- Indices in the US open lower

- The dollar gains 0.55%

- 2-year yields fall, while 10-year yields tick higher

Midweek, US indices are opening lower. The declines are supported by a strengthening dollar, which is rising after testing a key support level. Not much is happening in the markets today, similar to the previous days of this week. Low volatility and the lack of significant macroeconomic releases are leading investors to sell stocks. The key event of the day will likely be the release of Nvidia's quarterly report after the close of trading on Wall Street.

The stock declines are being driven by a strongly gaining dollar. The USDIDX index has recently been under significant downward pressure due to the approaching first interest rate cut in the US. The dollar's decline had a positive effect on stock valuations. However, after reaching its lowest level in many months and testing the lower end of the consolidation channel, the dollar is strongly rebounding today, returning above the 101,0000 point level.

Source: xStation 5

US100

The technology stock index is losing 0.40% at the time of publication, dropping to the 19,550-point level. Investor uncertainty may be supported by the upcoming quarterly report from Nvidia, which recently has been a key driver of the AI sector's bullish trend. The declines in the index follow a test of a significant resistance level around 20,000 points. Therefore, the declines may continue until the next support zone around 19,000 points.

Source: xStation 5

Company News

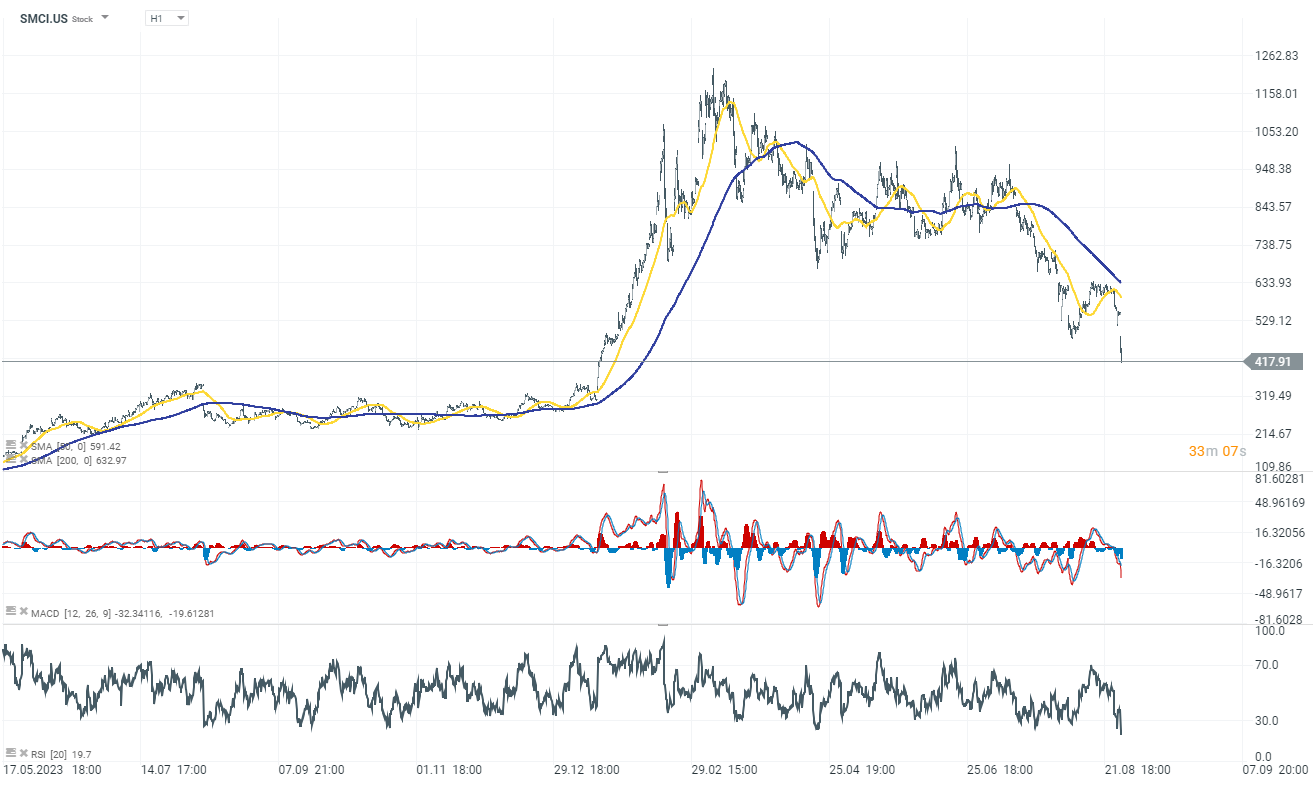

Super Micro Computer (SMCI.US) stock dips by over 21% after the company announced a delay in filing its annual 10-K report, citing the need for more time to assess internal controls over financial reporting. The delay follows Hindenburg Research's short position announcement, raising concerns over accounting practices. However, J.P. Morgan defended Super Micro, stating there is limited evidence of accounting issues beyond previously known matters. The company confirmed no changes to its previously announced fiscal year results.

Ambarella (AMBA.US): gains over 11% after its Q2 financial results and Q3 guidance exceeded market expectations. The company forecasts Q3 revenue between $77M and $81M, with a midpoint of $79M, significantly above the consensus estimate of $69M. Additionally, Ambarella projects an adjusted gross margin of 62.5% to 64%, surpassing the consensus of 62.5%.

elf Beauty (NYSE: ELF) gains 3.50% following the announcement of a new $500M share repurchase program. This decision comes after the company exhausted its previous $25M buyback program, with $17M worth of shares repurchased in the last two weeks.

nCino (NCNO.US) drops nearly 12% due to slightly lower-than-expected Q3 guidance, despite surpassing Q2 expectations. The company anticipates Q3 non-GAAP EPS of $0.15–$0.16, slightly below the consensus of $0.16, and revenue of $136M to $138M, with a midpoint of $137M, below the consensus of $138.7M. Nonetheless, nCino raised its FY2025 non-GAAP EPS guidance to $0.66–$0.69 and reaffirmed its total revenue outlook of $538.5M–$544.5M.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.