Federal Reserve will release FOMC minutes from its July meeting today at 7:00 pm BST. However, market attention is primarily focused on today's revision of labor market data and the upcoming Jackson Hole speech from Fed Chair Powell, scheduled for Friday.. What can we expect from today's minutes release, and what impact might it have on the market?

Fed Maintained Its Stance in July

The Fed's statement during the July meeting did not bring many changes, although the emphasis on the dual mandate from the central bank was interpreted as a sign that it is time to normalize policy in response to the clear cooling in the labor market. Powell was decidedly more dovish during the press conference, so there is a possibility that the minutes from the discussions of the monetary committee members will indicate the potential start of rate cuts. Of course, since then, we've heard new statements from bankers suggesting the necessity of beginning the normalization of monetary policy. Besides the discussion on interest rates, it’s worth noting whether FOMC members discussed pausing balance sheet normalization.

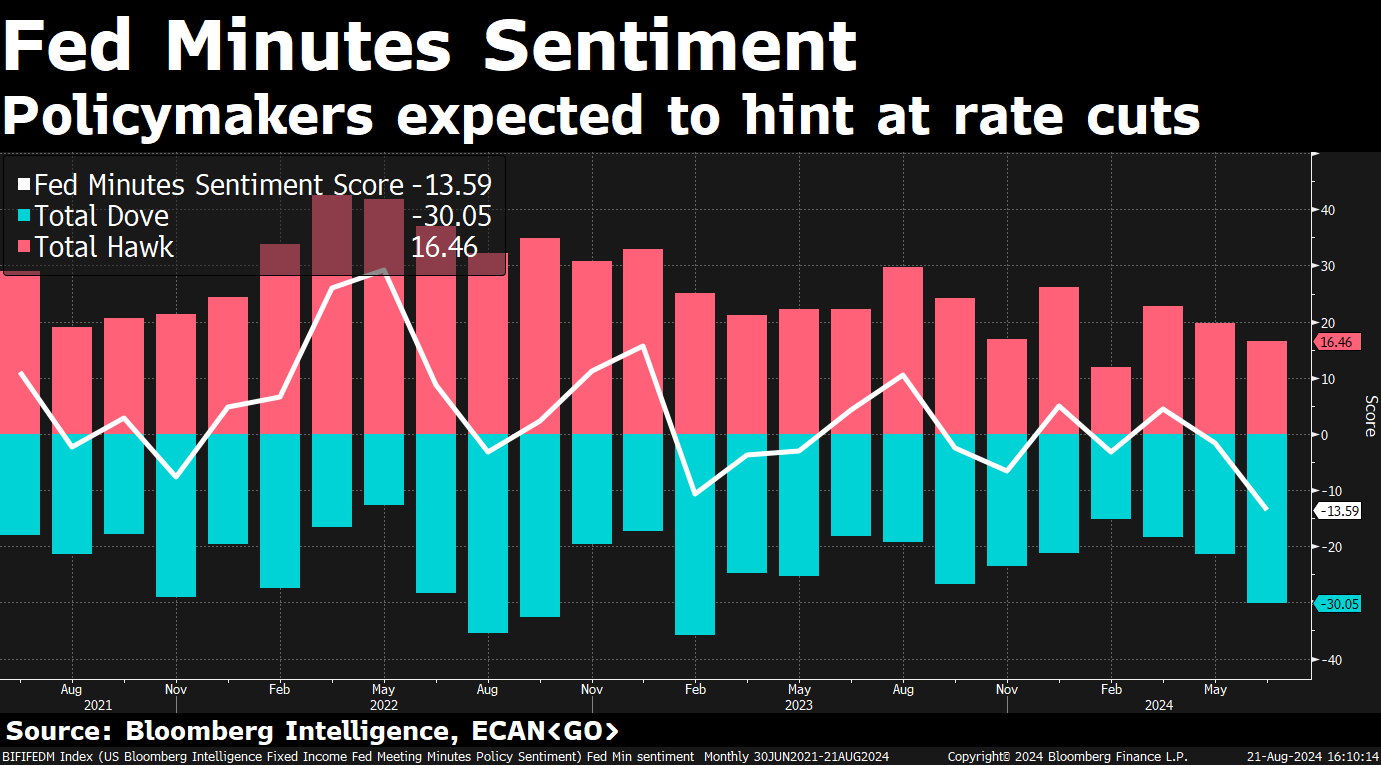

According to Bloomberg, the tone of the minutes should be more dovish. On the other hand, a large amount of other market information may limit the reaction to today's event. Source: Bloomberg Finance LP, XTB

It is worth mentioning that the BLS ultimately revised U.S. employment by 818,000, which is roughly in the middle of the expected range of 600,000 to 1 million. The labor market is, of course, significantly weaker than the monthly NFP data suggested, but this should not lead to major actions from the Fed. Nonetheless, Powell may acknowledge on Friday that the labor market is weaker than the Fed has perceived in recent months, which could be seen as a dovish signal.

