NFP report for October is a key release of the day! Report will be released at 12:30 pm BST today and is expected to show a weaker jobs growth than in September. Data for September was very strong and while expectations for October are lower, they are still pointing to a decent growth in US employment. However, some worrying signs can be spotted in other US labor market reports.

ADP report released on Wednesday pointed to a lower-than-expected jobs increase of 113k (exp. 150k) while the employment subindex in the US services ISM report unexpectedly dropped below the 50 points threshold in October, signaling that employment in the sector is contracting. However, it should be noted that NFP reports have been constantly defying market concerns over the past months and kept beating expectations. Having said that, it cannot be ruled out that we will once again see solid jobs data today even as other labor market measures are flashing warning signs.

What market expects from the NFP report for October?

- Non-farm payrolls. Expected: 180k. Previous: 336k

- Private payrolls. Expected: 150k. Previous: 263k

- Unemployment rate. Expected: 3.8%. Previous: 3.8%

- Wage growth (monthly). Expected: 0.3% MoM. Previous: 0.2% MoM

- Wage growth (annual). Expected: 4.0% YoY. Previous: 4.2% YoY

Other US labor market data for October

- ADP report: 113k vs 150k expected (89k previously)

- Challenger report on lay-offs: 36.84k vs 47.46k previously

- Services ISM employment subindex: 46.8 vs 50.6 expected (51.2 previously)

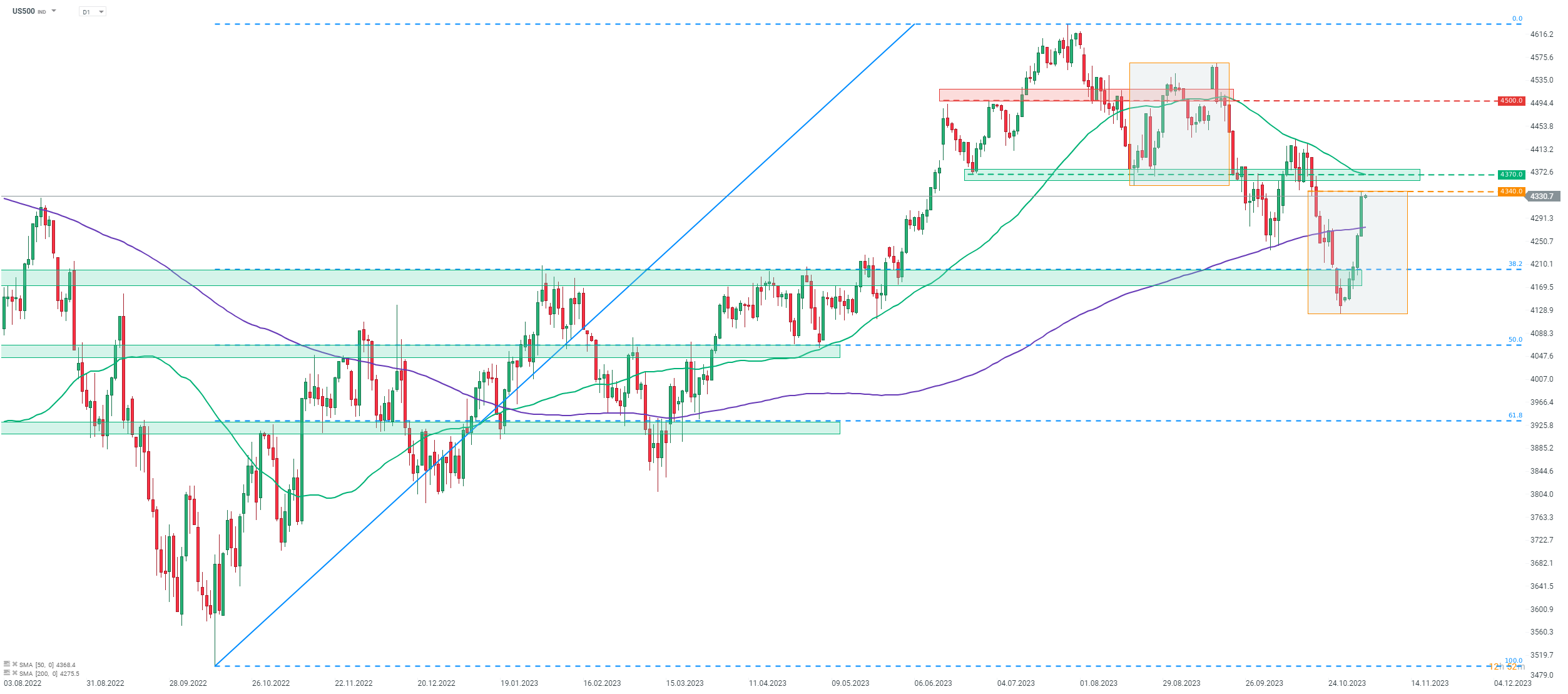

S&P 500 futures (US500) are trading in a strong upward move this week. The index is trading around 5% higher week-to-date and at the highest level in two weeks. Recovery rally has encountered the first major obstacle - the upper limit of the Overbalance structure in the 4,340 pts area. A break above would hint at trend reversing from bearish to bullish. However, the attempt at breaking above this area made yesterday failed to result in a breakout and whether the index 'makes it or breaks it' will likely depend on today's NFP data.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.