- Futures in the US indicate a lower opening

- However, volatility is limited ahead of key reports

Futures indicate a slightly lower opening for the cash session in the US. Investors are awaiting key quarterly and macroeconomic report publications. Right after the opening of the cash session, the JOLTS report on new job openings and the Conference Board index will be published. Today, after the session closes, reports from Microsoft, Alphabet, and AMD, among others, will also be known.

Before the market opening, the US500 is down 0.15% but the price remains around 4950 points. The US100 loses a little more, 0.23% to 17660 points. The dollar is calm in the first part of the day, however, despite this, we can observe a moderate strengthening of EURUSD, which is unchanged. The yields on US Treasury bonds are slightly down to 4.04%.

Daily Highlights

- Microsoft ticked up premarket. Its results are poised to show a jump in revenue as cloud and PC demand recovers. Alphabet, also due after the close, may report a second consecutive period of double-digit growth driven by AI and ad spending.

- The euro-area economy stagnated in the fourth quarter, unexpectedly avoiding further contraction. Firmer growth in Italy and Spain offset in line publication in Germany, which shrank 0.3%. French figures were flat.

- The IMF raised its forecast for global growth to 3.1% this year from 2.9% on better-than-expected expansion in the US and fiscal stimulus in China. The fund expects a soft landing but warned of risks from war and inflation

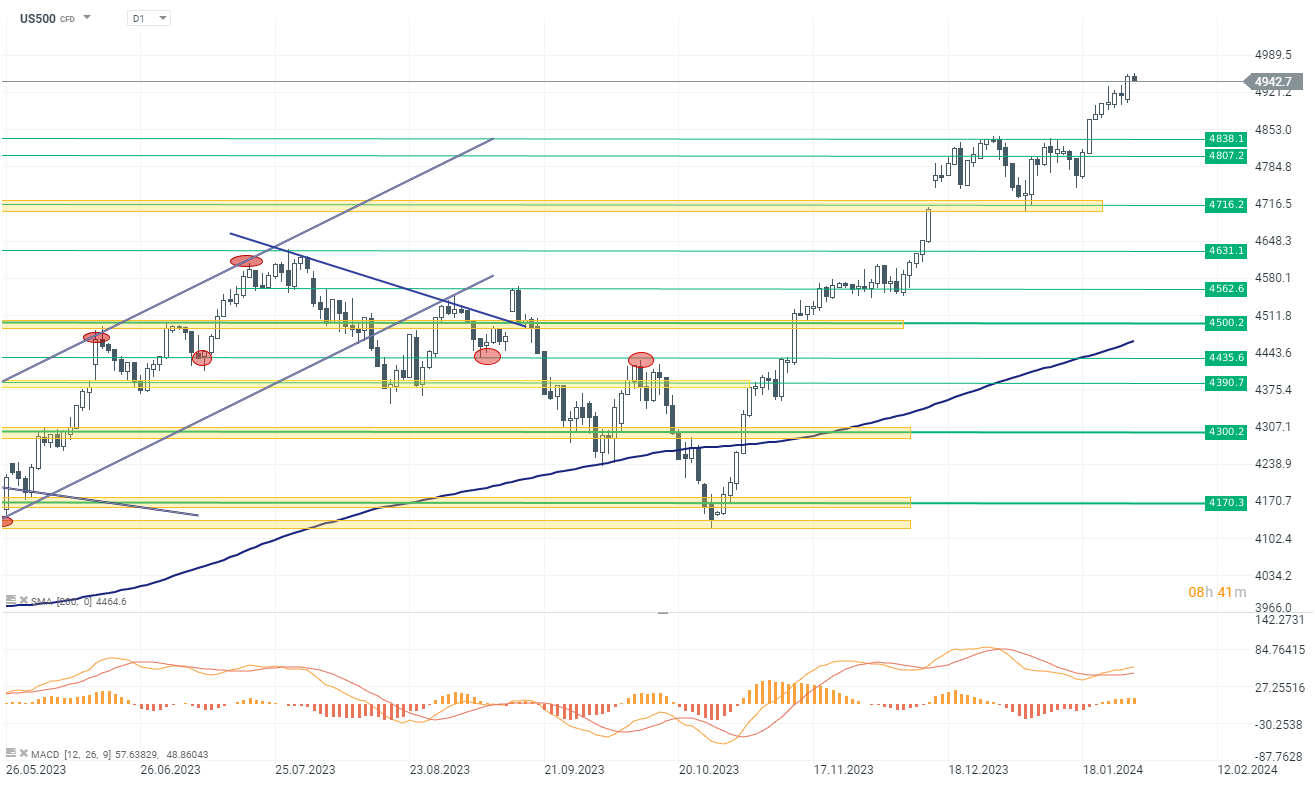

US500

Despite today's decline before the session opening, the US500 remains in a strong upward trend. Over the last 9 sessions, we have experienced only one closing with a slight loss. The increases are driven by relatively good company results, as well as strong economic data. However, the next direction will likely only be determined in the second half of this week. Investors will learn key company reports and macro publications, including tomorrow's Fed decision. In case of an upward movement, an important psychological level is 5000 points. Otherwise, the nearest support for a downward movement will be 4820-4840 points.

Source: xStation 5

Company News

Super Micro Computer's shares (SMCI.US) surged over 10% in premarket trading following a report of higher-than-expected second-quarter net sales and an increased revenue forecast for the year. This performance was driven by strong demand for AI Rack-scale and an improvement in supply. Barclays analysts George Wang and Tim Long, noting the company's robust guidance for the second half of the year, raised their price target to $691 from $396. Super Micro's revenue forecast for the fiscal year is now set between $14.3 billion to $14.7 billion, up from the previous $10 billion to $11 billion.

Source: xStation 5

Source: xStation 5

Tesla (TSLA.US) climbs 6.80%, poised to extend gains for a third consecutive session. This increase comes as Cathie Wood's Ark Investment Management ETFs purchased more shares of the electric vehicle (EV) maker, despite Tesla's stock having tumbled 25% this year.

General Motors (GM.US) exceeded Wall Street's expectations for the fourth quarter and overall profit growth in 2023, though it will likely fall short of the record levels achieved in 2022. In 2023, GM reported adjusted earnings before interest and taxes (EBIT) of $12.4 billion, aligning with its upper-end forecast of $12.7 billion. For the current year, GM projects adjusted EBIT to range between $12 billion to $14 billion, which is still less than 2022's record $14.5 billion.

Danaher Corporation's (DHR.US) shares gains 2.30% despite reporting a disappointing core sales outlook for the full year of 2024. The life sciences firm anticipates a decline in core sales by low-single digits year-over-year. However, Danaher's fourth-quarter results exceeded expectations, with an adjusted EPS of $2.09 against the Bloomberg Consensus estimate of $1.91. Sales reached $6.41 billion, surpassing the estimated $6.02 billion, and operating profit stood at $1.34 billion.

Whirlpool's (WHR.US) shares fell 5.6% in premarket trading after the home appliance manufacturer announced weaker-than-expected revenue and earnings per share forecasts for the year. The company's guidance, including a North America EBIT margin of 8.4% and a subdued free cash flow outlook, fell short of already low expectations, raising concerns about leverage and dividend sustainability.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.