Summary:

-

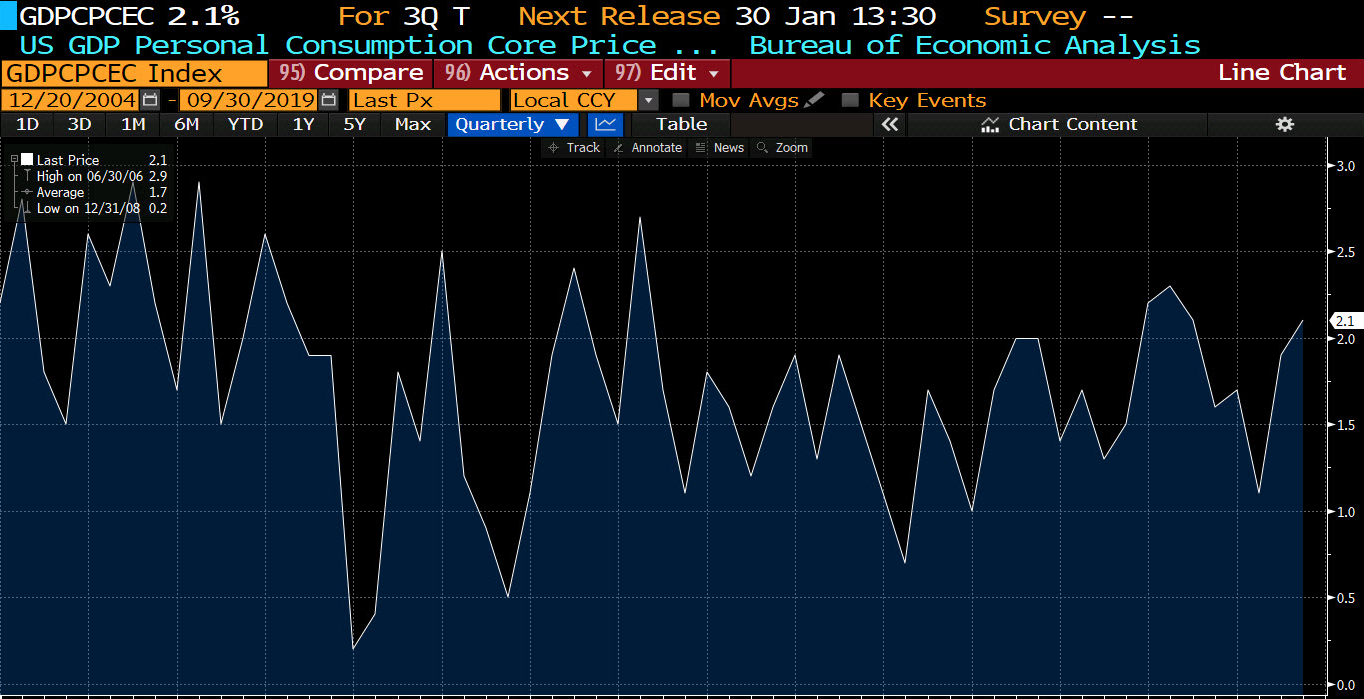

Final Q3 US GDP 2.1%; Core PCE also 2.1%

-

US500 moves up to new ATH

-

CAD falls back as retail sales miss

The final US session of the week has a couple data releases of note with the first coming out as expected with a growth reading in line with forecasts. For the 3rd quarter an annualised GDP final print of 2.1% was as expected and continues to point at steady if not spectacular growth in the world’s largest economy. At the same time the Fed’s preferred inflation gauge showed an increase of 2.1%, with the core PCE Q/Q also matching forecasts.

The Core PCE rose in Q3 to come in near its highest level in several years and also above the Fed’s 2% threshold. Source: Bloomberg

US stocks are on track for another good week with the markets continuing to push higher and the US500 has made a new record peak in recent trade ahead of the cash session. There’s still the University of Michigan reading to come and traders should also be aware that today is quad witching where several significant futures and options contracts expire which can lead to increased volatility.

US stocks have extended their run higher and there is still no signs of any bearish reversals. Those who follow the RSI may note some possible bearish divergence but unless there’s a reversal in price then the market remains in its current mode of a melt up. Source: xStation

In the FX space there was a sharp move lower in the Canadian dollar following the release of some softer than expected consumer spending figures. For October retail sales came in at -1.2% vs +0.5% expected, the worst monthly performance since November 2018. The prior reading was -0.1%. The weakness was also seen in the core reading with ex autos printing -0.5% vs +0.2% expected and +0.2% prior.

USDCAD surged over 40 pips in the immediate reaction to the soft data, although the rally has since been pared somewhat. Source: xStation

Wall Street extends gains; US100 rebounds over 1% 📈

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.