.5%, so it will not be difficult to beat this result. What are the market expectations for today's report?

- Annualized GDP is expected to increase by 2.0% compared to the previous growth of 1.4%.

- The GDP deflator is expected to drop to 2.6% from 3.1%.

- Core PCE is expected to rise by 2.7% q/q compared to the previous level of 3.7% q/q.

- Private consumption is expected to increase by 2.0% compared to the previous level of 1.5%.

The market consensus seems to be quite conservative. Bloomberg Intelligence indicates a reading of 2.1%, Bloomberg's Nowcast quantitative model indicates a reading of 2.3%, while the GDPNow model from the Atlanta Fed suggests growth at the level of 2.6%.

Growth in the first quarter was limited by net exports and inventories. It is expected that in Q2, the negative impact will come from net exports, but it will be larger than in Q1. However, in the second half of the year, economic growth may be influenced by a weakening labor market, which could lead to reduced spending. It does not seem that today's report will significantly change expectations for the Fed meeting next week or the anticipated rate cut in September. However, it may affect expectations for further moves this year. Source: Macrobond, XTB

How will the market react?

The consensus remains relatively low, so it will be quite easy to beat it. Stronger growth should positively impact the dollar and limit the current declines in index futures. Market attention will also be focused on the Core PCE price index and the deflator. Significant declines are expected in this regard, which should reinforce the Fed's communication about the need for rate cuts. However, if there is not a substantial drop, it could further strengthen the dollar and potentially resume larger declines in US indices.

EURUSD

EURUSD is rebounding slightly this morning, despite negative data from Germany. Good data from the USA could push the pair back towards the 1.0800 level. However, if the GDP change falls below 2.0% and inflation data drops more than expected, a return to around the 1.0900 level is possible. Source: xStation5

EURUSD is rebounding slightly this morning, despite negative data from Germany. Good data from the USA could push the pair back towards the 1.0800 level. However, if the GDP change falls below 2.0% and inflation data drops more than expected, a return to around the 1.0900 level is possible. Source: xStation5

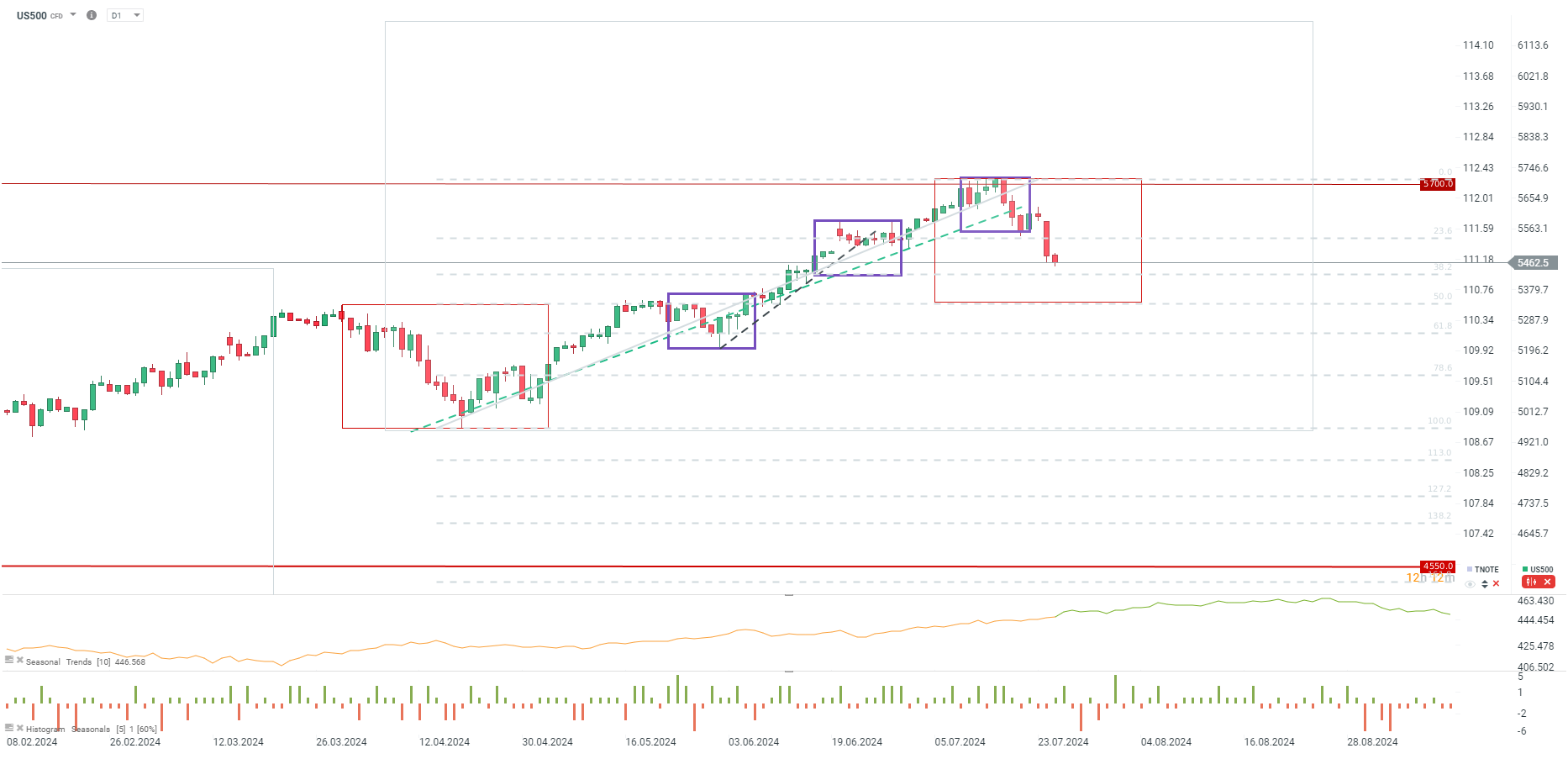

US500

Index futures continue the declines that started last week, although the biggest drops occurred during yesterday's session. US500 is breaking through important support levels. Theoretically, strong GDP and a drop in price indexes should lead to a revival in the index, but strong GDP and a smaller decline in the deflator and Core PCE could reduce expectations for further Fed cuts and deepen the declines. In that case, the key support level will be 5430 during today's session and 5340 in the coming weeks. Source: xStation5

Index futures continue the declines that started last week, although the biggest drops occurred during yesterday's session. US500 is breaking through important support levels. Theoretically, strong GDP and a drop in price indexes should lead to a revival in the index, but strong GDP and a smaller decline in the deflator and Core PCE could reduce expectations for further Fed cuts and deepen the declines. In that case, the key support level will be 5430 during today's session and 5340 in the coming weeks. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.