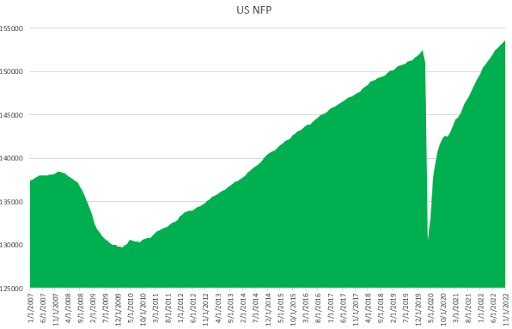

Highly anticipated NFP report was released at 1:30 pm GMT and showed the US economy unexpectedly added 263 k jobs in November, compared to 261k increase in October and well above market expectations of 200k. It is the lowest job gain since April last year, as the labour market is normalizing after the pandemic shock. Still, it continues to signal a healthy and tight market, above the pre-pandemic average of 150K-200K jobs created per month. Notable job gains occurred in leisure and hospitality, health care, and government while employment declined in retail trade and in transportation and warehousing. Monthly job growth has averaged 392K thus far in 2022, compared with 562K per month in 2021. Notable job gains occurred in leisure and hospitality (88K), including a gain of 62K in food services and drinking places; health care (45K); and government (42K), mostly in local government (32K). In contrast, employment declined in retail trade (-30K), namely general merchandise stores (-32K), electronics and appliance stores (-4K), and furniture stores (-3K); and in transportation and warehousing (-15K). Monthly job growth has averaged 392K thus far in 2022, compared with 562K per month in 2021.

The jobless rate remained unchanged at 3.7%, in line withmarket estimates. The jobless rate has been in a narrow range of 3.5% to 3.7% since March, suggesting that the tight labor market will likely continue to contribute to inflationary pressure in the world's largest economy for some time to come. The number of unemployed persons rose by 48 thousand to 6.01 million in November, while the number of employed decreased by 138 thousand to 158.5 million.

Closely watched wage growth rose to 5.10% YoY, after an upwardly revised 4.9% increase in October and above analysts' expectations of a 4.6% YoY.

Source: XTB, Macrobond

Source: XTB, Macrobond

Today's reading signals that the labour market is still tight and Fed will most likely remain committed to bringing down inflation with more rate hikes, however a lot will depend from US inflation reading which will be published on December 13.

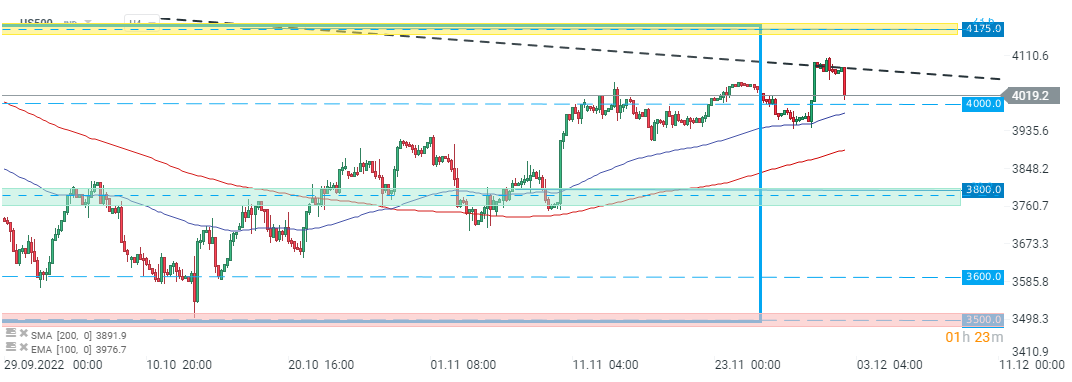

US500 failed ot break above long-term downward trendline and is heading towards major support at 4000 pts. Source: xStation5

US500 failed ot break above long-term downward trendline and is heading towards major support at 4000 pts. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.