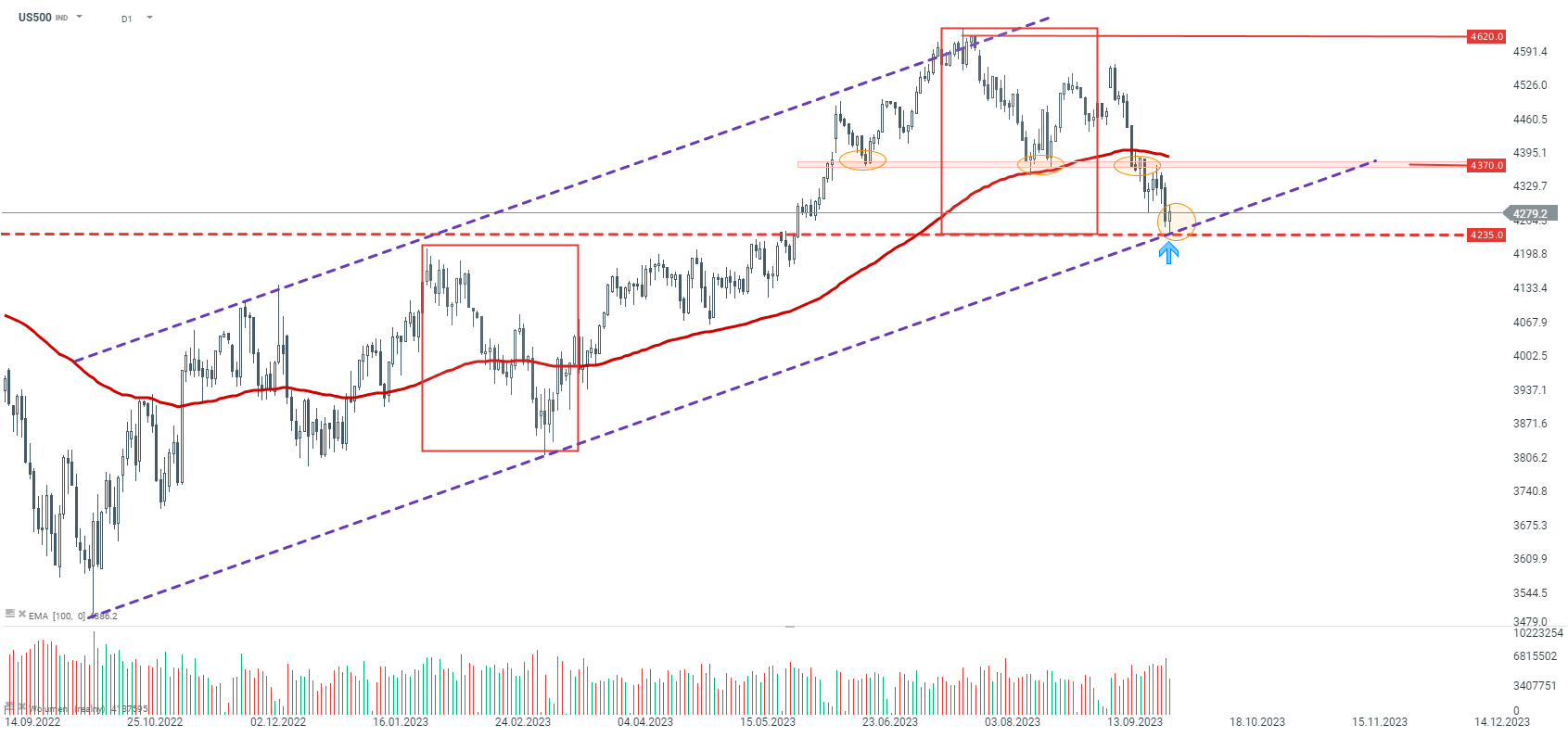

The beginning of the new month brought a deepening decline in the stock market. However, it should be noted that the contract based on the S&P500 (US500) has reached a key medium-term support level where buyers have appeared. We are talking about the level of 4235 points, which results not only from the upper limit of the upward channel but also from the broad geometry of 1:1. If this support is successfully defended, according to the Overbalance methodology, it will be possible to generate another upward wave. Otherwise, a price breakdown below this point may trigger a stronger downward move and even lead to a change in trend to a bearish one.

Source: xStation 5

Looking at a shorter time frame - H1, the index remains in a downward trend. The key short-term resistance is currently the tested zone around 4280 points. If it were to be surpassed, the next significant level would be 4330 points, which corresponds to the previous upward correction. If that too was surpassed, the next resistance falls around 4365 points, resulting from earlier local peaks and measuring 38.2% of the last downward wave. It seems that only its negation could lead to a change in sentiment to bullish.

Source: xStation 5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.