The latest CPI report from the United States showed deceleration in price growth but it still came above market expectations. Moreover, core CPI inflation continued to accelerate faster-than-expected, what led to an immediate market reaction. It looks like US500 and USDJPY will once again be in the center of attention with USDJPY cross offering the largest carry trade potential among major currency pairs.

While inflation is easing, it continues to surprise to the upside, at least when it comes to headline measure. Data for September showed a smaller impact of energy prices and cars prices on the overall inflation. Data for OCtober is likely to show a positive contribution from energy prices - gasoline price increase again and price of oil and oil derivatives resume declines only in recent days.

What are market expectations?

-

Headline inflation is expected to continue to drop but only from 8.2 to 8.0% YoY. It should be noted that headline US inflation stayed above 8% since March!

-

On a monthly basis, headline CPI is expected to come in at 0.6% MoM, compared to previous 0.5% MoM (reflecting increase in fuel prices)

-

Core inflation is expected to slow from 6.6 to 6.5% YoY

-

On a monthly basis, core CPI is expected to increase 0.5% MoM, compared to a previous increase of 0.6% MoM

Inflation is key measure for Fed

The latest US jobs report supported the outlook for further tightening of Fed's policy. However, the unemployment rate started to increase, in-line with the central bank's projections. This was likely a reason behind strong upward move on stock market indices and weakening of USD in the aftermath of data release. Today, the market will also look for hints on whether Fed's actions are having an effect on lowering inflation. As such, reading that is in-line with expectations or below them may provide a lift for equities, which would welcome more stimulus (or at least hopes for more stimulus) following a mixed earnings season.

On the other hand, if inflation fails to slow, especially core measure, the chance for another 75 bp rate hike in December will increase. This could lead to an upward impulse on USDJPY.

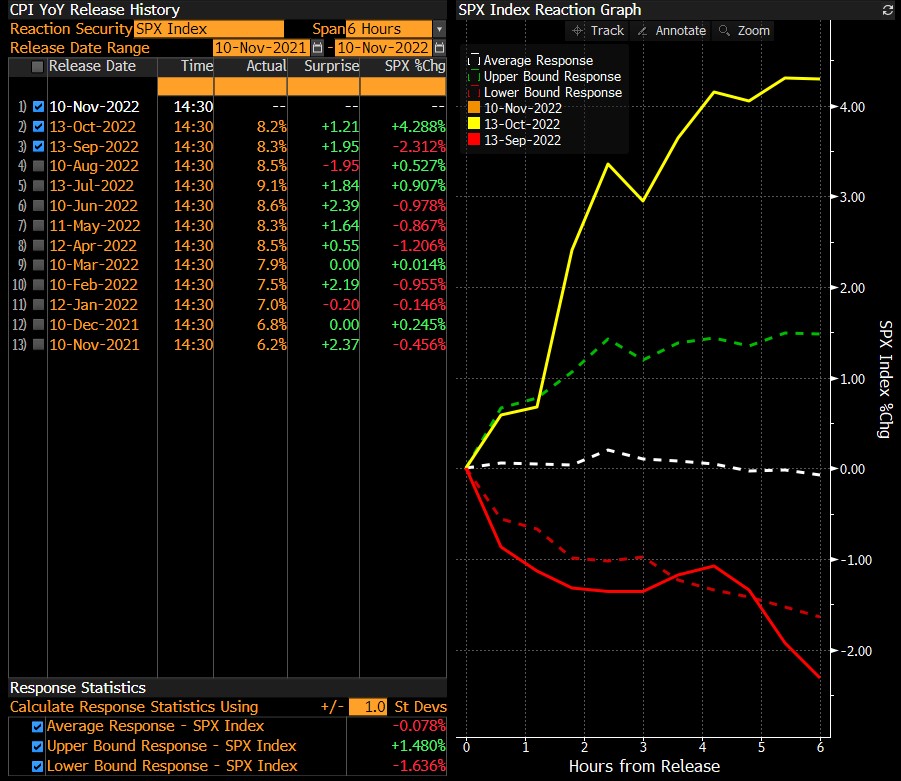

As one can see, S&P 500 saw quite a reaction to previous inflation data, especially the latest two. It should be noted that cash markets open an hour after the release. Immediate reaction will be, however, visible on the futures market (US500). Source: Bloomberg

As one can see, S&P 500 saw quite a reaction to previous inflation data, especially the latest two. It should be noted that cash markets open an hour after the release. Immediate reaction will be, however, visible on the futures market (US500). Source: Bloomberg

US500

US500 briefly dropped to the lowest level since November 2020 following release of inflation data for September. However, the market started to recover later on and bounced over 10%. If today's release comes in-line with Fed expectations and shows that the central bank's actions are having effect, it could mean that a smaller rate hike will be announced at the December meeting. This, in turn, will limit yields rally and give a chance to breath and look towards 4,000 pts area. Source: xStation5

US500 briefly dropped to the lowest level since November 2020 following release of inflation data for September. However, the market started to recover later on and bounced over 10%. If today's release comes in-line with Fed expectations and shows that the central bank's actions are having effect, it could mean that a smaller rate hike will be announced at the December meeting. This, in turn, will limit yields rally and give a chance to breath and look towards 4,000 pts area. Source: xStation5

USDJPY

USDJPY is trading in an important technical spot. If US inflation fails to slow in-line with expectations, the pair may launch upward impulse and look towards the 150.00 area. On the other hand, a break below 145.00 area on the back of lower-than-expected inflation print would provide the pair with a chance to launch a large downward correction with 140.00 area being a potential target. Source: xStation5

USDJPY is trading in an important technical spot. If US inflation fails to slow in-line with expectations, the pair may launch upward impulse and look towards the 150.00 area. On the other hand, a break below 145.00 area on the back of lower-than-expected inflation print would provide the pair with a chance to launch a large downward correction with 140.00 area being a potential target. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.