-

Wall Street open lower, threatens to extend downbeat streak for fourth day

-

Powell to testify before US Senate committee today

-

Root rallies after WSJ report, Spirit AeroSystems slumps on employee strike

Wall Street indices launched today's cash session slightly lower. Nasdaq was top underperformer at session launch with 0.4% drop while Dow Jones outperformed, dropping only 0.1%. If US indices finish today's trading lower it would be the fourth consecutive session of declines. Fed Chair Powell will appear in Congress today for the second day of his semiannual testimonies. Powell will testify before US Senate committee today but given that yesterday's testimony before US House committee turned out to be largely a non-event, today's event is not expected to produce any major market moves.

Source: xStation5

Source: xStation5

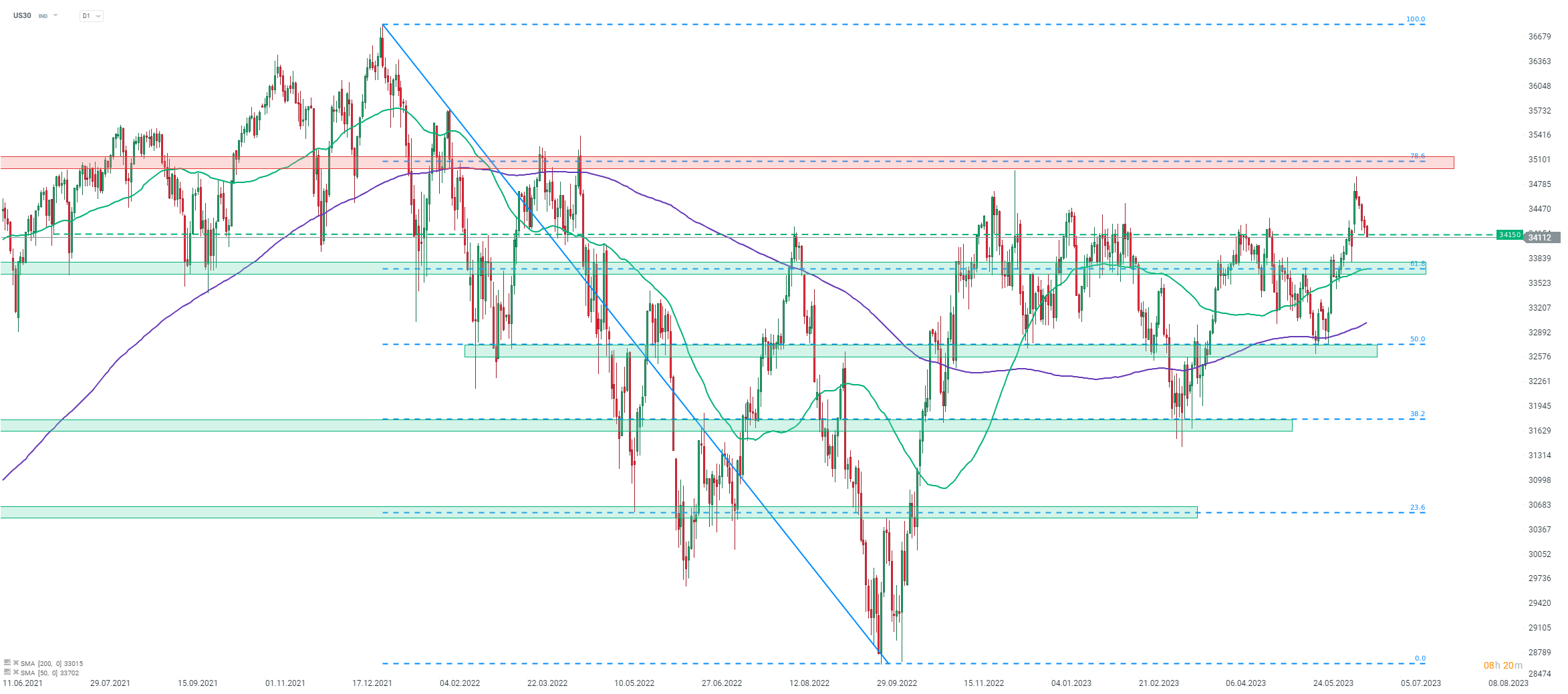

Dow Jones (US30) continues a recently-launched pullback. Index failed to reach the 35,000 pts area and started to pull back at the end of the previous week. Taking a look at US30 at D1 interval, we can see that the index is currently testing 34,150 pts swing area, marked with previous local highs. Should we see a break below, declines may deepen with a test of the support zone marked with 61.8% retracement of the downward move launched at the beginning of 2022 being a potential target.

Company News

Boeing (BA.US) is trading lower today after union workers at Spirit AeroSystems Holdings (SPR.US) vote to go on a strike. Spirit AeroSystems is Boeing's biggest supplier and an employee strike will result in suspension of output at the company's factory. This puts Boeing's plans to increase 737 Max production at question as Spirit was making fuselages for 737 Max jets. Share of Spirit AeroSystems dropped almost 10% on the news.

Root (ROOT.US), US car insurance company, surges today following a Wall Street Journal report. WSJ reported that Embedded Insurance offered to purchase Root at $19.34 per share. Today's surge comes on top of 60% gain made during yesterday's Wall Street session.

Darden (DRI.US), US multi-brand restaurant operator, is pulling back after releasing fiscal-Q4 2023 (quarter ended on May 28, 2023) results and fiscal-2024 guidance. Darden reported fiscal-Q4 sales at $2.77 billion, up 6.4% YoY and in-line with a $2.77 billion estimate. Comparable sales were 4% YoY higher (exp. 4.1% YoY) while EPS from continuing operations reached $2.58 (exp. $2.54). Darden expects revenue in full fiscal-2024 to reach $11.5-11.6 billion (exp. $11.1 billion) and adjusted EPS from continuing operations to fall into the $8.55-8.85 range (exp. $8.81).

Analysts' actions

- Tesla (TSLA.US) cut to 'equal-weight' at Morgan Stanley. Price target set at $250.00

- Alcoa (AA.US) cut to 'underweight' at Morgan Stanley. Price target set at $33.00

- Expedia (EXPE.US) rated 'buy' at B Riley. Price target set at $160.00

- Agree Realty (ADC.US) upgraded to 'buy' at Mizuho Securities. Price target set at $70.00

- Kellogg (K.US) upgraded to 'market-perform' at Bernstein. Price target set at $62.00

- Celanese (CE.US) cut to 'neutral' at Bank of America. Price target set at $116.00

Shares of Spirit AeroSystems Holdings (SPR.US) launched today's trading with a big bearish price gap, dropping below the $29.50 support zone. Company and one of Boeing's biggest suppliers said that it will suspend operations as union workers decided to go on a strike. The next level to watch should the pullback deepen can be found at $25.00. Source: xStation5

Shares of Spirit AeroSystems Holdings (SPR.US) launched today's trading with a big bearish price gap, dropping below the $29.50 support zone. Company and one of Boeing's biggest suppliers said that it will suspend operations as union workers decided to go on a strike. The next level to watch should the pullback deepen can be found at $25.00. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.