- U.S. indexes lose slightly; US30 records deepest retreat, near 0.5%

- Medical robot and software provider Intuitive Surgical (ISRG.US) gains 7.5% on wave of Q2 year-end results; shares at historic highs

- Semiconductors under pressure again; Intel loses nearly -5%, TSMC near -3%

- Tesla records more than 2% sell-off; Comerica (CMA.US) and WR Berkley (WRB.US) stocks depreciate sharply

- Crowdstrike (CRWD.US) loses -10% as a result of global IT failure

The U.S. stock market is trading another weaker session today, although the scale of supply is relatively small at this point. Despite on that, US indices are on a way to weakest week since April. Netflix's results caused virtually no volatility on the currency; the stock is trading 0.7% lower. Semiconductors are still under pressure, with TSMC shares losing 1.8% despite yesterday's excellent Q2 results and higher forecasts, suggesting a potential at least temporary reversal of momentum from the chipmakers; Intel is also losing more than 3%. U.S. 10-year Treasury bond yields return above 4.2%

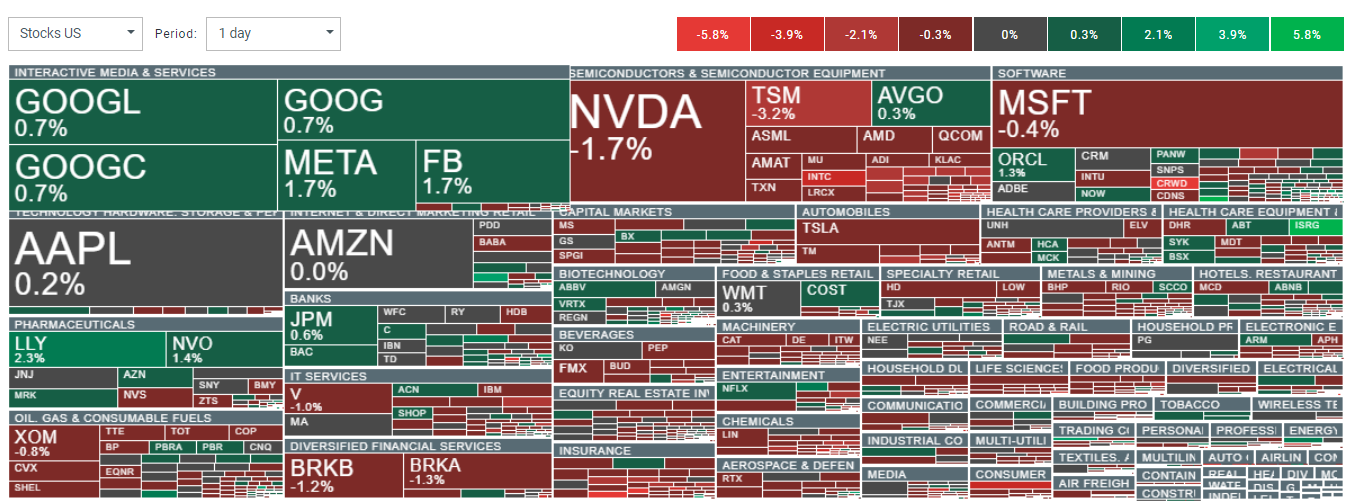

Most U.S. companies are down today; oil and gas, insurance, and semiconductors and software sectors are performing poorly. Shares of obesity drug makers Eli Lilly (LLY.US) and Novo Nordisk (NVO.US) are gaining. Source: xStation5

US30 chart

Looking at the DJIA (US30) contracts, we see record selling since the last roll-off in June; the index has retreated below the key momentum averages SMA50 and SMA100 on the hourly interval and is struggling to hold support at the 38.2 Fibonacci retracement of the upward wave from early July, at 40700 points.

Source: xStation5

News from companies

- Hawaiian Electric Industries gains more than 30% as the company was among the companies that tentatively agreed to softer-than-expected contract terms to resolve litigation related to last year's Maui fire

- Comerica shares are losing more than 10% after the lender said it expects its full-year net interest income to fall 14% from a year earlier. The company also said it has received preliminary information that its banking unit will no longer act as agent for its Direct Express program, which had been bringing it additional profits

- Halliburton's shares lost nearly 7%, with the oilfield services company's second-quarter revenue falling short of expectations. According to J.P Morgan, the results were disappointingly weak, even more so given the company's dominance in the oil & gas services market

Robotics and AI - great results for Intuitive Surgical

Intuitive Surgical's (ISRG.US) results surprised Wall Street, with the company beating profit and revenue forecasts. Earnings per share came in at $1.78 against $1.54 forecasts; revenues also rose to $2.01 billion against expectations of $1.97 billion (a 14% year-on-year increase). Da Vinci robot operations grew 17% year over year, and the installed base of robots grew an impressive 14% year over year, suggesting a significant increase in business scale to more than 9200 globally installed robots. A further 341 robots were installed in Q2 alone, with 70 models, including the latest da Vinci 5. Operating profit rose to $754 million in the latest quarter from $618 million in Q2 2023. The company expects to maintain the growth rate.

Chart of Intuitive Surgical (ISRG.US, D1)

The stock is trading in a multi-year upward channel, but a correction scenario is not out of the question; key support will be found around $390 per share, where we see recent price reactions and the 23.6 Fibonacci retracement. Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.