-

US futures point to a lower open today

-

3M (MMM.US) to provide 35 million facemasks a month

-

Gilead (GILD.US) acquires Forty Seven for $95.50 a share

Global equity markets started the week on a strong footing with Asian indices closing significantly higher on Monday. However, risk-on moods abated during the European trading hours. US futures are down 1% while earlier they traded 2% higher.

Head of US coronavirus task force expects many more cases

The United States reported two coronavirus-related deaths over the weekend and around 20 new cases. Major point of concern is that cases began to surface in key US cities, like for example New York. It also looks like Seattle may be a site of the first, bigger US coronavirus outbreak. Mike Pence, Vice President of the United States and head of the US coronavirus task force, said that he expects many more coronavirus cases to be reported. Having said that, the situation in the US is likely to get worse. ISM manufacturing release for February (3:00 pm GMT) will offer an insight on the damage. Apart from that, Donald Trump will meet with representatives of major pharmaceutical companies today. The aim of the meeting is to discuss progress on cure development.

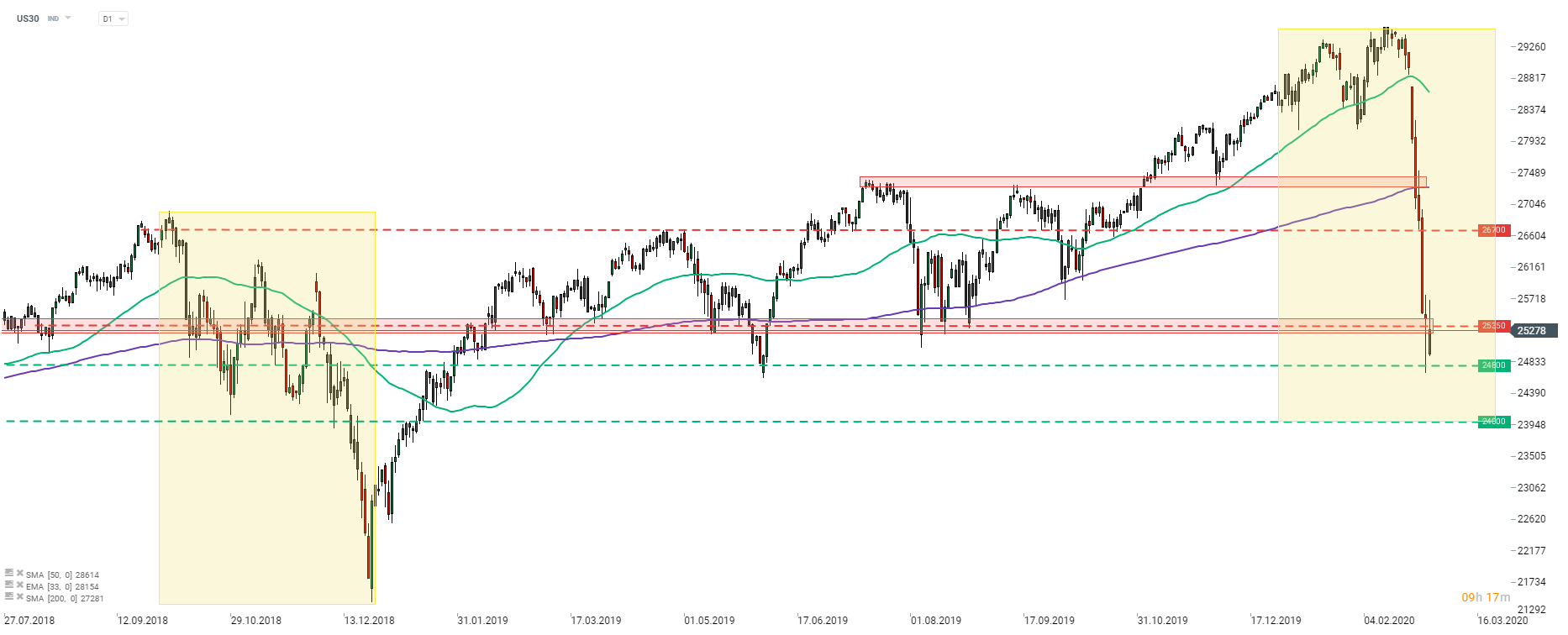

Dow Jones (US30) attempted to break above the price zone at 25350 pts today but failed. The index is pulling back below the zone and, in case downbeat moods prevail, may be set to test Friday’s low at around 24800 pts. These two levels should be on watch at the beginning of today’s session. Traders should keep in mind that volatility may jump at 3:00 pm GMT when ISM data is released. Source: xStation5

Dow Jones (US30) attempted to break above the price zone at 25350 pts today but failed. The index is pulling back below the zone and, in case downbeat moods prevail, may be set to test Friday’s low at around 24800 pts. These two levels should be on watch at the beginning of today’s session. Traders should keep in mind that volatility may jump at 3:00 pm GMT when ISM data is released. Source: xStation5

3M (MMM.US) is one of the US companies attracting increased attention during the ongoing market turmoil. This is because 3M has a “Medical Solutions” business unit that manufacturers, among others, facemasks. The company has earlier hinted that it will boost facemask production due to the outbreak. Mike Pence, US Vice President, said over the weekend that the company will provide 35 million face masks a month.

Twitter (TWTR.US) gains in premarket trade. The move follows Bloomberg report saying that Eliott Management, famous activist investor, has taken a stake in the company. Moreover, Eliott is said to be pushing for a replacement of the Chief Executive Officer, Jack Dorsey. Shares climbed as much as 9% in pre-session trade.