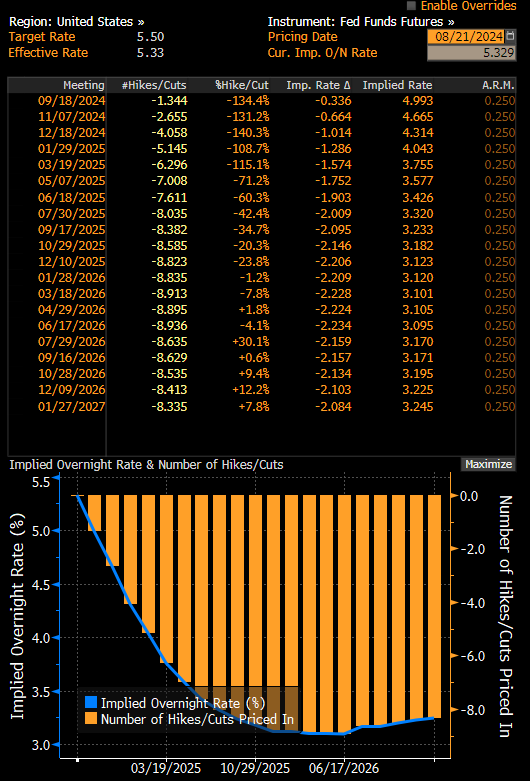

The market still estimates that the probability of a 50 bp rate hike in September is slightly above 30%, while a 25 bp cut is fully priced in. By the end of the year, a 100 basis points of rate cuts are anticipated. Source: Bloomberg Finance LP

How Might the Market React?

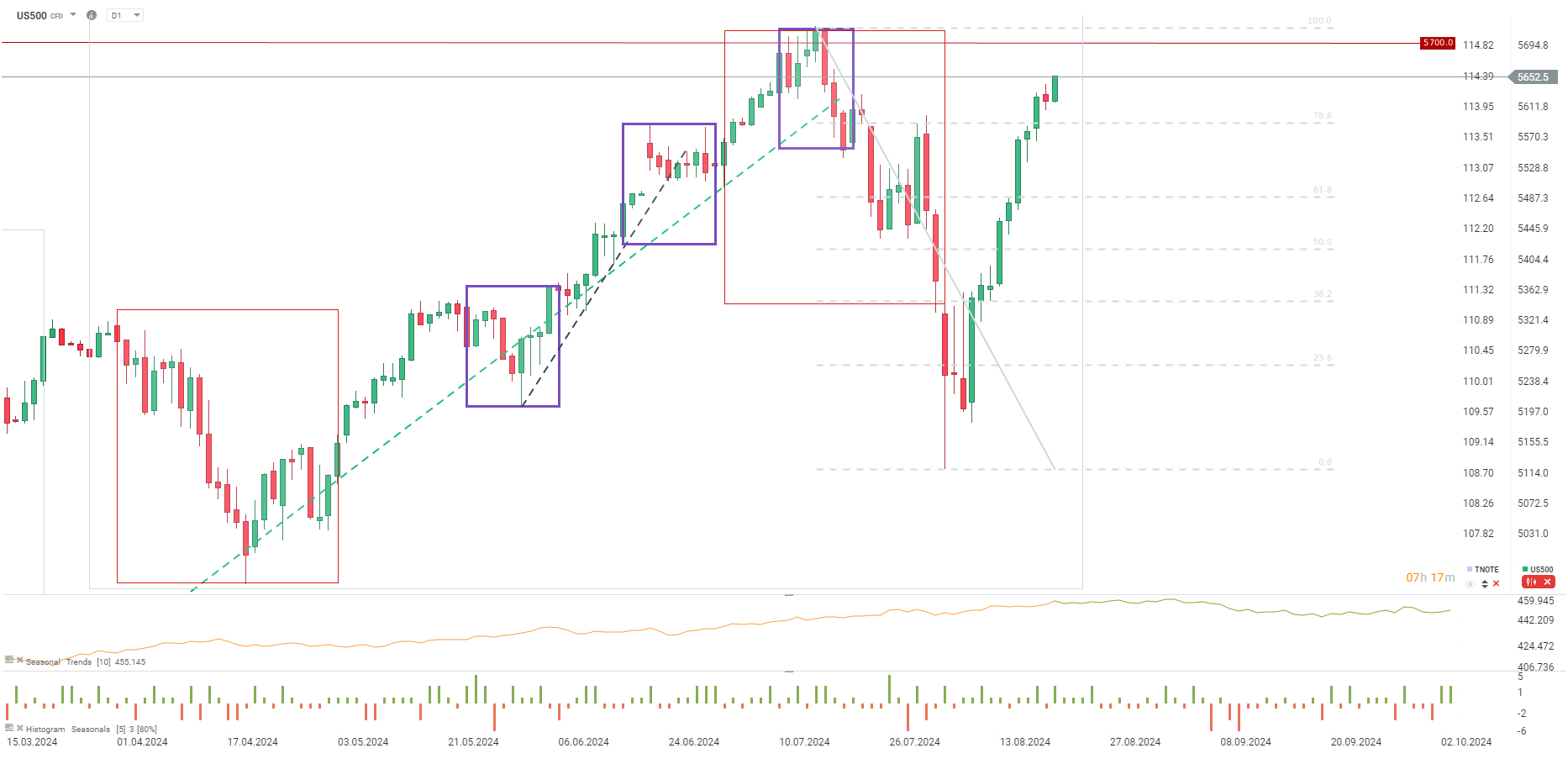

The US500 is rising today in anticipation of the minutes and after the BLS revision of employment data. Dovish minutes, a significant revision in employment numbers, and expectations of Powell hinting at rate cuts this Friday are all working in favor of Wall Street. Since August 8, the US500 has already risen by 8%, and it is just 1.5% below historic highs. The nearest resistance can be found at 5,700 points, while the support is just above the 78.6% retracement of the last downward wave, around 5,600 points.

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.