NFP report for September scheduled for release at 1:30 pm BST today is a key macro report of the week and its importance only grew after US labor market data released earlier this week turned out to be inconclusive. Release will be watched closely as failure to show a jobs market cooling in-line with Fed projections could trigger another spike in Treasury yields. Let's take a quick look at what market expects from the report and how key markets look like before the release.

What does the market expect?

- Non-farm payrolls. Expected: 170k. Previous: 187k

- Private payrolls. Expected: 160k. Previous: 179k

- Unemployment rate. Expected: 3.7%. Previous: 3.8%

- Wage growth. Expected: 4.3% YoY. Previous: 4.3% YoY

ADP came in weak, other reports signaled labor market strength

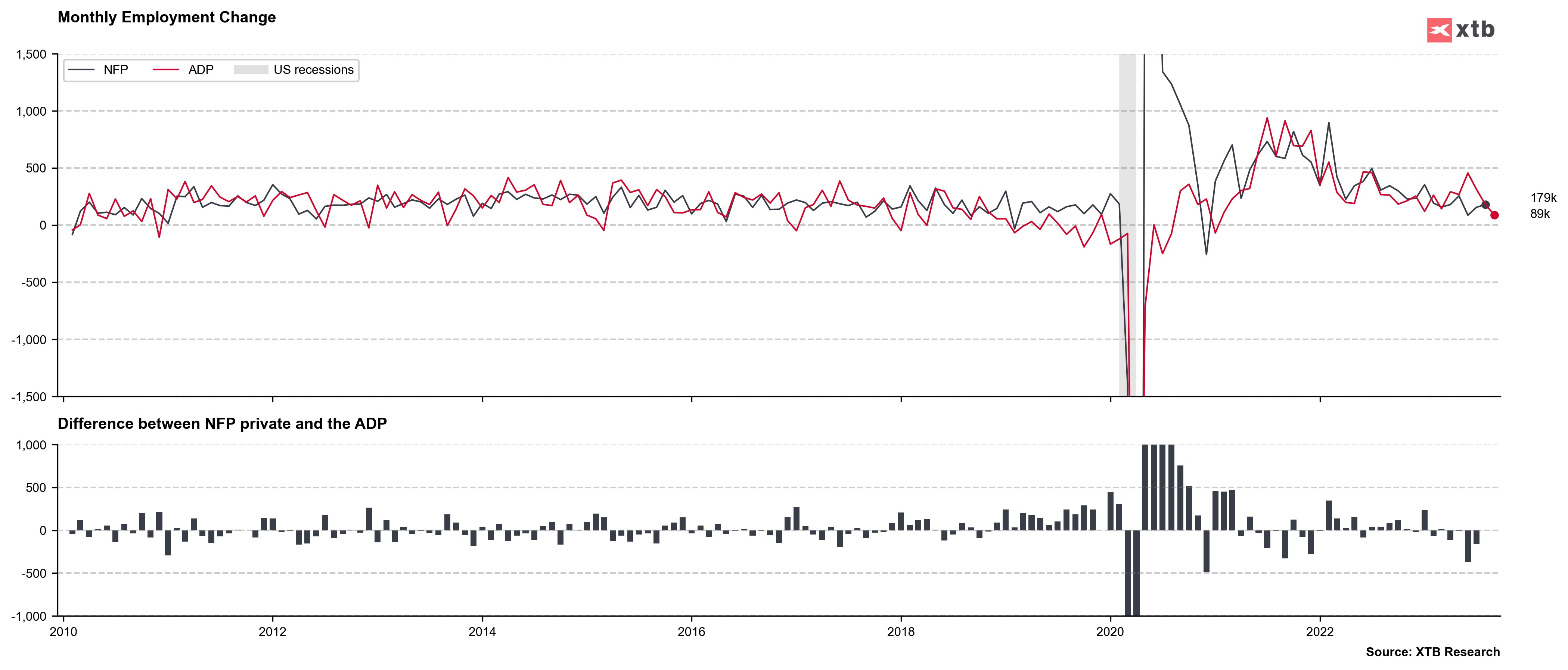

Investors were offered a number of reports from the US labor market this week. ADP report for September released on Wednesday turned out to be much worse than expected, showing a jobs gain of just 89k while the market expected a gain of 155k. However, Challenger report pointed to a much smaller lay-offs in September (47.46k) than it did for August (75.15k), and initial jobless claims data has once again come in below expectations (207k vs 210k expected). NFP report will therefore be a key and should it print a solid reading, signaling that the US labor market is not cooling as Fed expected, it could be a trigger for more hawkish pricing in the markets with potential resumption of a strong upward move on yields and USD.

ADP report for September hinted at a weakish jobs gain of just 89k. Source: Bloomberg Finance LP, XTB Research

ADP report for September hinted at a weakish jobs gain of just 89k. Source: Bloomberg Finance LP, XTB Research

Biden's speech hints at good reading?

A point to note is that US President Joe Biden is scheduled to deliver a speech on jobs report at 4:30 pm BST today and this speech was announced on Thursday afternoon. Why is this important? Jobs data was provided to the White House on Thursday afternoon and the fact that Biden's speech was announced after that time could be a strong hint that the NFP report for September will be solid. Of course, it does not necessarily mean that the report will be superb but it is a fact that Biden tends to speak on jobs after a good report is released.

A look at the markets

US100

Nasdaq-100 futures (US100) has managed to recover a bulk of loss from the beginning of the week but continue to trade below the 15,000 pts mark. A look at the chart at D1 interval shows that the index has managed to defend the lower limit of the Overbalance structure at 14,650 pts and therefore prevent technical setup from becoming more bearish. As long as the index stays above the 14,650 pts zone the uptrend is still in play, at least in theory.

Source: xStation5

Source: xStation5

EURUSD

Strong pick-up in US Treasury yields has provided support for the US dollar and pushed EURUSD down to a 10-month low. As the situation on the bond market calmed a bit, an attempt to recover some losses and climb back above the 1.0550 resistance zone can be observed on the pair. However, even a break above this zone would not be confirmation of bullish trend reversal as a break above the upper limit of the Overbalance structure at 1.0630 would be needed.

Source: xStation5

Source: xStation5

GOLD

Gold as well as other precious metals have been trading under pressure recently as bond yields kept climbing. Taking a look at the GOLD chart at the D1 interval, we can see that the price has plunged from the upper limit of the bearish channel to the lower limit. While declines have been halted, no recovery move has been launched yet. Strong NFP report would likely trigger another pick-up in yields and it could mean more pain for GOLD bulls with potential for a decisive breakout below the range of the channel.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.