FOMC rate decision turned out to be in-line with market expectations - US central bank delivered a 50 bp rate hike to 4.25-4.50% range. Decision to hike rates by 50 bp was unanimous, signaling that none of Fed members saw a need for an even smaller 25 bp rate hike after yesterday's CPI print. This can be seen as somewhat hawkish.

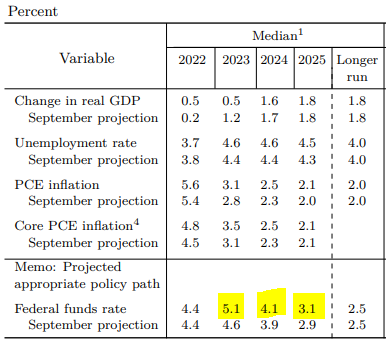

Details of the statement as well as revisions of economic projections are hawkish as well - median forecast for end-2023 level of rates moved from 4.6% in September projections to 5.1% in December projection. Median for end-2024 moved from 3.9% in September to 4.1% now. Also headline and core PCE inflation forecasts were revised higher for 2023 and 2024, signaling that Fed may need to keep tight policy for longer. There was also a massive revision to 2023 GDP forecasts - down from 1.2% growth to just 0.5% growth.

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

FOMC members see rates peaking above 5% in 2023. A major downward revision to the 2023 GDP forecast is also noteworthy. Source: Federal Reserve

Reaction of the market also shows that decision was seen as hawkish - US dollar gained and equities dropped. S&P 500 (US500) erased daily gains and is now trading 0.6% lower on the day. The index tested psychological 4,000 pts area but bulls did not manage to break below, at least not yet. EURUSD dropped to a 1.0630, erasing most of today's gains. Gold pulled back and tested $1,800 per ounce area but no break below occurred. Upcoming Powell's presser (start - 7:30 pm GMT) is likely to be a source of additional volatility on the markets.

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

US500 plunged following the FOMC decision, erasing daily gains and testing 4,000 pts area. While bulls managed to defend the area for now, volatility on the markets is elevated and is expected to remain so throughout Powell's presser. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.