The widely watched US CPI inflation for October has just been released and unexpectedly showed a massive deceleration in price growth in October. The annual inflation rate in the US slowed for a fourth month to 7.7% in October, the lowest since January, and below analysts estimates of 8%. It compares with 8.2% in September. Compared to the previous month, the CPI rose 0.4%, the same as in September and below expectations of a higher 0.6% rate. On a yearly basis CPI index advanced 6.3% YoY in October, after rising at a 40-year high of 6.6% in September and compared with market expectations of 6.5% gain.

The energy index increased 17.6%, below 19.8% in September, due to gasoline (17.5% vs 18.2%) and electricity (14.1% vs 15.5%). A slowdown was also seen in the cost of food (10.9% vs 11.2%) and used cars and trucks (2% vs 7.2%). On the other hand, prices for shelter (6.9% vs 6.6%) and fuel oil (68.5% vs 58.1%) increased faster.

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing. Still, figures continue to point to strong inflationary pressures and a broad price increase across the economy, mainly in the services sector while prices of goods have benefited from some improvements in supply chains.

Today's report eases concerns that high inflation will last longer than expected and may make policymakers rethink the need for aggressive tightening going forward. Following today’s data release we can observe weakening of the US dollar, while major US indices futures rose sharply.

Source: Bloomberg

Source: Bloomberg

US500 jumped above key resistance at 3800 pts following the CPI data release. Source: xStation5

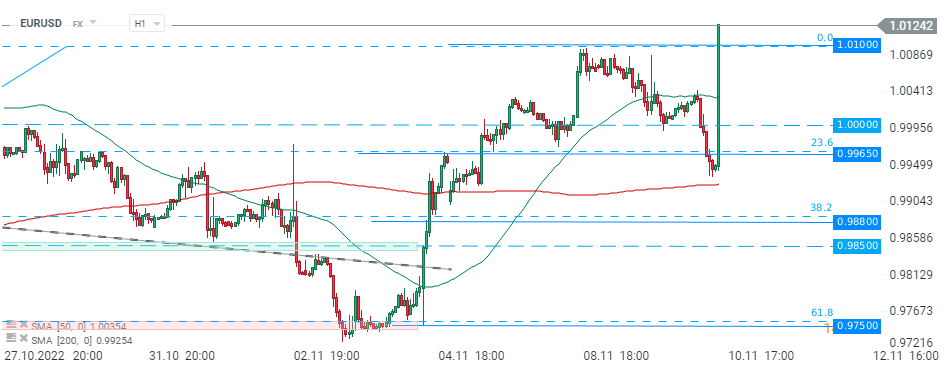

EURUSD broke above parity level. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.