While 3M (MMM.US) is one of the biggest facemask producers in the United States, production of masks is not a major part of its business. Having said that, the stock failed to catch a bid on recent market sell-off. However, the company may attract increased attention today after VP Pence said that it will provide 35 million masks a month. The nearest support for the stock is marked with local lows from 2015 as well as the lower limit of the downward channel ($137.50). Source: xStation5

While 3M (MMM.US) is one of the biggest facemask producers in the United States, production of masks is not a major part of its business. Having said that, the stock failed to catch a bid on recent market sell-off. However, the company may attract increased attention today after VP Pence said that it will provide 35 million masks a month. The nearest support for the stock is marked with local lows from 2015 as well as the lower limit of the downward channel ($137.50). Source: xStation5

Gilead Sciences (GILD.US) announced it will buy Forty Seven, the US clinical-stage immuno-oncology company. Gilead will acquire Forty Seven shares for a $95.50/share - 95% above Friday’s closing price. The transaction will be carried out on an all-cash basis and is expected to close in the second quarter of the year. Citi and JPMorgan act as financial advisers to Gilead while Centerview Partners advises Forty Seven.

United Airlines Holdings (UAL.US) confirmed earlier Reuters report. Reuters said that the CEO of United Airlines sent an internal memo to employees saying that the company would likely need to cut more flights. The decision comes as a coronavirus outbreak hit demand for travel.

United Airline Holdings (UAL.DE) slumped recently as the coronavirus outbreak limited demand for travel causing deterioration in the outlook for the airline sector. The stock dropped to the support zone ranging above the 61.8% Fibo level last week. Shares erased over a half of the upward move started in mid-2016 and may be on track for more weakness. In such a scenario, the stock may decline towards the support at 78.6% retracement ($50.50). Source: xStation5

United Airline Holdings (UAL.DE) slumped recently as the coronavirus outbreak limited demand for travel causing deterioration in the outlook for the airline sector. The stock dropped to the support zone ranging above the 61.8% Fibo level last week. Shares erased over a half of the upward move started in mid-2016 and may be on track for more weakness. In such a scenario, the stock may decline towards the support at 78.6% retracement ($50.50). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.