Market reaction to the Fed's decision has been muted. The dollar initially ticked lower, while stock indices gained when the Fed announced it would begin tapering quantitative tightening (QT) on June 1. However, the market was expecting that it would happen soon, as the Fed had indicated at its previous meeting (minutes) that it would likely begin tapering soon. The pace of balance sheet reduction through Treasuries will be $25 billion, which is less than the $30 billion that had been expected (the pace is still $60 billion per month until June 1).

However, the key takeaway for the market is the statement that the Fed sees no progress on inflation and that it is not appropriate to consider rate cuts until the data justifies it. This news is negative for the stock market. In addition, today's ISM manufacturing data was also negative for the stock market as it showed worse prospect for the economy and higher price pressure.

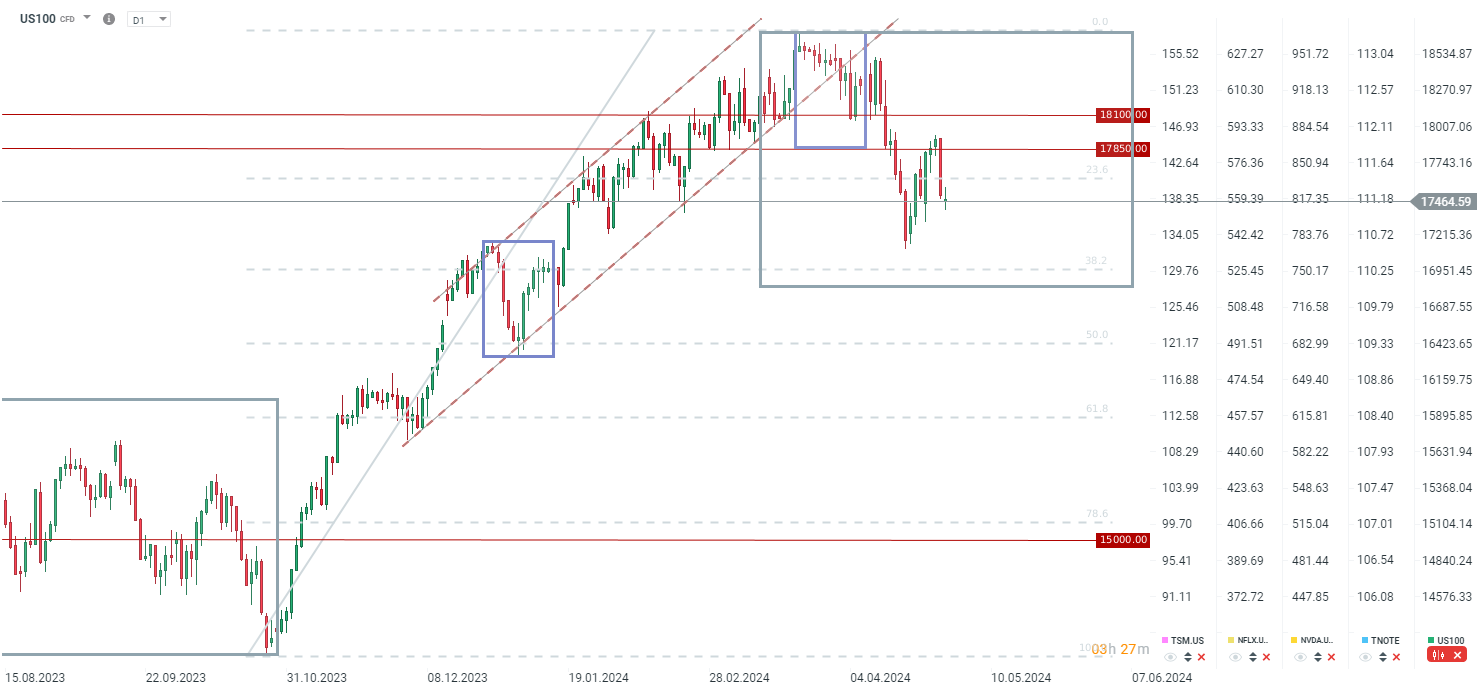

US100 jumped to around 17,500 points quickly, after the decision was released, but it fell back to pre-decision levels a few minutes later, remaining under pressure after yesterday's sharp declines. It is worth noting that chip-related stocks, such as SMCI (-14%) and AMD (-7%), which reported earnings yesterday, are down sharply.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.