Today at 7:00 PM BST publication of FOMC minutes, report may shed light on FED monetary policy

The minutes from the Federal Open Market Committee (FOMC) meeting held on May 2-3 will be released today at 7:00 PM BST. Report from Minutes is highly anticipated by markets as it could provide further insights into the FED Monetary Policy 📈

During the May meeting, the Fed raised interest rates by 25 basis points, bringing the target rate range to 5%-5.25%. The minutes will reveal how seriously the officials considered keeping rates steady and whether any members of the FOMC favored a pause.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appLeading up to the meeting, some more dovish members of the committee expressed concerns about further tightening, citing the potential impact of recent bank failures on financial conditions. However, last week Fed Chairman Jerome Powell dismissed these concerns and emphasized the stability of the banking system. Powell also hinted at a possible pause but clarified that the central bank would closely monitor the data and act accordingly.

Market expectations are leaning towards a pause in the next FOMC meeting scheduled for June 13-14. Currently, the target rate probabilities for the next hike is at 30.5%. Although still lower than 50%, market expectations have been shifting towards a rate hike over the past couple of weeks.

Source: CME Fedwatch tool

Given the uncertainty surrounding the economy and future policy direction, the Fed is more constrained in providing forward guidance. Probably the most important data that will influence the Fed's decision at the next meeting are yet to come, such as labor market data at the end of the month and CPI data just before the meeting.

The return of the US500 Index after the last rate hike by the FED shows that not every end of a tightening cycle results in immediate declines in the stock market. This was only the case during recessions in 1974, 1980, and 2000. In other situations, excluding the pre-COVID tightening, the stock market experienced a crash even one year after the end of the tightening cycle. The impact on the market depends on the market outlook and the degree of aggressiveness in interest rate hikes leading up to it.

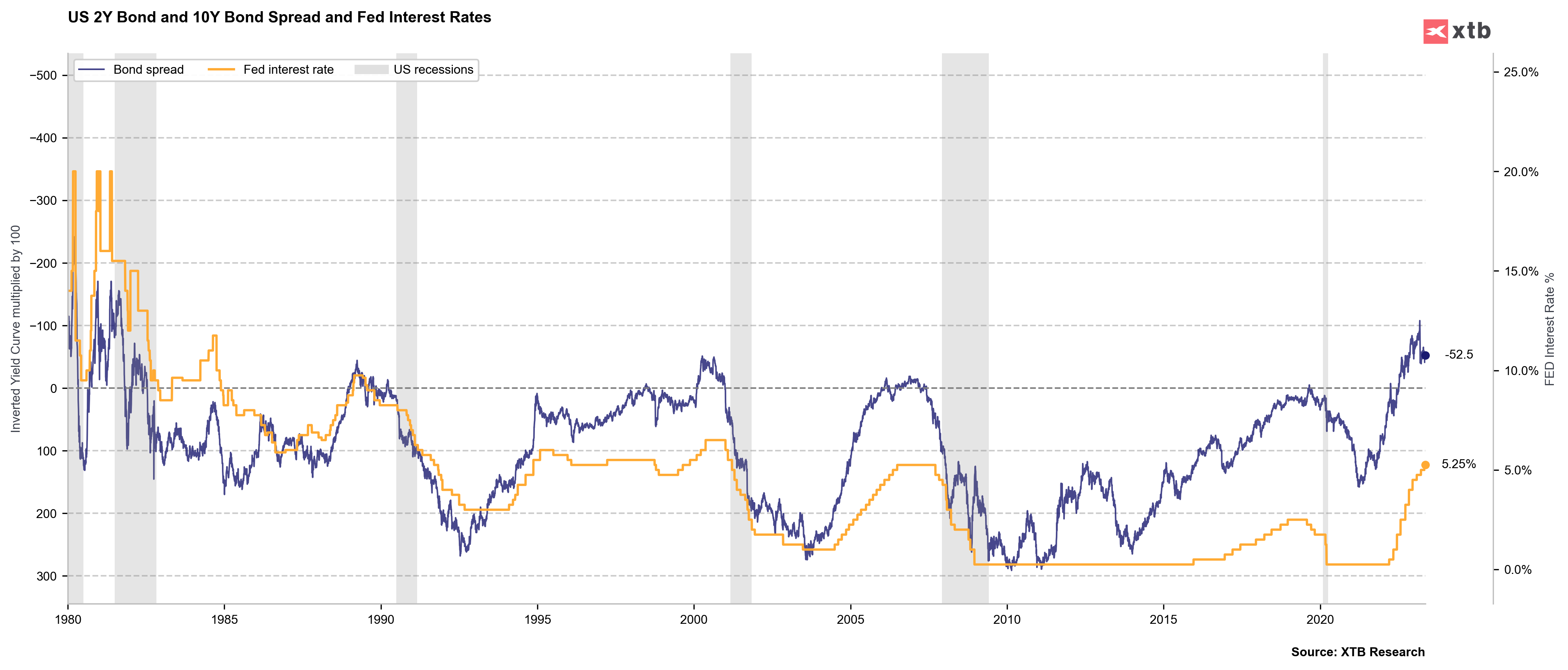

The return of the US500 Index after the last rate hike by the FED shows that not every end of a tightening cycle results in immediate declines in the stock market. This was only the case during recessions in 1974, 1980, and 2000. In other situations, excluding the pre-COVID tightening, the stock market experienced a crash even one year after the end of the tightening cycle. The impact on the market depends on the market outlook and the degree of aggressiveness in interest rate hikes leading up to it. The US Inverted Yield Curve*100 suggests that the tightening cycle might come to an end. The yield curve is moving away from negative territory, historically indicating that a recession may follow once the yield returns to positive levels.

The US Inverted Yield Curve*100 suggests that the tightening cycle might come to an end. The yield curve is moving away from negative territory, historically indicating that a recession may follow once the yield returns to positive levels.

Wall Street moves back ahead of the FOMC Minutes

US500 index, currently trading at 4,146 points - down by 0.3% today. The price action has proved a bearish trajectory, as it was rejected from the upper line of the descending channel, indicated by the blue line. This rejection serves as a confirmation of the bear market, suggesting a bearish trend in the market. The price is now heading towards the lower support level at 4,100 points, indicating further downside potential. It is important to note that the recent sharp moves in the market have been influenced by both the upcoming release of the FOMC Minutes and the ongoing impasse over the debt-ceiling issue.

In the past few weeks, the bullish momentum in the US500 index has certainly faded. The market sentiment has shifted towards a more cautious and bearish stance, reflecting the changing expectations and uncertainties surrounding various factors. The rejection from the upper line of the bear market channel further strengthens the bearish outlook.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.