The Russell 2000 mid-cap U.S. index (US2000) is trading down more than 1.2% sell-off today, largely compounded by declines in the regional bank sector, which came under pressure from a broader down session among U.S. banks, where JP. Morgan (JPM.US) is losing nearly 7%, following a warning about expected lower net interest income (NII) in 2025.

- Biotechnology companies are posting the strongest gains in the index, for some of which Fed rate cuts could prove salutary and lower the risk of 'capital burnout' and business suspensions.

- Additional volatility in the market is fueled by the presidential debate between Trump and Kamala Harris due to take place Tuesday night.

- Sentiment in the smaller-cap market is further weighed down by weakness in the larger indices, which, despite recent sell-offs, are not showing strength;contracts on the DJIA (US30) are losing 0.8% today.

- Fitch Ratings analysts expect the Fed's upcoming monetary easing cycle to be relatively mild and slow, by 'historical standards'

- Federal Reserve member, Michelle Bowman commented banking sector and informed that 'concerns for stress tests include volatility & transparency.'

- Shares of New York Community Bancorp (NYCB.US) are losing almost 7% today; investors expect that higher recession probability may be a trigger for sell-off in banks, vulnerable to commercial real estates risk

- US NFIB Business Optimism Index today came in 91.2 vs. 93.6 exp. after strong upbeat to 93.7 in July. The reading suggests that the rebound in July may be only temporary, while overall US small business sentiments are still under pressure despite awaited Fed policy easing.

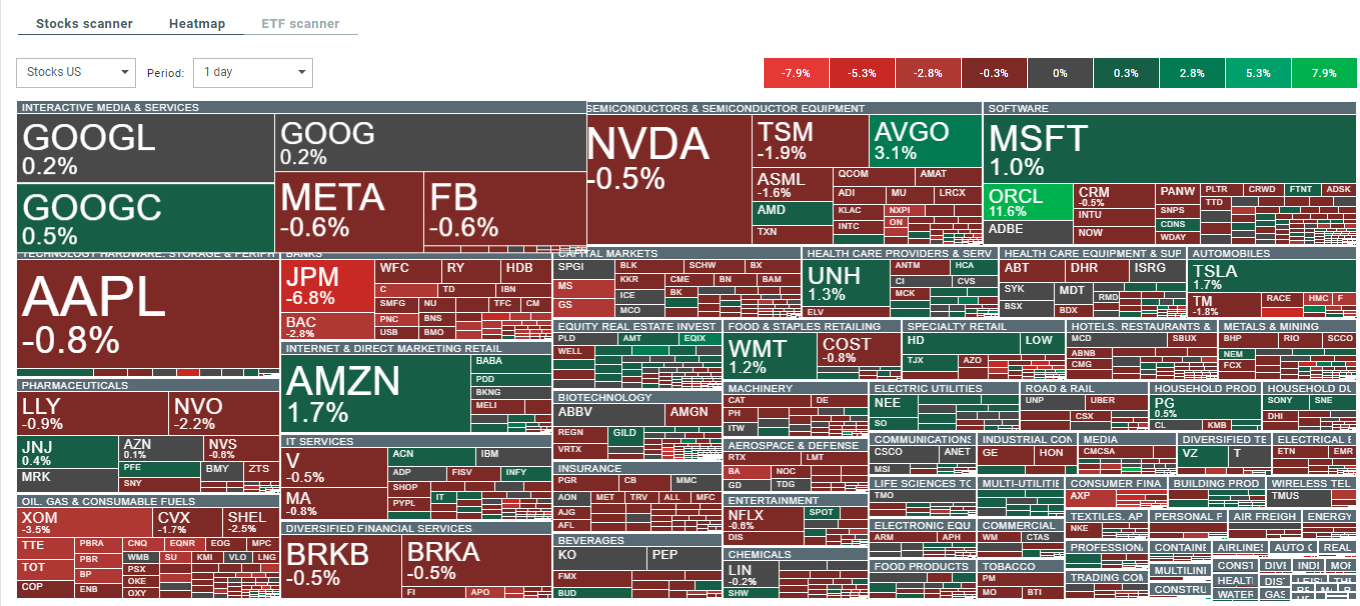

The sell-off in oil, financials, with moderate declines in the technology sector weighs on investor sentiment in the broader US market today. Source: xStation5

The sell-off in oil, financials, with moderate declines in the technology sector weighs on investor sentiment in the broader US market today. Source: xStation5

US2000 is today testing the 200-session exponential moving average (EMA200), which is the conventional boundary between a downtrend and an uptrend. Previous three attempts to go below it resulted in a decisive rebound.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.