Futures on Nasdaq 100 (US100) 3 hours after stock market opening after yesterday holiday pause defended 20,000 points level, where we can see firs strong support zone after the rollover.

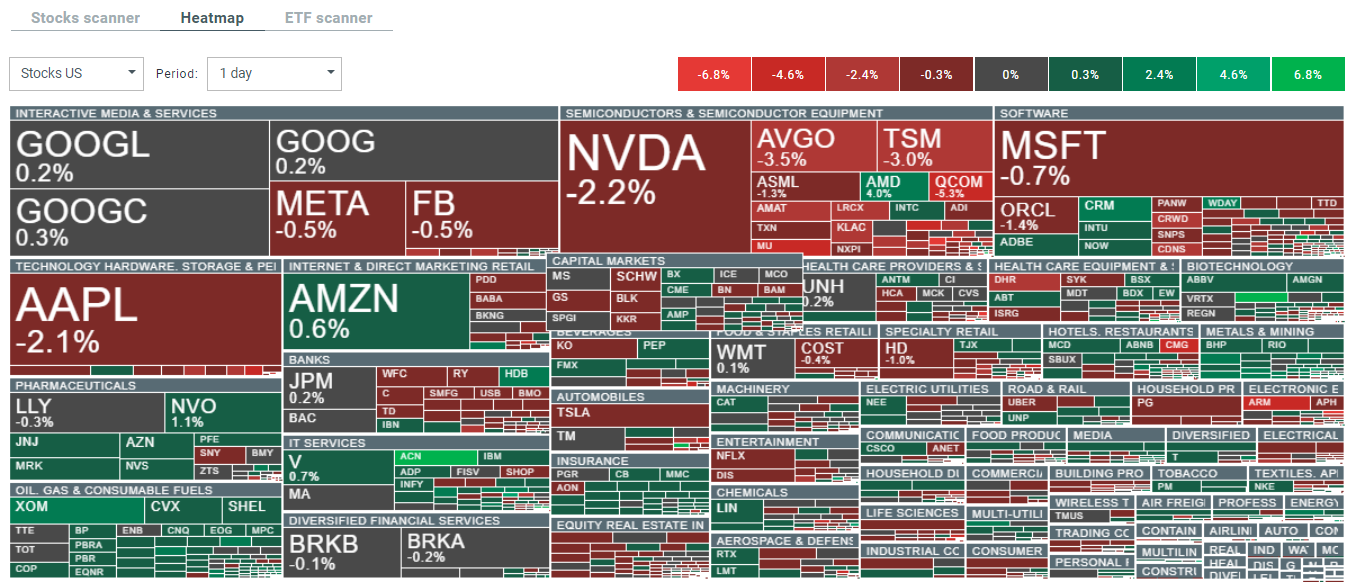

- We can see higher selling activity among AI (especially semiconductor stocks) with Nvidia (NVDA.US) erasing early almost 3% gains; now the stock of the biggest company in the world is losing more than 2%.

- Despite planning wafer price hike and higher recommendations from analysts (Bernstein) citing AI catalysts, we can see also TSMC (TSM.US) stock dropping by almost 3%. The possible reason of the decline is possibly profit realization, after US stock market reached record high.

- President Putin signing the agreement with North Korea said that 'Russia is thinking about possible changes to its nuclear doctrine' as NATO is moving to Asia, creating a security threat to the country. We can see higher selling, trading volume today on US100 contract.

US100 (M1)

Source: xStation5

Source: xStation5

What Bernstein sees for TSCM?

- Bernstein lifted price targets for TSMC’s to NT$1,080, from NT$900 (to $200 from $150 before, for US ADR-s). Now, analysts are expecting TSMC to surpass its 2024 guidance, driven by high-end phone demand and advanced technology wafers. The company's data center AI revenue is on the rise however, an unexpected boost has come from AI's influence on smartphone upgrades.

- Bernstein says that 3nm and 5nm production in company runs with full capacity and Q3 2024 revenue will beat guidance with revenues rising 25% YoY in 2024 and EPS rising 28% on yearly basis (and 26% increase in 2026, due to chipn-on-wafer-on-substrate (CoWoS) technology adoption and Intel's Lunar Lake as well as the price hikes for advanced AI chips.

- Bernstein suggested that TSMC with forward price-to-earnings (P/E) ratio of 20 times still trades with 25% discount to average forward P/E of companies from SOX semiconductors index, which is now a new 'record high' premium for TSMC 'peers' from the index - despite rapid growth in TSMC business, and earnings growth.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.