Summary:

-

S&P500 just over 0.5% from all-time high

-

P&G to gain after outlook raised

-

CAD falls back as retail sales miss

October has traditionally been one of the more worrisome months for US stock markets with several well known large swoons giving investors the jitters whenever the month rolls around. However, the current month has been pretty solid on the whole and as we move into the final trading days US benchmarks are well placed to have another stab at moving up their previous peaks into uncharted territory.

The US500 is back above the 3010 level and within striking distance of its all time high at 3029.5 set back in July. Source: xStation

One stock to watch on the open this afternoon is Procter and Gamble after the firm reported a solid set of results and also raised their financial forecasts going forward. Adjusted earnings per share came in at $1.37 vs a consensus of $1.24 while revenue also topped forecasts hitting $17.8B vs $17.42B expected. One of the main factors behind this outperformance was strong demand for beauty and healthcare products. Shares are called to begin strongly as a result, with pre-market trade pointing to a gain of around 4%.

You’d be hard pressed to find a cleaner uptrend for a stock in the past 18 months than that seen in Procter & Gamble. The 100 day SMA has done a fairly good job of defining it and after the recent dip back to this the market could be set to rally once more. 125.30 a level to keep an eye on above. Source: xStation

The only real release of note this afternoon from North America comes in the form of Canadian retail sales, with the latest figures showing a little bit of softness in consumer spending. In M/M terms the headline retail sales data for August came in at -0.1% vs +0.4% expected, although this can be viewed more favourably than it first appears due to the prior being revised higher to +0.6% from +0.4% prior. There was a similar story with the core as a print of -0.2% was below the 0.0% consensus forecast but the prior was revised up to 0.0% from -0.1% originally. Also of note for CAD traders is the outcome of the recent elections, with PM Trudeau set to remain in place, albeit with a minority government.

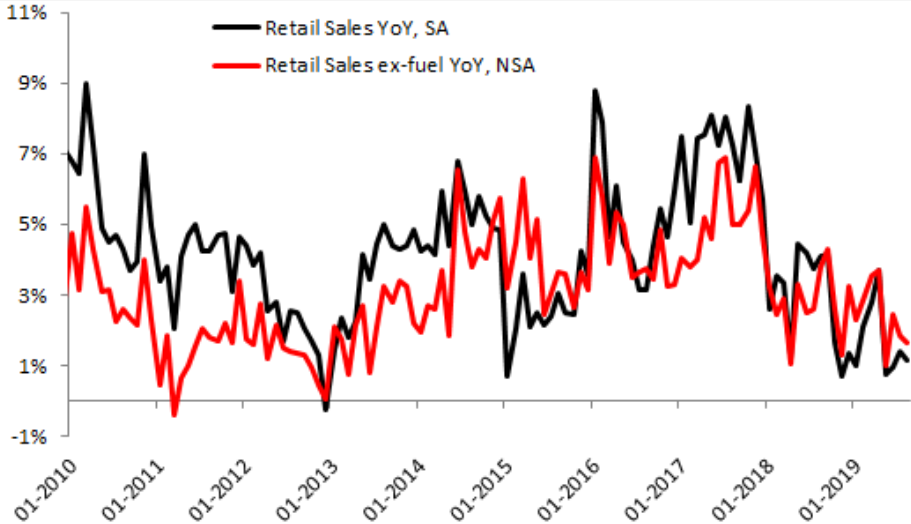

Canadian consumer spending continues to reside near its lowest level of growth this decade, with the latest retail sales figures disappointing. Source: XTB Macrobond

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.