- Wall Street set to open slightly lower on Tuesday

- Tomorrow, CPI data will determine the direction for US indices

- Apple (AAPL.US) will present its new iPhone 15 model today

Wall Street is set to open slightly lower in today's market session following yesterday's market gains. The US500 is trading 0.20% lower and the US100 is declining by 0.30%. The dollar (USD) is trading slightly higher today, approaching a crucial resistance level around 105 points. If the dollar begins to correct after several weeks of substantial gains, it may unleash upside potential for riskier assets such as equities.

Another important event is tomorrow's CPI reading, which may dictate the direction for the next couple of days before the Fed's interest rate decision. If tomorrow's data comes in below expectations, it may support further gains of US equities. However, higher or in-line data could exert more selling pressure as this indicates that cooling inflation might be more challenging. This data marks the second release in a row where the expected inflation rate is higher than the previous month. Following the local low of the CPI in June at 3.0%, the CPI is now expected to reach 3.6% year-on-year in August.

US500

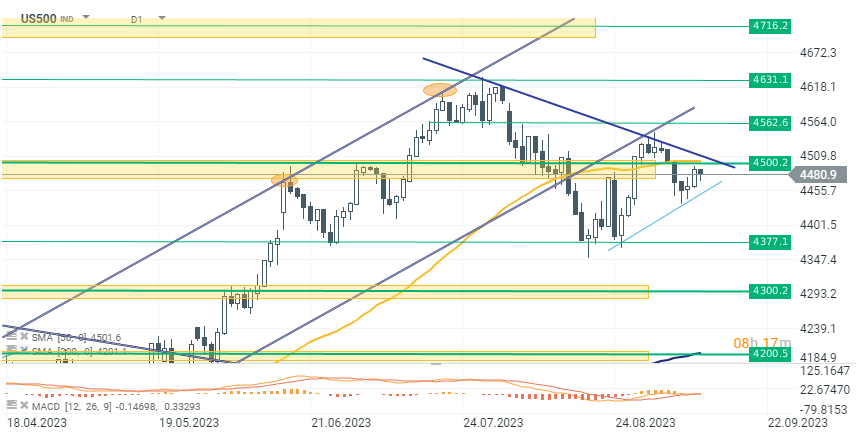

The US500 index price currently is at 4480 points, reflecting a 0.20% decline from its yesterday levels. The index has retraced from a pivotal resistance point at 4500 points and appears to be heading lower. Failure to breach this resistance could intensify selling pressure, potentially pushing the US500 price down. In this scenario, the next crucial support lies in the range of 4380-4400 points. Notably, the recent correction has created a new downward trendline, marked by two local peaks (indicated by the blue line), which could be the new index's trajectory. Traders should closely monitor developments around these key levels for potential market direction cues. Source xStation 5

The US500 index price currently is at 4480 points, reflecting a 0.20% decline from its yesterday levels. The index has retraced from a pivotal resistance point at 4500 points and appears to be heading lower. Failure to breach this resistance could intensify selling pressure, potentially pushing the US500 price down. In this scenario, the next crucial support lies in the range of 4380-4400 points. Notably, the recent correction has created a new downward trendline, marked by two local peaks (indicated by the blue line), which could be the new index's trajectory. Traders should closely monitor developments around these key levels for potential market direction cues. Source xStation 5

Company News:

Oracle (ORCL.US) - Oracle Corp. reported a slowdown in its cloud sales growth for the quarter, causing a decline of up to 12% in its premarket trading shares. Cloud revenue, a closely monitored metric, increased by 30% to $4.6 billion in the quarter ending on August 31, with $1.5 billion coming from renting computing power and storage online and $3.1 billion from applications. However, this growth rate was slower compared to the previous quarter's 54% jump. Oracle Chairman Larry Ellison remained optimistic about growing AI demand, noting that companies have signed contracts for over $4 billion in capacity from Oracle's cloud service, twice the amount booked in the previous quarter.

Geron (GERN.US) stock rose 8.0% after Goldman Sachs upgraded its stance to ‘buy’ from ‘neutral’, citing the potential for the company’s new drug application for imetelstat, aimed at treating lower-risk MDS.

UPS (UPS.US) - stock fell 2.0% after the delivery giant stated that its new five-year contract covering some 340,000 Teamsters-represented workers in the United States would increase wage and benefit costs at a 3.3% compound annual growth rate over the life of the agreement.

Apple (AAPL.US) - Apple is set to launch the iPhone 15 at an event on September 12 at 6 PM BST. While the event is not expected to bring a major breakthrough, some new features will be introduced. As the world's largest public company, Apple's performance often has a ripple effect on the overall stock market. Recent issues, such as Chinese authorities banning iPhones for government workers and fears of a broader sales ban in China, had previously put pressure on Apple's stock but have eased recently.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.