The Fed's minutes have been interpreted as another hint towards a rate hike, although there seems to be significant disagreement among bankers. Nonetheless, since yesterday, we've been witnessing increased selling in American contracts, although today, as time passes, there is a desire to recover losses. However, this might change after the start of the Wall Street session at 3:30 PM.

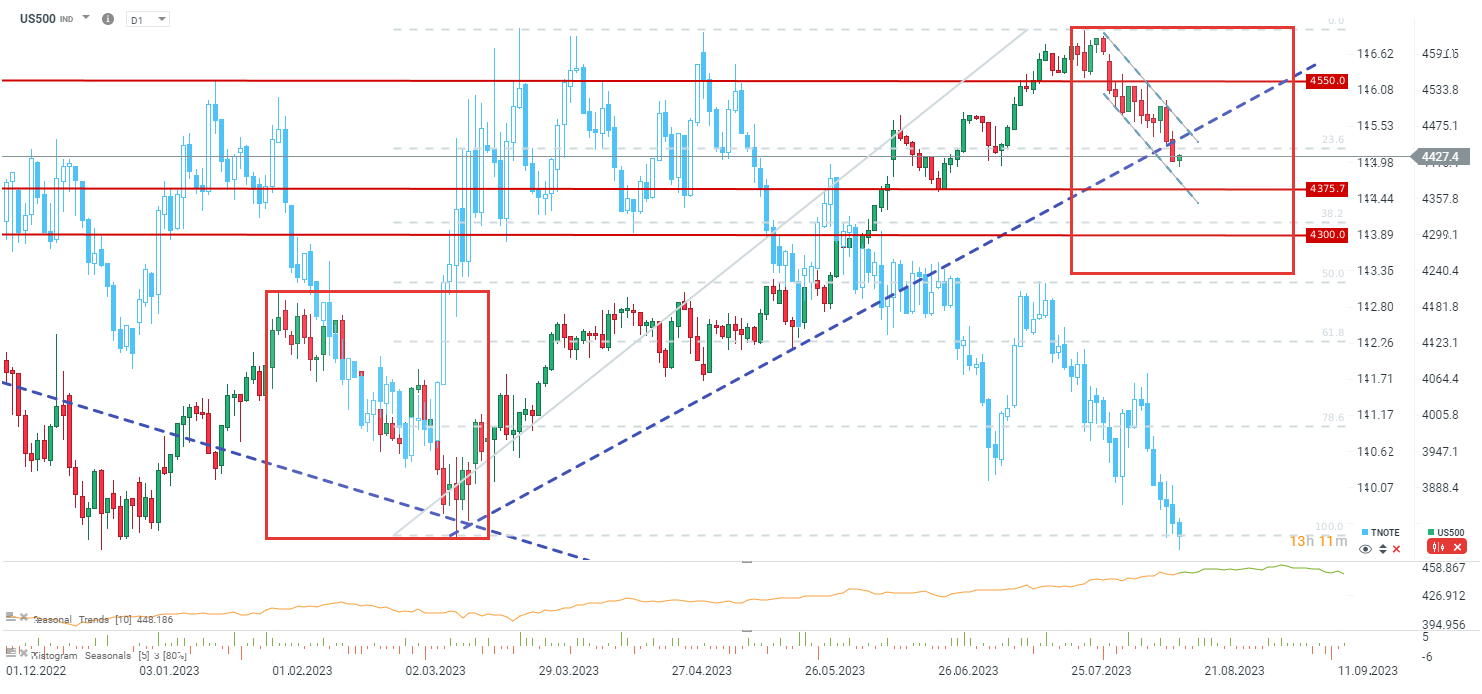

The US500 index has broken the upward trendline and is currently below the 23.6% retracement of the last upward impulse that began in March. At the same time, it's noticeable that within the current corrective decline in the upward trend, there is a sustained downward sequence within a descending trend channel. Today's revival is occurring as we approach the lows from July. Bullish problems could arise around the 23.6% retracement, potentially leading to a continuation of the downward trend towards the vicinity of 4375 points. The scope of the entire major correction in the long-term trend suggests a possible descent even to around 4200 points.

Source: xStation5

The US100 index has long surpassed the downward trendline and is currently below the 15,000 point level. Only after rising above 15,080 points could we consider a larger revival attempt. Nevertheless, the US100 is defending the range of the largest correction in the trend, where there is also the 23.6% retracement of the entire upward trend that began in autumn 2022.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.