US500 and US100 are paring back yesterday's losses, EURUSD is bouncing back, and gold is trading near yesterday's open, following Powell's comments that are giving more confidence about possible rate cuts this year.

Powell indicates that the chances of any potential hikes are very low and still the Fed expects that the normalization of policy is coming. Of course, the Fed does not see progress in reaching the inflation target now, but inflation remains below 3%, causing the Fed's focus to shift more towards the labor market objective. The Fed believes that the level of interest rates is sufficiently restrictive and that their high level has caused a clear slowdown in economic growth and demand.

The market is already pricing in the chances of a rate cut in September, although earlier during the start of the speech the market was pricing in November or no cut this year at all. Powell indicates that the Fed is still confident that it will be able to bring inflation down to target, but it will be a more bumpy road than previously expected.

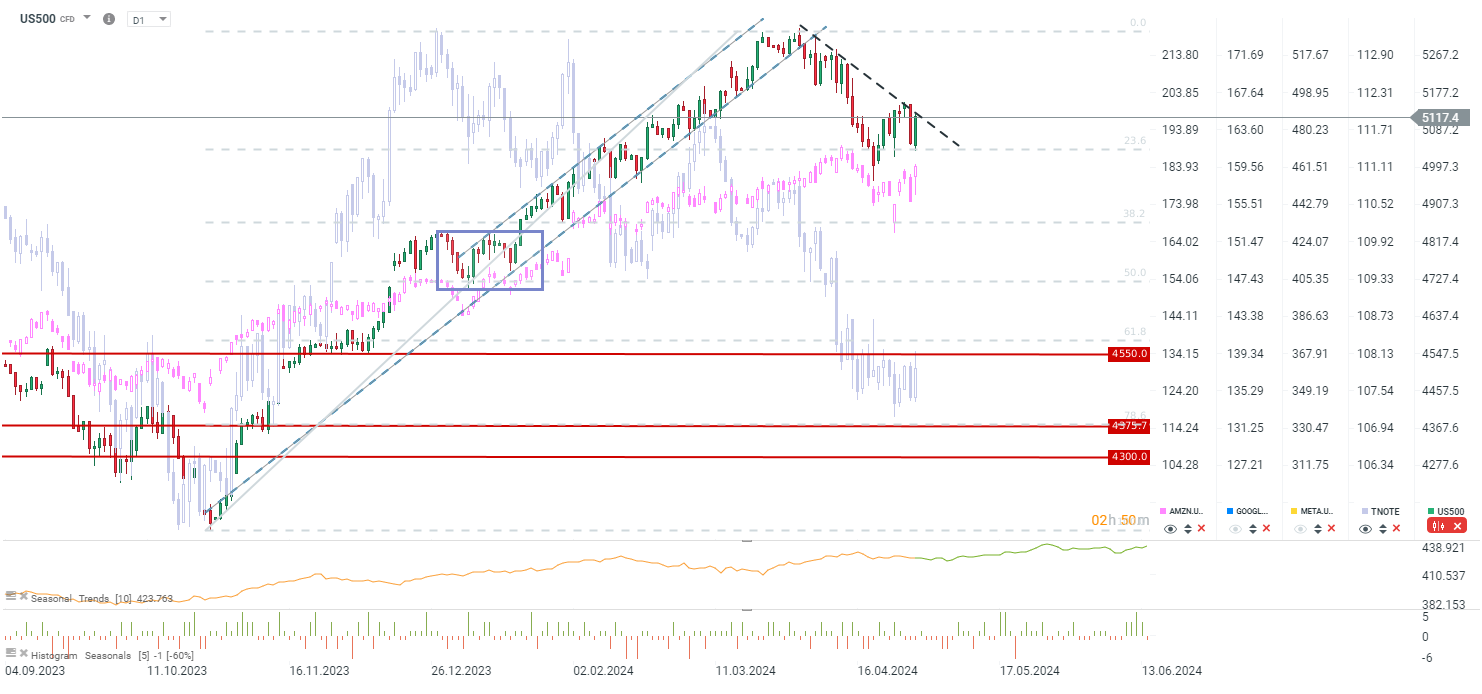

US500 is testing downward trend line and it is close to resistance close to local high at 5150. The next possible target for bulls is located at 5200 points. On the other hand the key local support is at 5040. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.