- Wall Street traded lower ahead of the FOMC minutes

- Weak Chinese data deteriorate market sentiment

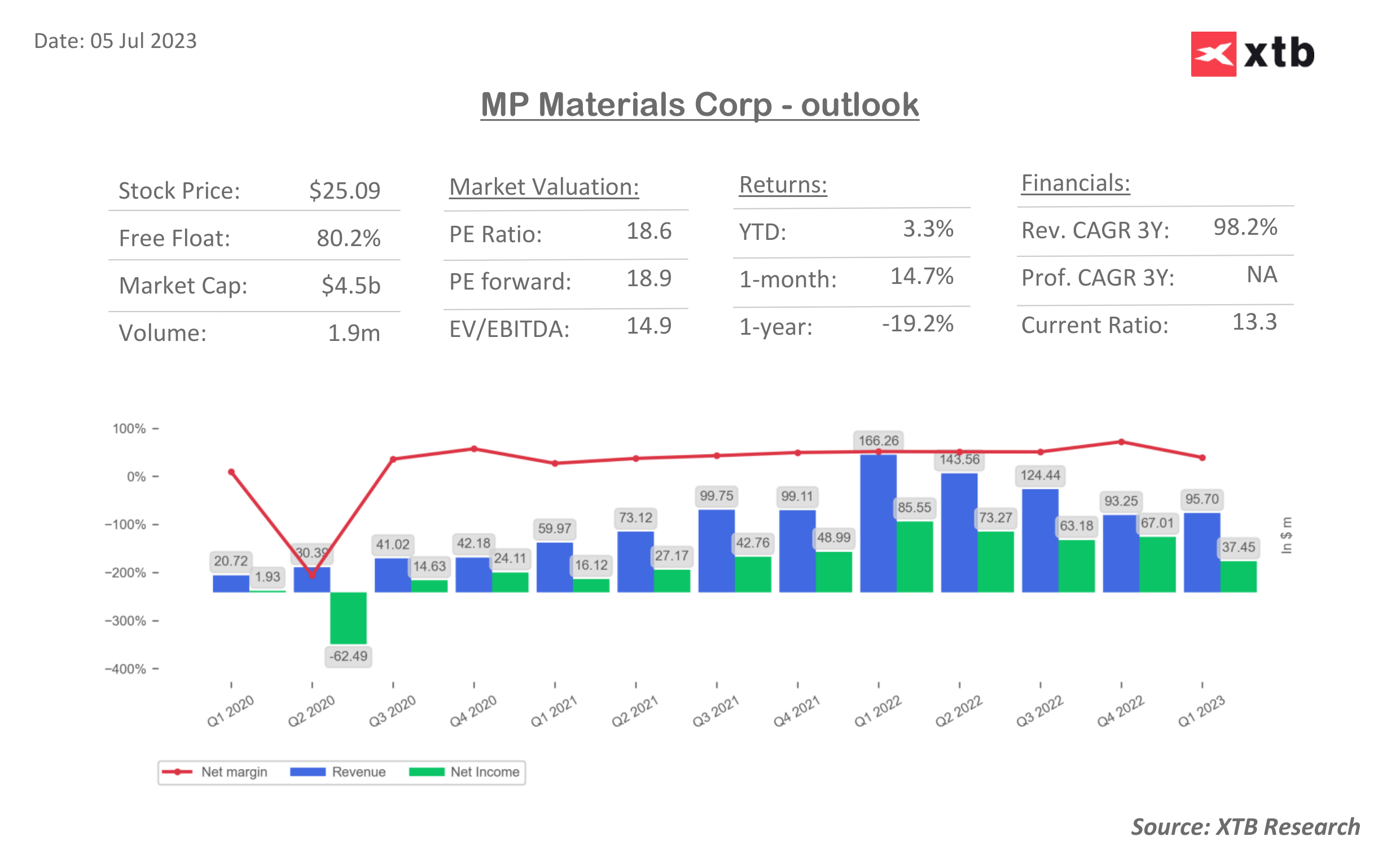

- MP Materials (MP.US) gains after China’s move to restrict export of critical minerals

Wall Street indices launched today's trading slightly lower. Nasdaq and SPX were almost 0.2% lower at the opening while Dow Jones dropped 0.4%.

Market sentiment deteriorated after disappointing data from China undermined risk appetite, leading to a decrease in market confidence. China witnessed a slower growth rate in its services sector last month, surpassing expectations and reaching its lowest level since January. This decline in growth was attributed to reduced consumer spending.

Investors have tempered their expectations for gains in Asian equities this year due to diminishing optimism surrounding the possibility of looser monetary policy and concerns about China's economic outlook. A survey conducted by Bloomberg suggests that the MSCI Asia Pacific Index is projected to reach 174 points by the end of the year, reflecting a 5% increase from its closing level on Tuesday. This forecast is lower than the prediction of 178.5 from a similar survey conducted three months prior.

A struggling Chinese economy could potentially worsen conditions in the US. However, on the other hand, it also exerts downward pressure on global prices of various commodities and weighs down inflation figures.

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US equities categorised by sector and industry. Size represents market capitalisation, the leaders among large-cap companies are Google (GOOGL.US), Tesla (TSLA.US), and Meta (META.US). Source: xStation5

US500 is currently consolidating near a resistance level at 4485 points. If it breaks above this level, the next resistance zone is anticipated around 4550 points. Alternatively, if the resistance holds, the price may decline towards the 4300 level. With the upcoming release of the FOMC minutes, higher volatility on indices should be expected.

Company News:

- Netflix (NFLX.US) gains 1.2% as Goldman upgrades the streaming service to neutral, saying management has executed its password sharing crackdown more effectively than expected.

- Rivian (RIVN.US) rises as much as 2.2% after the company started delivering the electric vans it makes for Amazon.com Inc. to Europe — its first commercial shipments outside the US.

- Wolfspeed (WOLF.US) jumps 13% after Renesas Electronics makes a $2 billion deposit to secure a 10-year supply commitment of silicon carbide bare and epitaxial wafers from the chipmaker.

- MP Materials (MP.US) gains 8% after China’s move to restrict exports of rare earth specialty materials germanium and gallium.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.