• Signs of a slowdown in the worldwide spread of the coronavirus

• US indices rally at the opening

• Kraft Heinz (KHC.US) shares rose 3%

US indices opened higher at the open on Tuesday,continuing yesterday’s strong gains, amid hopes over a slowdown in coronavirus cases in the US and worldwide. New York Governor Andrew Cuomo, announced yesterday that the virus-related fatality rate was effectively flat for two days. President Trump also noted that ‘there’s tremendous light at the end of the tunnel’ regarding development of the coronavirus vaccine. Investors also welcomed recent news that the US government may introduce another stimulus package of 1 trillion around May, in order to help the US economy to recover. Dow Jones opened 4.1% higher, S&P 500 rose 3.1%, while the NASDAQ Composite advanced 2.7%.

The dollar index has fallen further below 100 today, while risk appetite has improved as investors have welcomed signs of a slowdown in the spread of coronavirus worldwide.

S&P500 (US500) managed to break out from the consolidation zone and the upward move is being continued after US open. Should upbeat moods prevail, resistance at 2904.6 pts may come into play. However breaking below the 2648.0 pts level will negate the bullish scenario.Source: xStation5

S&P500 (US500) managed to break out from the consolidation zone and the upward move is being continued after US open. Should upbeat moods prevail, resistance at 2904.6 pts may come into play. However breaking below the 2648.0 pts level will negate the bullish scenario.Source: xStation5

Kraft Heinz (KHC.US) — shares of the food and beverage company soared 3% in extended trading after company announced that thanks to the surging demand related to the coronovirus outbreak, the company expects approximately 3% net higher sales growth and around 6% organic net sales increase in the first quarter. Analysts had been expecting a sales decline. “Right now, our mission as a company has never been clearer: we have a huge responsibility to keep feeding the world,” announced CEO Miguel Patricio.

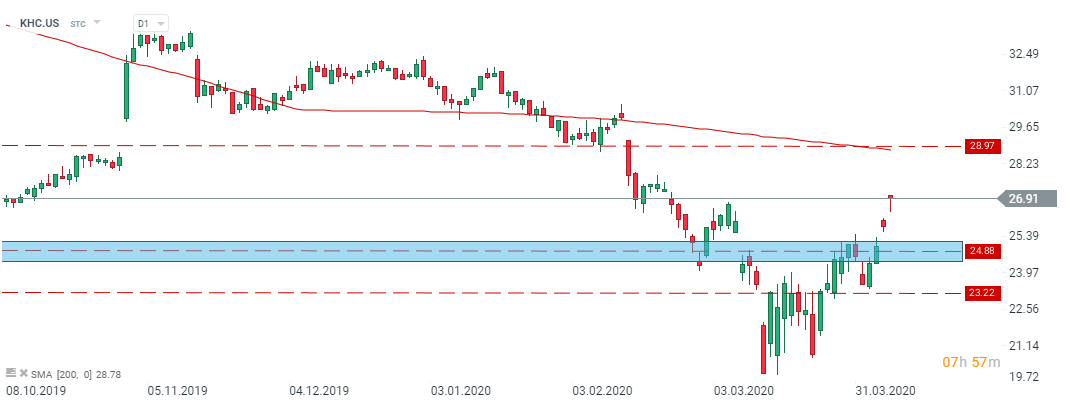

Kraft Heinz (KHC.US) – price broke above important resistance level at$24.88 per share and is heading towards next major level at $28.97 per share, which is additionally strengthen by 200 MA (redline). Source: xStation5.

Kraft Heinz (KHC.US) – price broke above important resistance level at$24.88 per share and is heading towards next major level at $28.97 per share, which is additionally strengthen by 200 MA (redline). Source: xStation5.

AT&T (T.US) - The Company has released a financial update that considers the impact of a coronavirus outbreak. AT&T confirmed that company’s cash position and balance sheet remain strong, as well as an attractive level of liquidity. The company will continue to pay quarterly dividends to the shareholders.

AT&T (T.US) – share price managed to break above key resistance level at $28.76 per share and is currently testing local resistance at $30.84 per share. If the positive sentiment prevails on the market then the price may be heading towards next resistance level at $34.05 per share. However, in case of a break lower, the next support to watch is $27.22 per share. Source: xStation5

AT&T (T.US) – share price managed to break above key resistance level at $28.76 per share and is currently testing local resistance at $30.84 per share. If the positive sentiment prevails on the market then the price may be heading towards next resistance level at $34.05 per share. However, in case of a break lower, the next support to watch is $27.22 per share. Source: xStation5

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Wall Street extends gains; US100 rebounds over 1% 📈

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.